Trade Alert - (FXY) August 11, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (FXY) - Buy

Buy the Currency Shares Japanese Yen Trust (FXY) September, 2016 $99-$102 in-the-money vertical bear put spread at $2.50 or best

Opening Trade

8-11-2016

expiration date: September 16, 2016

Portfolio weighting: 10%

Number of Contracts = 40 contracts

I?m sorry, but I just don?t believe that the Japanese yen can trade through ?100 to the dollar and stay there.

So I am therefore going to double up my yen short through adding the Currency Shares Japanese Yen Trust (FXY) September, 2016 $99-$102 in-the-money vertical bear put spread at $2.50 or best.

The plan here is to let our existing August yen short expire in six days at it's maximum profit point under $97, then run the September for another month.

With the stock market trading this high, the possibility of a 25 basis point rate hike by the Federal Reserve at the September 16-17 meeting is squarely back on the table.

I don?t think they will do it, but the dollar and stocks will levitate until then.

This is a bet that the Japanese yen is not going to blast through to a new multiyear high over the next month.

It is much more likely that the yen is double topping here on the charts, presaging a much larger move down.

We have had a series of big disappointments from the Tokyo government over the past two weeks that have driven the (FXY) up a monster six points, a huge move in the foreign exchange markets.

First, the Bank of Japan failed to increase quantitative easing at their last meeting. Then the Abe government introduced a reflationary infrastructure package of $275 billion that was seen by the market as too little too late.

If this is your first trade with the Mad Hedge Fund Trader, you may want to pass. (FXY) options are notoriously illiquid during US trading hours.

You have to just put your limit order in the market and wait. If you get your price, fine. If not, walk away. Chasing is NOT allowed here.

If you can?t trade options, then buy the ProShares Ultra Short Yen ETF (YCS) outright. The yen is going much lower.

The best execution for the options can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

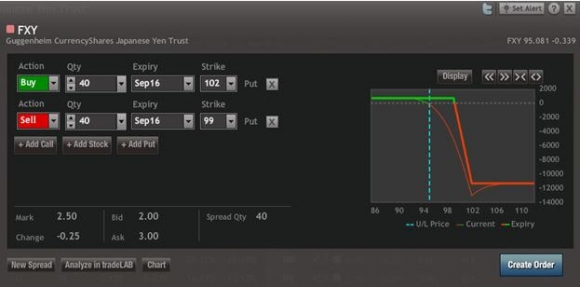

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options trade, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

Don?t execute the legs individually or you will end up losing much of your profit.

Keep in mind that these are ballpark prices only.

You can pay up to $2.70 for the spread and it still makes sense.

More depth on the Japanese yen to follow.

Here are the specific trades you need to execute this position:

Buy 40 September, 2016 (FXY) $102 puts at???..??$6.70

Sell short 40 September, 2016 (FXY) $99 puts at..????..$4.20

Cost:????????????.???????.?.....$2.50

Potential Profit: $3.00 - $2.50 = $0.50

(40 X 100 X $0.50) = $2,000 or 20% profit in 25 trading days.