2023 Annual Asset Class Review

I am once again writing this report from a first-class sleeping cabin on Amtrak’s legendary California Zephyr.

By day, I have two comfortable seats facing each other next to a panoramic window. At night, they fold into two bunk beds, a single and a double. There is a shower, but only Houdini could navigate it.

I am anything but Houdini, so I foray downstairs to use the larger public hot showers. They are divine.

We are now pulling away from Chicago’s Union Station, leaving its hurried commuters, buskers, panhandlers, and majestic great halls behind. I love this building as a monument to American exceptionalism.

I am headed for Emeryville, California, just across the bay from San Francisco, some 2,121.6 miles away. That gives me only 56 hours to complete this report.

I tip my porter, Raymond, $100 in advance to make sure everything goes well during the long adventure and to keep me up to date with the onboard gossip.

The rolling and pitching of the car is causing my fingers to dance all over the keyboard. Microsoft’s Spellchecker can catch most of the mistakes, but not all of them.

As both broadband and cell phone coverage are unavailable along most of the route, I have to rely on frenzied Internet searches during stops at major stations along the way to Google obscure data points and download the latest charts.

You know those cool maps in the Verizon stores that show the vast coverage of their cell phone networks? They are complete BS.

Who knew that 95% of America is off the grid? That explains so much about our country today.

I have posted many of my better photos from the trip below, although there is only so much you can do from a moving train and an iPhone 14 Pro Max.

Here is the bottom line which I have been warning you about for months. In 2023, we will probably top the 84.63% we made last year, but you are going to have to navigate the reefs, shoals, and hurricanes. Do it and you can laugh all the way to the bank. I will be there to assist you to navigate every step.

The first half of 2023 will be all about trading. After that, I expect markets to go straight up.

And here is my fundamental thesis for 2023. After the Fed kept rates too low for too long, then raised them too much, it will then panic and lower them again too fast to avoid a recession. In other words, a mistake-prone Jay Powell will keep making mistakes. That sounds like a good bet to me.

Let me give you a list of the challenges I see financial markets are facing in the coming year:

The Ten Key Variables for 2023

1) When will the Fed pivot?

2) How much of a toll will the quantitative tightening take?

3) How soon will the Russians give up on Ukraine?

4) When will buyers return to technology stocks from value plays?

5) Will gold replace crypto as the new flight to safety investment?

6) When will the structural commodities boom get a second wind?

7) How fast will the US dollar fall?

8) How quickly will real estate recover?

9) How fast can the Chinese economy bounce back from Covid-19?

10) How far will oil prices keep falling?

The Thumbnail Portfolio

Equities – buy dips

Bonds – sell buy dips

Foreign Currencies – buy dips

Commodities – buy dips

Precious Metals – buy dips

Energy – stand aside

Real Estate – buy dips

1) The Economy – Bouncing Along the Bottom

Whether we get a recession or not, you can count on markets fully discounting one, which it is currently doing with reckless abandon.

Anywhere you look, the data is dire, save for employment, which may be the last shoe to fall. Technology companies seem to be leading us in the right direction with never-ending mass layoffs. Even after relentless cost-cutting though, there are still 1.5 tech job offers per applicant, which is down from last year’s three.

The Fed is currently predicting a weak 0.5% GDP growth rate for 2023, the same feeble rate we saw for 2022. What we might get is two-quarters of negative growth in the first half followed by a sharp snapback in the second half.

Whatever we get, it will be one of the mildest recessions or growth recessions in American economic history. There is no hint of a 2008-style crash. The banking system was shored up too well back then to prevent that. Thank Dodd/Frank.

So far, so good.

A Rocky Mountain Moose Family

2) Equities (SPX), (QQQ), (IWM) (AAPL), (XLF), (BAC) (JPM), (BAC), (C), (MS), (GS), (X), (CAT), (DE)

Since my job is to make your life incredibly easy, I am going to narrow my equity strategy for 2023.

