Trade Alert - (HD) September 18, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (HD)- BUY

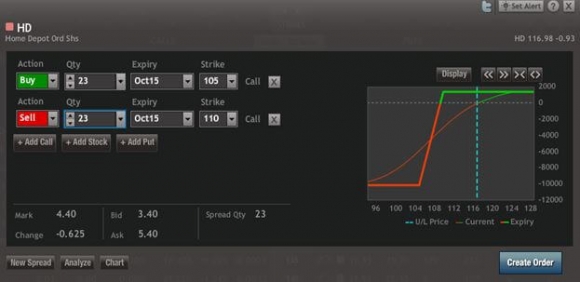

Buy the Home Depot (HD) October, 2015 $105-$110 in-the-money vertical bull call spread at $4.40 or best

Opening Trade

9-18-2015

expiration date: October 16, 2015

Portfolio weighting: 10%

Number of Contracts = 23 contracts

You can pay all the way up to $4.60 for this spread and it still makes sense. If you can?t do options, buy the (HD) shares outright.

Keep in mind that we have ?fast trading? conditions now, so the prices can be anywhere.

With the Volatility Index (VIX) trading above $24, I?ll take that as a ?BUY? signal. With volatility this high, trades that are seemingly impossible can get done. This is one of those ?Mission Impossibles.?

Now that the Fed decision is out of the way, it?s time to start scaling in to the best companies that will outperform for the rest of the year.

If you are uncertain about How to Execute a Vertical Bull Call Spread, please watch my instructional video on the website by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/ .

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 23 October, 2015 (HD) $105 calls at????.??$12.20

Sell short 23 Octoberr, 2015 (HD) $110 calls at????..?$7.80

Net Cost:?????????????????????.....$4.40

Potential Profit at expiration: $5.00 - $4.40 = $0.60

(23 X 100 X $0.60) = $1,380 or 1.38% profit for the notional $100,000 portfolio.