Turbulence at Boeing (BA)

You would think that with all the bad news out, Boeing shares would finally hit bottom.

All Boeing 737 Max 8 planes have been grounded. The 58 new $100 million planes a month scheduled for delivery have been suspended. That means one of the largest companies in the United States is banned from selling far and away its most important product.

Wrong!

This morning we learned that Federal prosecutors are investigating Boeing as to whether it was criminally negligent in obtaining the troubled aircraft’s original FAA certification. Subpoenas for emails and documentation have been issued, and a general ruckus created.

This was a guaranteed outcome. You want deregulation? This is what you get. You cut budgets? This is also what you get. I highly doubt that Boeing will be found criminally culpable for the two crashes. This is all an outcome from the US government’s withdrawal from oversite of the private sector.

The truth is that the technological and cost advantages of the Boeing 737 Max are so enormous that airlines have little choice but to stand behinf them. That explains why Boeing has a ten-year, 4,636 plane order book for the plane. Boeing has to fix this problem or there will be NO aircraft industry.

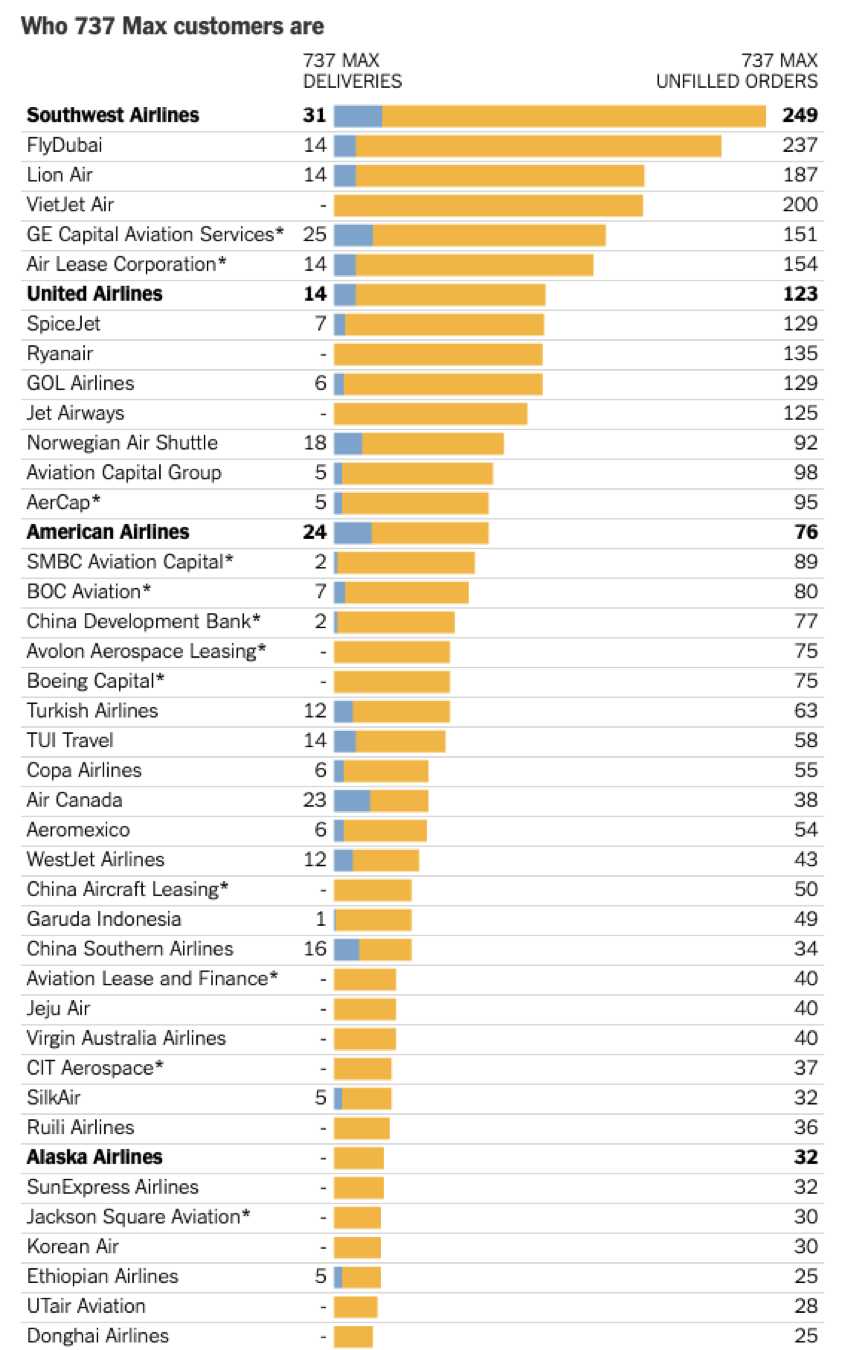

This is why Southwest Airlines (LUV) has ordered 249 of the cutting edge planes, followed by 123 for United (UAL) and 76 for American (AAL).

Having been a commercial pilot for most of my life, and once owning a European air charter company I have some insights into this issue.

These two crashes are not a software problem, which can be fixed in days. It is a pilot training issue. And I have been subjected to this training myself hundreds of times until I can do it blindfolded and in my sleep. Whenever you have a runaway autopilot problem, you PULL THE DAMN CIRCUIT BREAKER!

However, if you are poorly trained, as are many emerging airline pilots, and can’t remember which of the 100 circuit breakers you need to pull with a runaway autopilot then the plane will crash. The harsh truth here is that MOST modern-day pilots can’t hand fly a plane without an autopilot.

I am therefore willing to bet that Boeing shares are near or at a medium-term bottom, now $75 off its high from only weeks ago.

Boeing Aircraft (BA) is one of the great icons of American manufacturing, and also one of the country’s largest exporters. I was given a private, sneak preview of the new Dreamliner at the Everett plant days before the official launch with the public, and I can tell you that this engineering marvel is a quantitative leap forward in technology. No surprise that the company has amassed one of the greatest back order books in history.

I can also tell you that my family has a very long history with Boeing (BA). During WWII, my dad got down on his knees and kissed the runway when the B-17 bomber in which he served as tail gunner (two probables) made it back despite the many holes. It was only after the war that he learned that the job had one of the highest fatality rates in the services.

Some 40 years later, I got down on my knees and kissed the runway when a tired and rickety Boeing 707 held together with spit and bailing wire which was first delivered as Dwight Eisenhower’s Air Force One in 1955, flew me and the rest of Reagan’s White House Press Corp to Tokyo in 1983 and made it there in one piece.

I even tried to buy my own personal B-17 bomber in the nineties for a nonprofit air show I was planning but was outbid by the late Paul Allen on behalf of his new aviation museum. Note to self: never try to outbid a co-founder of Microsoft on anything.

So it is with the greatest difficulty that I examine this company in the cold hard light of a stock analyst. There is nothing fundamentally wrong with the company. But its major customers around the world are suffering from some unprecedented stress.

US airlines are getting hammered by the rising cost of fuel. Delta even resorted to the unprecedented move of buying its own refinery to assure fuel supplies. Europe, where Boeing competes fiercely against its arch enemy, Airbus, is clearly in recession. Government-owned airlines there are in ferocious cost-cutting mode.

China, another one of Boeing’s largest customers, is also slowing down, thanks to the trade war. As for Japan, the economy there is going from bad to worse. All Nippon Airways was awarded the first Dreamliner for delivery because it is such a large customer. It is just a matter of time before this harsh reality starts to put a dent in the company’s impressive earnings growth.

This is not for the weak of heart.