It's all about falling interest rates.

When interest rates are high, as they are now, you only look at trades and investments that can benefit from falling interest rates.

In the first half, that will be value plays like banks, (JPM), (BAC), (C), financials (MS), (GS), homebuilders (KBH), (LEN), (PHM), industrials (X), capital goods (CAT), (DE).

As we come out of any recession in the second half, growth plays will rush to the fore. Big tech will regain leadership and take the group to new all-time highs. That means the volatility and chop we will certainly see in the first half will present a generational opportunity to get into the fastest-growing sectors of the US economy at bargain prices. I’m talking Cadillacs at KIA prices.

A category of its own, Biotech & Healthcare should do well on their own. Not only are they classic defensive plays to hold during a recession, technology and breakthrough new discoveries are hyper-accelerating. My top three picks there are Eli Lily (ELI), Abbvie (ABBV), and Merck (MRK).

Block out time on your calendars because whenever the Volatility Index (VIX) tops $30, I am going pedal to the metal, and full firewall forward (a pilot term), and your inboxes will be flooded with new trade alerts.

There is another equity subclass that we haven’t visited in about a decade, and that would be emerging markets (EEM). After ten years of punishment by a strong dollar, (EEM) has also been forgotten as an investment allocation. We are now in a position where the (EEM) is likely to outperform US markets in 2023, and perhaps for the rest of the decade.

Frozen Headwaters of the Colorado River

3) Bonds (TLT), (TBT), (JNK), (PHB), (HYG), (MUB), (LQD)

Amtrak needs to fill every seat in the dining car to get everyone fed on time, so you never know who you will share a table with for breakfast, lunch, and dinner.

There was the Vietnam Vet Phantom Jet Pilot who now refused to fly because he was treated so badly at airports. A young couple desperately eloping from Omaha could only afford seats as far as Salt Lake City. After they sat up all night, I paid for their breakfast.

A retired British couple was circumnavigating the entire US in a month on a “See America Pass.” Mennonites are returning home by train because their religion forbade automobiles or airplanes.

The national debt ballooned to an eye-popping $30 trillion in 2021, a gain of an incredible $3 trillion and a post-World War II record. Yet, as long as global central banks are still flooding the money supply with trillions of dollars in liquidity, bonds will not fall in value too dramatically. I’m expecting a slow grind down in prices and up in yields.

The great bond short of 2021 never happened. Even though bonds delivered their worst returns in 19 years, they still remained nearly unchanged. That wasn’t good enough for the many hedge funds, which had to cover massive money-losing shorts into yearend.

Instead, the Great Bond Crash will become a new business. This time, bonds face the gale force headwinds of three promised interest rate hikes. The year-end government bond auctions were a complete disaster.

Fed borrowing continues to balloon out of control. It’s just a matter of time before the last billion dollars in government borrowing breaks the camel’s back.

That makes a bond short a core position in any balanced portfolio. Don’t get lazy. Make sure you only sell a rally lest we get trapped in a range, as we did for most of 2021.

A Visit to the 19th Century

4) Foreign Currencies (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

With a major yield advantage over the rest of the world, the US dollar has been on an absolute tear for the past decade. After all, we have the world’s strongest economy.

That is about to end.

If your primary assumption is that US interest rates will see a sharp decline sometime in 2023, then the outlook for the greenback is terrible.

Currencies are driven by interest rate differentials and the buck is soon going to see the fastest shrinking yield premium in the forex markets.

That shines a great bright light on the foreign currency ETFs. You could do well buying the Australian Dollar (FXA), Euro (FXE), Japanese yen (FXE), and British Pound (FXB). I’d pass on the Chinese yuan (CYB) right now until their Covid shutdowns end.

5) Commodities (FCX), (VALE), (DBA)

Commodities are the high beta play in the financial markets. That’s because the cost of being wrong is so much higher. Get on the losing side of commodities and you will be bled dry by storage costs, interest expenses, contangos, and zero demand.

