Activists Lay In on eBay

A highly compelling argument – that was my initial reaction after diving into Elliot Management’s letter to eBay’s (EBAY) shareholders after the ruthless investor activist announced an over 4% stake in one of the original online marketplace giants.

Not only that, hedge fund Starboard Value LP also has gotten in on the act with a position of less than 4%.

Starboard has doubled down agreeing with the general points of Elliot Management’s prognosis on the weakness of eBay’s business model

There are no two ways about it - eBay has been condemned to tech purgatory as of late and is in dire need of a facelift.

If you’re a manager of any sort of magnitude at e-commerce platform eBay, this was the letter of doom and gloom you hoped you would never get.

The equity Gods have been harsh to eBay as PayPal (PYPL), one of the Mad Hedge Technology Letter’s favorite picks in 2019, has risen over 130% after spinning off from eBay in 2015.

eBay is down substantially since that point in time reflecting a poorly run business in a secular growth industry that has produced home runs most evident in the performance of Jeff Bezos’ Amazon.com (AMZN).

The gist of Elliot’s diagnosis centered around the terrible operational execution at the Silicon Valley firm.

It essentially repeats this premise over and over throughout the content.

Current management is historically bad that any efficiencies implemented into the platform would boost growth reverting it back to a point closer to a trajectory that echoes closer to a normal high growth e-commerce company.

How did eBay peter out to mediocrity?

Let me explain.

There is a time-established pattern that Elliot Management identified – eBay management increasing spend to stimulate growth, failing to deliver the goods and reverting back to square one.

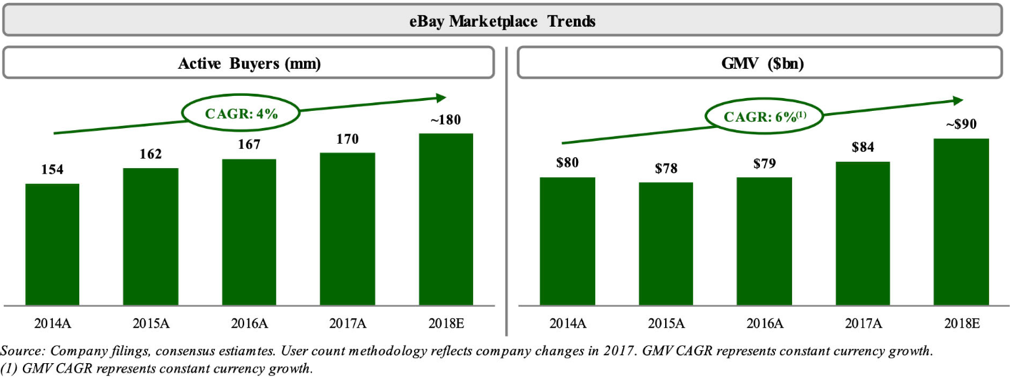

The result is paltry growth in the mid-single digits which can be seen in minimal growth numbers in the gross merchandise volume (GMV), a metric established to gauge the total amount of volume pushed through eBay.

The activist hedge fund claimed that shares could potentially double if their calculated plan could shortly be deployed.

The plan was straight forward and there was no innovative x-factors described or pivot to augmented reality or machine learning that many firms like to hype up.

Elliot’s strategy is purely operational relating to the core business – where is Tim Cook when you need him!

The argument originates from whether eBay management can allocate resources more efficiently, focus on boosting foundational growth in the core marketplace, and develop new verticals that were completely missed in its development, then the stock would react favorably.

I would even double down and say that if they do half of what they promise in the Elliot’s letter, shares should pop at least 30%.

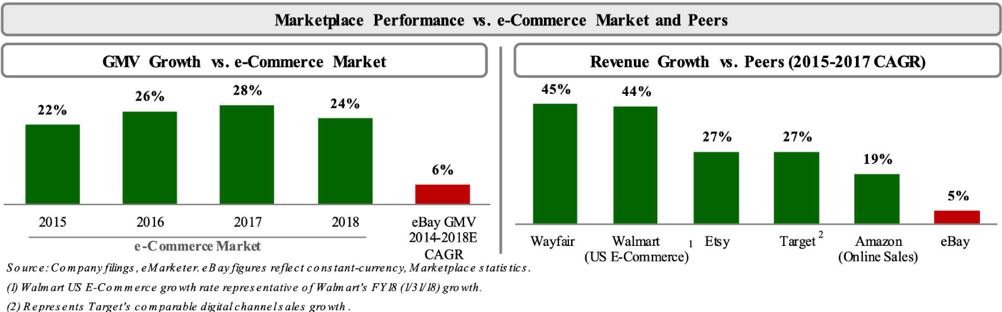

eBay exists under a backdrop of massive secular drivers fueling e-commerce.

