How to Execute a Vertical Bull Call Spread

We have recently had a large influx of new subscribers.

I have no idea why. Maybe it’s my sterling personality and rapier-like wit.

For whatever reason, I think it's time for all to undergo a refresher course on how to most efficiently go long the market with the best possible risk/reward ratio.

I’m talking about buying vertical bull call debit spreads.

Most investors make the mistake of investing in positions with only a 50/50 chance of success, or less. They’d do better with a coin toss.

The most experienced hedge fund traders find positions that have a 99% chance of success and then leverage up on those trades. Stop out of the losers quickly and you have an approach that will make you well into double digits, year in and year out, whether markets go up, down, or sideways.

For those readers looking to improve their trading results and create the unfair advantage they deserve, I have posted a training video on How to Execute a Vertical Bull Call Spread.

This is a matched pair of positions in the options market that will be profitable when the underlying security goes up, sideways, or down in price over a defined limited period.

It is the perfect position to have on board during markets that have declining or low volatility, much like we have experienced for most of the last several years, and will almost certainly see again.

I have strapped on quite a few of these babies across many asset classes this year, and they are a major reason why I am up so much this year.

To understand this trade I will use the example of the Apple trade, which most people own and know well.

On October 8, 2018, I sent out a Trade Alert by text messages and email that said the following:

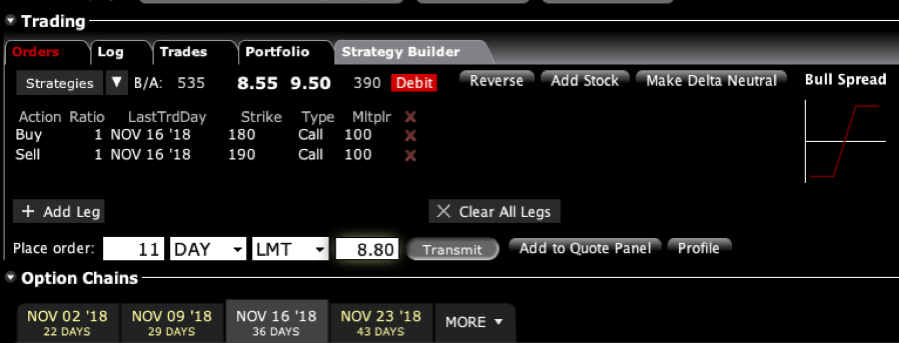

BUY the Apple (AAPL) November 2018 $180-$190 in-the-money vertical BULL CALL spread at $8.80 or best

At the time, Apple shares were trading at $216.17. To accomplish this, they had to execute the following trades:

Buy 11 November 2018 (AAPL) $180 calls at….……..…$38.00

Sell short 11 November 2018 (AAPL) $190 calls at…...$29.20

Net Cost:…………………….………..…...............……….….....$8.80

A screenshot of my own trading platform is below:

This gets traders into the position at $8.80, which costs them $9,680 ($8.80 per option X 100 shares per option X 11 contracts).

The vertical part of the description of this trade refers to the fact that both options have the same underlying security (AAPL), the same expiration date (November 16, 2018), and only different strike prices ($180 and $190).

The maximum potential profit can be calculated as follows:

+$190.00 Upper strike price

-$180.00 Lower strike price

+$10.00 Maximum Potential Profit

Another way of explaining this is that the call spread you bought for $8.80 is worth $10.00 at expiration on November 16, giving you a total return of 13.63% in 27 trading days. Not bad!

The great thing about these positions is that your risk is defined. You can’t lose any more than the $9,680 you put up.

If Apple goes bankrupt, we get a flash crash or suffer another 9/11-type event, you will never get a margin call from your broker in the middle of the night asking for more money. This is why hedge funds like vertical bull call spread so much.

As long as Apple traded at or above $190 on the November 16 expiration date, you will make a profit on this trade.

As it turns out, my take on Apple shares proved dead-on, and the shares rose to $222.22, or a healthy $32 above my upper strike.

The total profit on the trade came to:

($10.00 expiration - $8.80 cost) = $1.20

($1.20 profit X 100 shares per contract X 11 contracts) = $1,320.

To summarize all of this, you buy low and sell high. Everyone talks about it but very few actually do it.

Occasionally, Vertical Bull Call Spreads don’t work and the wheels fall off. As hard as it may be to believe, I am not infallible.

So if I’m wrong and I tell you to buy a vertical bull call spread, and the shares fall not a little, but a LOT, you will lose money. In those rare cases when that happens, I’ll shoot out a Trade Alert to you with stop-loss instructions before the damage gets out of control.

I start looking at a stop loss when the deficit hits 10% of the size of the position or 1% of the total capital in my trading account.

To watch the video edition of How to Execute a Vertical Bull Call Spread complete with more detailed instructions on how to execute the position with your online platform, please click here.

Good luck and good trading.

Vertical Bull Call Spreads Are the Way to Go in a flat to Rising Market