Commodities have one great attribute. They predict recessions earlier than any other asset class. When they peaked in March of 2022, they were screaming loud and clear that a recession would hit in early 2023. By reversing on a dime on October 14, they also told us that the recovery would begin in July of 2023.

You saw this in every important play in the sector, including Broken Hill (BHP), Peabody Energy (BTU), Freeport McMoRan (TCX), and Alcoa Aluminum (AA). Excuse me for using all the old names.

The heady days of the 2011 commodity bubble top are about to replay. Now that this sector is convinced of a substantially weaker US dollar and lower inflation, it is once more a favorite target of traders.

China will still demand prodigious amounts of imported commodities once its pandemic shutdown ends, but not as much as in the past. Much of the country has seen its infrastructure built out, and it is turning from a heavy industrial to a service-based economy, much like the US. Investors are keeping a sharp eye on India as the next major commodity consumer.

And here’s another big new driver. Each electric vehicle requires 200 pounds of copper and production is expected to rise from 1 million units a year to 25 million by 2030. Annual copper production will have to increase three-fold in a decade to accommodate this increase, no easy task, or prices will have to rise.

The great thing about commodities is that it takes a decade to bring new supply online, unlike stocks and bonds, which can merely be created by an entry in an excel spreadsheet. As a result, they always run far higher than you can imagine.

Accumulate all commodities on dips.

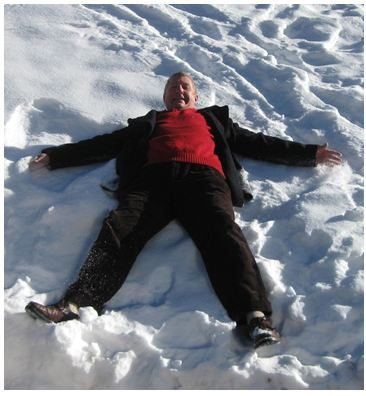

Snow Angel on the Continental Divide

6) Energy (DIG), (RIG), (USO), (DUG), (UNG), (XLE), (AMLP)

Energy was the top-performing sector of 2022. But remember, you will be trading an asset class that is eventually on its way to zero sooner than you think. However, you could have several doublings on the way to zero. This is one of those times.

The real tell here is that energy companies are bailing on their own industry. Instead of reinvesting profits back into their future exploration and development, as they have for the last century, they are paying out more in dividends and share buybacks.

Take the money and run.

There is the additional challenge in that the bulk of US investors, especially environmentally friendly ESG funds, are now banned from investing in legacy carbon-based stocks. That means permanently cheap valuations and share prices for the energy industry.

Energy now counts for only 5% of the S&P 500. Twenty years ago, it boasted a 15% weighting.

The gradual shutdown of the industry makes the supply/demand situation infinitely more volatile.

Unless you are a seasoned, peripatetic, sleep-deprived trader, there are better fish to fry.

And guess who the world’s best oil trader was in 2022? That would be the US government, which drew 400 million barrels from the Strategic Petroleum Reserve in Texas and Louisiana at an average price of $90 and now has the option to buy it back at $70, booking a $4 billion paper profit.

The possibility of a huge government bid at $70 will support oil prices for at least early 2023. Whether the Feds execute or not is another question. I’m advising them to hold off until we hit zero again to earn another $18 billion. Why we even have an SPR is beyond me, since America has been a large net energy producer for many years now. Do you think it has something to do with politics?

To understand better how oil might behave in 2023, I’ll be studying US hay consumption from 1900-1920. That was when the horse population fell from 100 million to 6 million, all replaced by gasoline-powered cars and trucks. The internal combustion engine is about to suffer the same fate.

7) Precious Metals (GLD), (DGP), (SLV), (PPTL), (PALL)

The train has added extra engines at Denver, so now we may begin the long laboring climb up the Eastern slope of the Rocky Mountains.

On a steep curve, we pass along an antiquated freight train of hopper cars filled with large boulders.