The industry is the most robust in the economy and is expanding in the mid-20% even as global sales are about to eclipse the $3 trillion mark.

E-commerce just has a penetration rate of 10% and the runway is long which should enable mainstay companies to grow their top and bottom line if not botched completely.

Average consumer spending is in the throes of major disruption from analog brick and mortar stores to digital e-commerce, and eBay’s strategic position offers an advantageous platform to carve out e-commerce success moving forward.

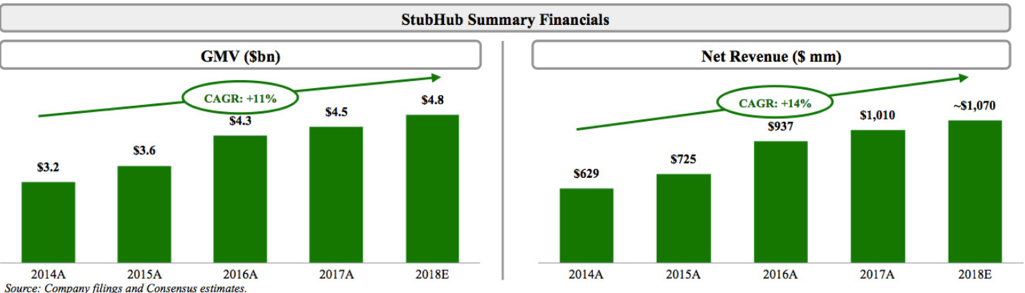

The first thing Elliot wants to do is reach up their sleeve for a little financial engineering magic by spinning out in-house mega-growth assets of StubHub, the e-ticket event vendor, and its portfolio of premium classified properties that possess double-digit sales growth and elevated margins.

Elliot argues that these two assets would perform better on a standalone basis because they wouldn’t be bogged down by eBay turning around the core business which could possibly result in some misallocated capital and delays.

The valuation of eBay’s Classified Groups assets is around $4.5 billion, but segment that out and the value could represent $10 billion.

The same boost in valuation applies to event ticket seller platform StubHub. The company is valued at just $2.2 billion under the umbrella of eBay but tear the baby out of eBay’s uterus and suddenly the valuation balloons to a rosier $4 billion.

Watching from afar, Elliot has pinpointed management’s “self-inflicted mis-execution” and management must summon all their power and resources to direct “singular attention to growing and strengthening marketplace.”

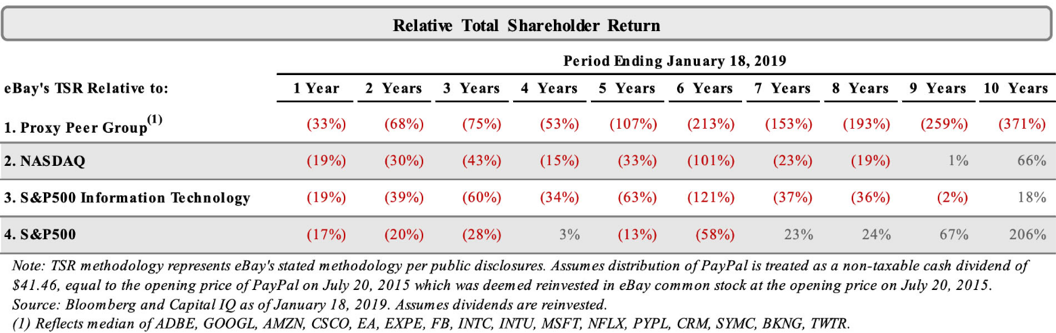

eBay has severely underperformed in share price relative to its peers by 107% in the past 5 years. Extrapolate the time horizon to 10 years and the underperformance shoots up to 371%.

These have been the tech golden years and there is no feasible excuse to why this company hasn’t been able to perform better or equal relative to their peer group.

