Closing Trade Alert on the (TLT)

Buy to Cover the Short position in the (TLT) September $116-$111 put spread at $0.07 or best

Closing Trade

8-28-2012 ? 11:30 AM EST

expiration date: 9-21-2012

Portfolio weighting: 5%on a delta basis

($5,000/100/$0.07) = 25 Contracts

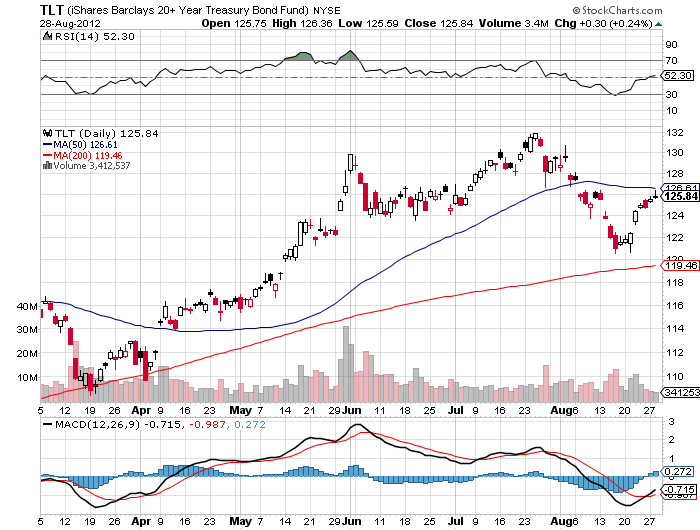

Eight days ago, I was dead-on correct in predicting that a risk reversal in the markets was imminent, and the Treasury bond market was ripe for at least a five point rally. Well, I lied. Instead we got a six points rally which has taken the value of our short position in the (TLT) September $116-$111 put spread from $0.37 to only $0.07, a drop of 81%.

The original 12 point collapse in the (TLT) was caused by comments made by European Central Bank President, Mario Draghi, who in July, said that he would do ?whatever it takes? to save the Euro. It was one of the easiest bets of the year that Mr. Mario would not follow up his words with action, especially during August, when the entire European leadership was taking their annual six week vacation on the Isle of Sylt, the South of France, or at Bognor Regis. Reminder to newbies and beginners: making money is not always this easy.

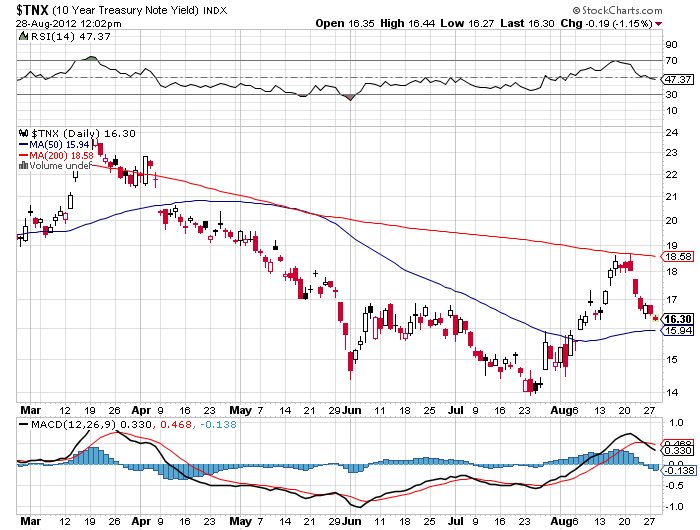

It is a no brainer to take profits here. Yields have plummeted from a high of 1.92% down to 1.63% in a mere eight days. We are now dead in the middle of the three month trading range for the (TLT). We get to come out three days before Ben Bernanke gives his Jackson Hole speech which could rile the financial markets. We also get to duck the coming weekend when Mario Draghi is prone to antics of the quantitative easing variety.

By coming out here, you also free up margin to do more interesting things in gold, silver, the Japanese yen, the Russell 2000, the S&P 500, and Apple. On top of all that, we have squeezed out the bulk of the profit on this position in just eight days. It is not worth it to hang on until September 21 only for 17 more basis points. The world could end by then. The risk/reward ratio is no longer favorable. Remember: hogs get fed, pigs get slaughtered.

The better way to play this move would have been to buy outright calls or call spreads on the (TLT), which would have added a hefty 5% to our year-to-date performance. But the melt up happened so fast, it was hard to pick a good entry point.

The profit on this trade is $0.37 - $0.07 = $0.30

That adds (25 X 100 X $0.30) = $750, or 0.75% to? the notional $100,000 portfolio.

To execute this trade:

Buy to cover the September, 2012 (TLT) $116 puts at..$0.11

Sell the September, 2012 (TLT) $111 puts at????.$0.04

Net Cost to cover:???????.?.??????...$0.07

Enter this trade as a single day limit order for the entire spread, not the individual legs. If you don?t get done, work your limit up a penny at a time. Your options trading platform should allow this. That keeps you from paying a double spread.

I am happy to report that this is the 14th consecutive profitable closing trade alert. If you add the 8 unrealized profitable trades still on the books, this takes my current run to 22 money-making ideas in a row.

Well, it?s back to my workout. I want to wear my Speedo with pride next summer on the Italian Riviera. On to the next one.

If you wish to receive trade alerts like this on a real time, instantaneous basis, please subscribe to my Trade Alert Service by clicking here .

Thank you Mr. Mario