Will Facebook Mark the Market Top?

The street is chattering today over the prospect of an enormous payday with the imminent IPO for the social media company, Facebook. Price talk is valuing the company as high as $100 billion, making it the largest such floatation in history. Could the mega deal spell the end of the current bull market?

Look at it this way. Assuming that Facebook sells only 5% of itself to the public, that sucks $5 billion out of the stock market. It is $5 billion that gets diverted away from existing equity allocations. Many investors will need to sell existing positions in other companies to pay for their new Facebook shares, especially in the technology sector.

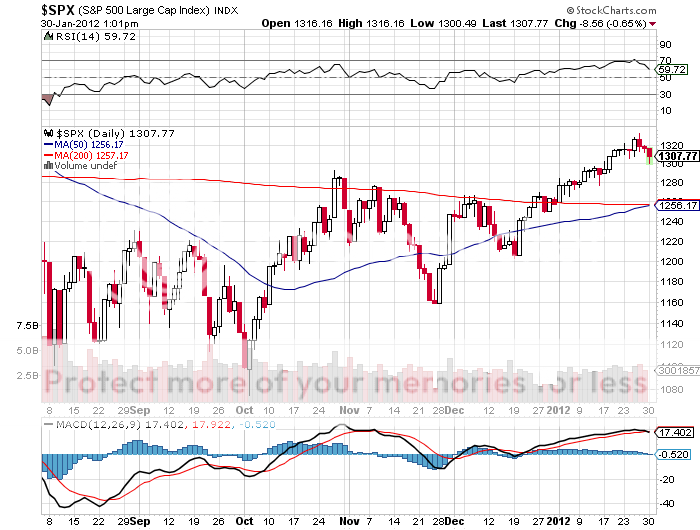

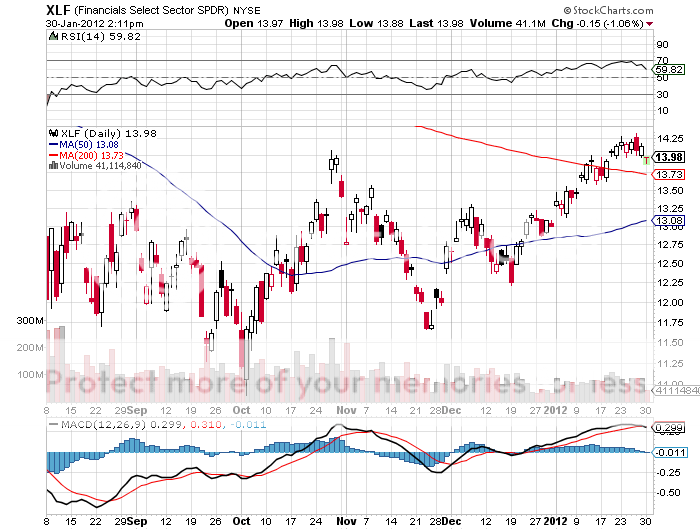

Can the market afford to lose $5 billion in buying power in its current fragile condition? I think not. Take a look at the chart below which has the (SPY) making a near parabolic move since the beginning of the year. At the very least, we need to pull back to just above $126, which takes us down to 1,256 on the S&P 500, smack dab on the 200 day moving average. If you don?t believe me, then take a look at the chart for the financials sector ETF (XLF), which has led the market this year and is clearly rolling over.

I?ll tell you who the big winner in a Facebook IPOP will be. The San Francisco Bay area. $100 billion is a ton of money to pour into a single urban area. The issue is expected to create several billionaires and as many as 3,000 new millionaires in my neighborhood.

The last time that happened was when Google (GOOG) went public, creating a wealth effect that never went away, taking the waiting list for a new Ferrari or Tesla out two years. Better buy real estate near Facebook?s Menlo Park headquarters, such as in Atherton, Palo Alto, and Mountain View. The bidding wars are about to begin!

If you have any doubts about this analysis, you can take it up with any of my 1,209 Facebook friends by clicking here.

Is Mark a Market Killer?