Buy Salesforce on the Dip

Taking the current temperature of bellwether stocks is just as important as understanding the secular trends imbuing the tech industry.

Salesforce (CRM) released earnings on Monday and the report was solid but not spectacular.

Shares of Salesforce sold off mildly following the report and could be an indicator of trading lethargy engulfing the hot software group.

At the end of 2018, I urged readers to focus on the cloud-based software stocks and they have performed admirably the first three months of the year.

This trade isn’t finished yet, but it needs a breather and that is what the slight consolidation of Salesforce’s stock is telling us.

The weak guidance issued for the following quarter was more than enough reason to take some profits and accumulate more gunpowder for the next big leg up.

I do not believe tempering forecasts is a material negative for the stock and anyone following this great company can wholeheartedly agree that they have resolutely delivered the top line growth promised by audacious founder and Co-CEO of Salesforce Marc Benioff.

Subduing next quarters forecasts could be a management trick to lower the bar that even mediocre performance can surpass.

I fully expect Salesforce to handily beat next quarters' estimates.

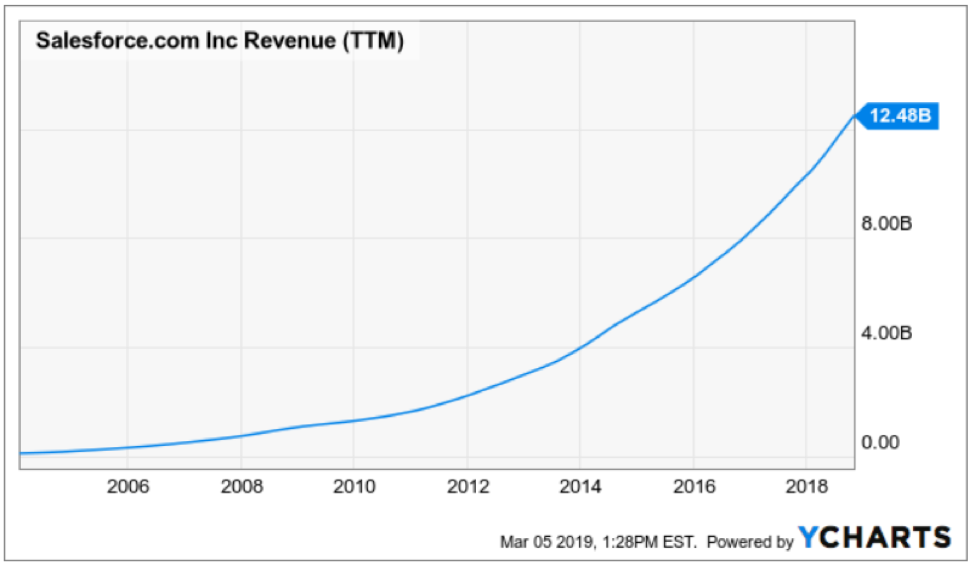

For the full year of 2018, Salesforce racked up more than $13.2 billion in revenue, making Salesforce the fastest enterprise software company ever to eclipse $13 billion.

Salesforce issued a new revenue target for fiscal year 2023 - $26 billion to $28 billion.

The company will need to organically double revenue again in the next 4 years to achieve this feat.

Last quarter experienced a continuation of revenue growth that has made Salesforce one of the leading luminaries of enterprise software industry with revenue in the quarter rising to more than $3.6 billion, up 27% YOY.

They are the 800-pound gorilla in the CRM industry commanding 20% of the overall CRM market according to Edge IDC which adds up to more than the next three competitors combined.

The accolades are impressive for a company that is on the verge of hitting its 20th anniversary and still squarely in uber-growth mode.

The impact of Salesforce is deep, creating a Salesforce economy growing around the firm, and the network effect derived from it is truly breathtaking, one that will deliver at least 3 million additional jobs and more than $850 billion in GDP impact by 2022.

The volume of $20 million and over relationships grew 48% YOY including two 9-figure renewal expansions in the quarter.

Take a look at the finance sector with Barclays as a golden example.

At the World Economic Forum, CEO of Barclays Jes Staley gloated that they had just signed the largest technology agreement in their 300-year history with Salesforce in January.

Salesforce is aiding them in the digital transformation for their 48 million customers, and aim to enhance the digital service offerings to them via the cloud.

I reckon that the volume of $20 million relationships will keep trending higher as Salesforce refine their products for big institutions, as almost every one of them is keen on rapid digital migration that will effectively serve the customer better and put the kibosh on expenses.

Recently raising annual revenue forecasts to around $16.05 billion was inevitable and is not a question of if, but how much earlier than expected can they deliver this overperformance.

It is the first stop on the way to $20 billion in annual sales and if Salesforce can continue to push this narrative of mid-20% top-line growth, shares will climb higher.

The amount of business gravitating towards their CRM interface is demonstrably positive with 96% of media companies from the Fortune 500 Salesforce customers.

This is just the beginning.

The crux of this narrative is that its business model is unrivaled amongst competitors and its strategic position will allow the company to harvest multiyear revenue growth of mid-20% YOY growth as cloud computing is the major recipient of this massive digital transformation.

Salesforce has an enviable position and any weakness in shares is temporary.

The company has forged into a new era of profitability and its scalability allows more and more revenue to drop down to the bottom line.

I believe operating income will accelerate and the company will become even more lucrative with exploding EPS growth just around the corner.

It’s one of the most efficient firms in the world and the 22% spike in new hires will add to the robust growth engine that is known as Salesforce, considering 85% of enterprise customers are in the first innings of full-blown digital transformation.