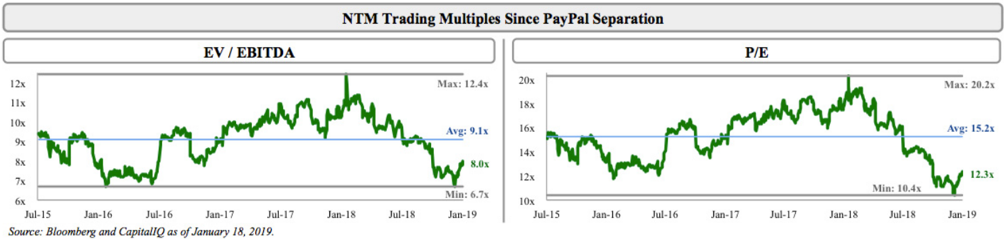

eBay is the second biggest e-commerce platform in the world but only trades at a PE of 12 showing the malaise of investor sentiment surrounding this name.

This is unfortunate because eBay has strong embedded actionable communities in South Korea, Australia, Italy, Germany, U.K., U.S., and Canada.

The tools are there but it is hard to take a stab when the tool is blunted by poor management.

Compare slow growth with the rocket-fueled growth of asset StubHub which has almost doubled revenue in the past 5 years.

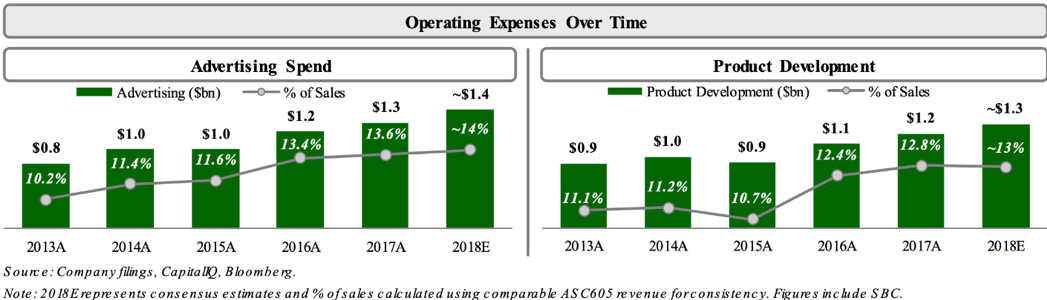

eBay has lifted advertising spend by 70% since 2013 and revved up product development by 45% as well. This has surprisingly led to material margin declines because of the failure of these initiatives to take hold.

One of the missteps resulting in this margin softness is the dysfunctional execution of its online platform infected by technical problems and operational headwinds.

A few notable events were a 2014 broad-based password hack and the botched fix to that problem exacerbated by a muddied communication strategy.

During this time, eBay was outmaneuvered by Google’s (GOOGL) search algorithm resulting in a massive decline in traffic as a result of this painful change.

The next year was similarly awful with a shoddy mobile application that did not resonate with customers and was put out to pasture shortly after rolling it out.

An online marketplace offering a platform for over four million buyers and sellers to carry out business requires high-level functioning. A failure to deliver this experience has caused long-time users to jump ship to other niche vertical platforms.

Innovative endeavors aren’t part of this new strategy to remake the company.

The underlying strategy effectively spells out that eBay needs to become more like Amazon and any sort of moderate success in doing that will positively boost the stock price – let’s call it what it is – an operational overhaul and nothing more than that.

The complaints don’t stop there and last year eBay was inundated with technical issues that included incorrect billing, deleted photos, warped title presentation, and senior management took the blame in a podcast confessing that management needs to pull things together and they “don’t want to repeat (the same mistakes) on a number of levels. And the technology issues that we have had with the platform are on top of the list.”

eBay is not a startup and presides over a profitable business.

Returning capital to shareholders was part of the plan as well.

This entails repurchasing shares of up to $5 billion which was $1 billion more than the original guidance – Elliot Management is an activist investor after all hoping to super-charge shareholder income streams.

Elliot wants to implement a 1.5% dividend yield due to eBay’s high free cash flow model.

After 2020, Elliot wants to allocate 80% of free cash flow for share repurchases and earmark the other 20% for M&A activity.

It is difficult to surmise if this plan will work smoothly or not, but if Elliot can bring in the correct team to execute this plan, I would give them the benefit of the doubt as making this plan into a viable success seems realistic.

But it is yet to be seen how laborious it will be to get the people they want through the door.

eBay is truly a unique asset and the chopped-down nature of its shares would stage a remarkable turnaround if some proven management from Amazon’s executive team could be captured and convinced that eBay is a legitimate option.

Easier said than done, but this is a step in the right direction.

My Luger is firmly in my holster and waiting for some action - if there are any whiffs of a real turnaround then I’ll shoot out some eBay trade alerts.