Mad Hedge Hot Tips

April 8, 2019

Fiat Lux

The Five Most Important Things That Happened Today

(and what to do about them)

1) Pinterest Launches a Down Round. With an IPO target of $9 billion compared to $12 billion in their last venture capital valuation, the IPO market is deflating very quickly. The weak (LYFT) post-market trading is the cautionary tale. Click here.

2) Boeing Shares Slammed, down 5%, on latest production cutback. Crash disruption may now extend to 6-9 months, and earnings cut 13%. We might get a second bite of the apple. Buy (BA) on the next order cancelation. Click here.

3) GE Gets Slaughtered, with an earnings downgrade from Morgan Stanley. It will take years to sort out this mess. Avoid (GE). Click here.

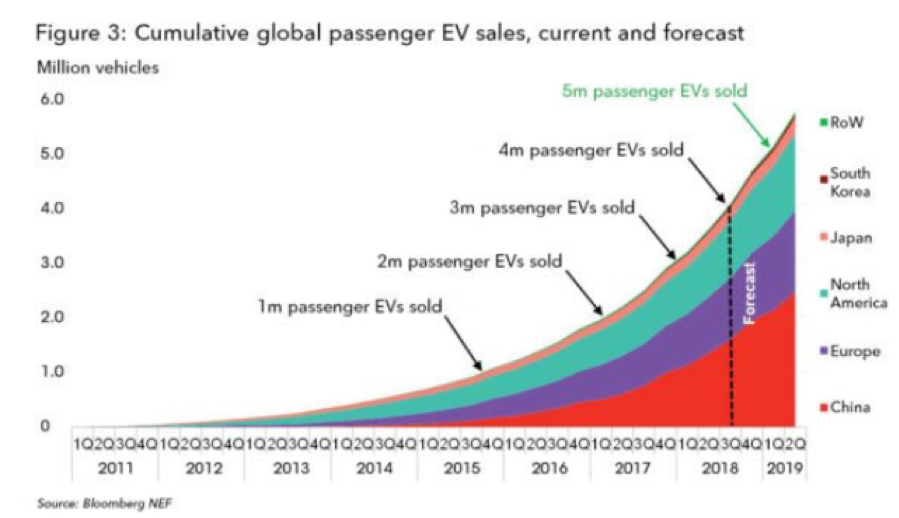

4) Copper Demand is Rocketing, off of soaring global electric car production. Each vehicle needs 22 pounds of the red metal, and 4 million have been built so far. Take a second bite of the apple with (FCX) as well. Click here.

5) The 30-Year Mortgage Plunges to 4.03%, and may save the spring selling season for residential real estate. Click here.

Published today in the Mad Hedge Global Trading Dispatch and Mad Hedge Technology Letter:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE FLIP-FLOPPING MARKET),

(SPY), (TLT), (TSLA), (BA), (LUV), (DAL),

(THE BATTLE FOR COFFEE IN CHINA),

(SBUX), (MSFT), (AAPL), (IBM)