Is the 30-Year Mortgage an Endangered Species?

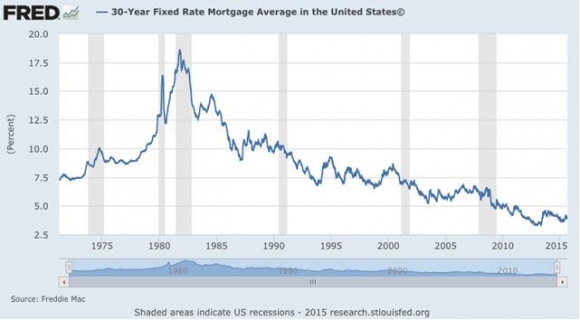

One of the great anomalies of the American credit markets has always been the existence of the 30-year fixed rate home mortgage.

Long the favorite of homeowners, it has financed the majority of US residential property purchases since a Depression era housing stimulus program created them in 1938.

That is until now.

A perfect storm of institutional, political and economic factors is conspiring to bring an end to this type of loan.

Is it truly going the way of the dodo bird?

Look at the global credit landscape, and the 30 year fixed rate loan exists nowhere else.

Banks in all other countries only offer floating rate loans, where interest rates are adjusted monthly, quarterly, or annually to reflect the ebb and flow of the bond market. Thus, the homeowner assumes all of the interest rate risk.

So if you borrow money to buy a house and interest rates remain unchanged or fall, then so does your monthly payment. If rates rise, then so does your monthly nut. If they rise a lot, then you are toast.

The 30-year fixed only exists thanks to a massive government subsidy. That comes in the form of two government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac.

They buy home mortgages from banks, securitize them, and sell them on to end investors with a government guarantee. Thus the government took all the credit risk off of the banks and on to their own books. At the peak, the pair owned or guaranteed more than $5 trillion in debt.

And therein lies the problem.

When the 2008-2009 financial crisis came storming in, it didn?t take long for many of GSE?s home loans to default.

Thanks to the credit excesses of the 2000s, liars loans, and excess leverage, it turns out that many of the loans sold to them as prime credits were in fact junk. The default rates of some mortgage-backed securities exceeded 50%.

It didn?t take long for the GSEs' capital to get completely wiped out. They effectively declared bankruptcy (the polite term used was conservatorship), and were only kept alive with a $360 billion government bailout.

Private shareholders in the two were wiped out, and the stocks delisted from the NYSE.

At present, the two GSE?s are stuck in a holding pattern, waiting for congress to decide their fates. Fat chance of congress deciding on anything in its current gridlocked state.

At the very least, they require $150 billion in new capital to operate independently once again. However, congress is in no mood to spend money either.

Many analysts expect that it is just a matter of time before the two GSEs disappear. The daggers are certainly out in Washington, where many see them as just another subsidy or entitlement program, which they are.

Wipe out the GSEs, and you kill off the 30 year fixed rate mortgage, and by implication, the residential housing market as well.

This is happening two years after the Federal Reserve is ending its quantitative easing program, which, at it's highs, bought 50% of all the mortgage backed securities issued, or about $40 billion a month.

A privatized 30-year market would probably boost rates by 200 basis points, up from the present 3.40% to 5.40%, or about what your average subprime borrower might have to cough up.

That means monthly mortgage payments that are 50% higher than now. That is unless you have a near perfect FICO score of 750 or higher, and are willing to move all of your current financial transactions to the new lender.

However, the banks are likely to step in with other products like a 5/1 year adjustable rate mortgage, or just outright floaters to fill the gap.

As long as the world remains in a deflationary funk, the prospects of a serious rate spike are extraordinarily? low. The end result will be more risk for consumers, and less for the banks?.and the government.

In any case, with some 40% of today?s buyers paying all cash, the debt markets are less relevant than they used to be.

The 30-year is a bit of a dinosaur. The average holding period for a home is four years, and I never understood why borrowers paid the extra premium for the 26 years worth of debt they didn?t need. I guess it's because that?s what everyone else does.

It is most efficient to match your loan maturity with the time you expect to stay in your house. Five year loans should cover most of us, and certainly ten years. Shorter-term loans carry interest rates 100-150 basis points cheaper than the 30-year fixed.

This is all another facet of an economy that is evolving at an accelerating rate. It is finding the true value of everything and re-pricing them accordingly at hyper speed.

Think Amazon and books, iTunes and music, Netflix and movies and Ebay and clothes. Suddenly things have gone from expensive to cheap, while others make the trip from artificially cheap to expensive.

The 30-year fixed rate loan is about to make that second trip.