The porter tells me this train is welded to the tracks to create a windbreak. Once, a gust howled out of the pass so swiftly that it blew a passenger train over on its side.

In the snow-filled canyons, we saw a family of three moose, a huge herd of elk, and another group of wild mustangs. The engineer informs us that a rare bald eagle is flying along the left side of the train. It’s a good omen for the coming year.

We also see countless abandoned 19th century gold mines and the broken-down wooden trestles leading to huge piles of tailings, relics of previous precious metals booms. So, it is timely here to speak about the future of precious metals.

Fortunately, when a trade isn’t working, I avoid it. That certainly was the case with gold last year.

2022 was a terrible year for precious metals until we got the all-asset class reversal in October. With inflation soaring, stocks volatile, and interest rates soaring, gold had every reason to fall. Instead, it ended up unchanged on the year, thanks to a 15% rally in the last two months.

Bitcoin stole gold’s thunder until a year ago, sucking in all of the speculative interest in the financial system. Jewelry and industrial demand were just not enough to keep gold afloat. That is over now for good and that is why gold is regaining its luster.

Chart formations are starting to look very encouraging with a massive head-and-shoulders bottom in place. So, buy gold on dips if you have a stick of courage on you, which I hope you do.

Higher beta silver (SLV) will be the better bet as it already has been because it plays a major role in the decarbonization of America. There isn’t a solar panel or electric vehicle out there without some silver in them and the growth numbers are positively exponential. Keep buying (SLV), (SLH), and (WPM) on dips.

Crossing the Great Nevada Desert Near Area 51

8) Real Estate (ITB), (LEN), (KBH), (PHM)

The majestic snow-covered Rocky Mountains are behind me. There is now a paucity of scenery, with the endless ocean of sagebrush and salt flats of Northern Nevada outside my window, so there is nothing else to do but write.

My apologies in advance to readers in Wells, Elko, Battle Mountain, and Winnemucca, Nevada.

It is a route long traversed by roving banks of Indians, itinerant fur traders, the Pony Express, my own immigrant forebearers in wagon trains, the Transcontinental Railroad, the Lincoln Highway, and finally US Interstate 80, which was built for the 1960 Winter Olympics at Squaw Valley.

Passing by shantytowns and the forlorn communities of the high desert, I am prompted to comment on the state of the US real estate market.

Those in the grip of a real estate recession take solace. We are in the process of unwinding 2022’s excesses, but no more. There is no doubt a long-term bull market in real estate will continue for another decade, once a two year break is completed.

There is a generational structural shortage of supply with housing which won’t come back into balance until the 2030s. You don’t have a real estate crash when we are short 10 million homes.

The reasons, of course, are demographic. There are only three numbers you need to know in the housing market for the next ten years: there are 80 million baby boomers, 65 million Generation Xers who follow them, and 86 million in the generation after that, the Millennials.

The boomers (between ages 58 and 76) have been unloading dwellings to the Gen Xers (between ages 46 and 57) since prices peaked in 2007. But there are not enough of the latter, and three decades of falling real incomes mean that they only earn a fraction of what their parents made. That’s what caused the financial crisis. That has created a massive shortage of housing, both for ownership and rentals.

There is a happy ending to this story.

Millennials now aged 26-41 are now the dominant buyers in the market. They are transitioning from 30% to 70% of all new buyers of homes. They are also just entering the peak spending years of middle age, which is great for everyone.

The Great Millennial Migration to the suburbs and Middle America has just begun. Thanks to the pandemic and Zoom, many are never returning to the cities. That has prompted massive numbers to move from the coasts to the American heartland.

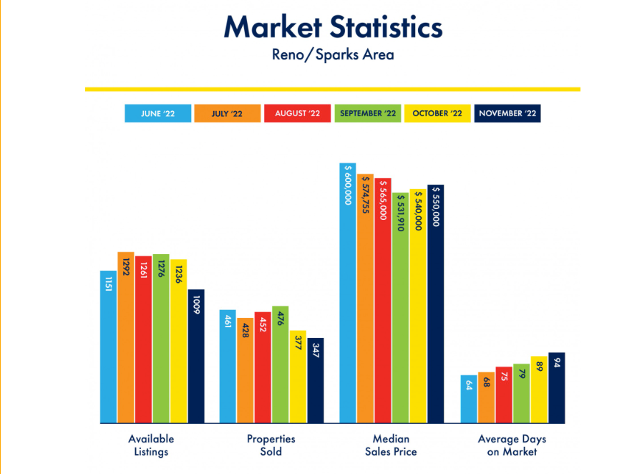

That’s why Boise, Idaho was the top-performing real estate market, followed by Phoenix, Arizona. Personally, I like Reno, Nevada, where Apple, Google, Amazon, and Tesla are building factories as fast as they can.

As a result, the price of single-family homes should continue to rise during the 2020s, as they did during the 1970s and the 1990s when similar demographic forces were at play.

This will happen in the context of a labor shortfall, soaring wages, and rising standards of living.

Rising rents are accelerating this trend. Renters now pay 35% of their gross income, compared to only 18% for owners, and less, when multiple deductions and tax subsidies are considered. Rents are now rising faster than home prices.

Remember, too, that the US will not have built any new houses in large numbers in 16 years. The 50% of small home builders that went under during the Financial Crisis never came back.

We are still operating at only a half of the 2007 peak rate. Thanks to the Great Recession, the construction of five million new homes has gone missing in action.

There is a new factor at work. We are all now prisoners of the 2.75% 30-year fixed rate mortgages we all obtained over the past five years. If we sell and try to move, a new mortgage will cost double today. If you borrow at a 2.75% 30-year fixed rate, and the long-term inflation rate is 3%, then, over time, you will get your house for free. That’s why nobody is selling, and prices have barely fallen.

This winds down towards the end of 2023 as the Fed realizes its many errors and sharply lowers interest rates. Home prices will explode…. again.

Quite honestly, of all the asset classes mentioned in this report, purchasing your abode is probably the single best investment you can make now after you throw in all the tax breaks. It’s also a great inflation play.

That means the major homebuilders like Lennar (LEN), Pulte Homes (PHM), and KB Homes (KBH) are a buy on the dip.

Recent Reno Real Estate Statistics

Crossing the Bridge to Home Sweet Home

9) Postscript

We have pulled into the station at Truckee amid a howling blizzard.

My loyal staff has made the ten-mile trek from my estate at Incline Village to welcome me to California with a couple of hot breakfast burritos and a chilled bottle of Dom Perignon Champagne, which has been resting in a nearby snowbank. I am thankfully spared from taking my last meal with Amtrak.

After that, it was over legendary Donner Pass, and then all downhill from the Sierras, across the Central Valley, and into the Sacramento River Delta.

Well, that’s all for now. We’ve just passed what was left of the Pacific mothball fleet moored near the Benicia Bridge (2,000 ships down to six in 50 years). The pressure increase caused by a 7,200-foot descent from Donner Pass has crushed my plastic water bottle. Nice science experiment!

The Golden Gate Bridge and the soaring spire of Salesforce Tower are just around the next bend across San Francisco Bay.

A storm has blown through, leaving the air crystal clear and the bay as flat as glass. It is time for me to unplug my MacBook Pro and iPhone, pick up my various adapters, and pack up.

We arrive in Emeryville 45 minutes early. With any luck, I can squeeze in a ten-mile night hike up Grizzly Peak and still get home in time to watch the ball drop in New York’s Times Square on TV.

I reach the ridge just in time to catch a spectacular pastel sunset over the Pacific Ocean. The omens are there. It is going to be another good year.

I’ll shoot you a Trade Alert whenever I see a window open at a sweet spot on any of the dozens of trades described above, which should be soon.

Good luck and good trading in 2023!

John Thomas

The Mad Hedge Fund Trader