Trade Alert - (FCX) April 26, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FCX) - BUY

Buy the Freeport McMoRan May 2019 $10.50-$11.50 bull call spread at $0.90 or best

Opening Trade

4-26-2019

expiration date: 5-17-2019

Portfolio weighting: 10%

Number of Contracts = 111 contracts.

Freeport McMoRan disappointed with Q1 earnings coming in at $.05 a share. versus the expected $0.08 a share, prompting a 17$ selloff in the stock. A 7% decline in the price of copper hasn’t helped either.

However, I believe this is due to temporary one-off non-recurring issues and doesn’t reflect the true strength of the company.

It is clear from the imminent end of the trade war with China that the hard landing scenario is off the table. This is great news for the producers of everything that the Middle Kingdom buys in bulk, especially copper.

I am therefore buying the Freeport McMoRan October $10.50-$11.50 bull call spread at $0.90 or best.

This is a very conservative short-term trade that assumes that the stock doesn’t hit new lows anytime soon.

This is a bet that (FCX) will not fall below $11.50 by the May 17 options expiration in 15 trading days.

Don’t pay more than $0.93 or the risk-reward will tip against you.

If you don’t do options, then buy the (FCX) shares outright. Its recent historic high is a lofty $50. Or, you can buy the copper ETF outright the Global X Copper Miners ETF (COPX).

If you like copper, you’ve got to love Freeport McMoRan (FCX), the world’s largest producers of the red metal. On top of that, the stock yields a 1.55% dividend and sell at a lowly multiple of 7X. These factors explain the sizeable insider buying that has been taking place in the shares over the past month.

Finally, the technical picture is looking pretty positive. The chart is showing that an upside breakout is taking place through the 200-day moving average, always a positive development for stocks.

This commodity is known in the investment industry as Dr. Copper, the only metal that has a PhD in economics. That’s because of its uncanny ability to predict the future of the global economy. Copper is now hinting of better things to come for China and the global economy as a whole.

The recent strength further is confirmed by longer term charts for the Shanghai index ($SSEC), which is showing that a double bottom may well be in place. It’s true that copper is no longer the dominant metal it once was.

Because of the lack of a consumer banking system in the Middle Kingdom, individuals have been hoarding 100-pound copper bars and posting them as collateral for loans. Get any weakness of the kind we have seen this year, and lenders panic, dumping their collateral for cash.

The high-frequency traders are now also in there in force, whipping around prices and creating unprecedented volatility. You can see this also in gold, silver, oil, coal, platinum, and palladium.

Notice how they seem to be running the movie on fast forward everywhere these days? Last year, we probably got an overshoot on the downside in copper that finally flushed out the last of the weak holders.

This is why I am loading up with a bull call spread Freeport McMoRan. The gearing in the company is such that a 50% rise in the price of copper triggers a 100% rise in (FCX).

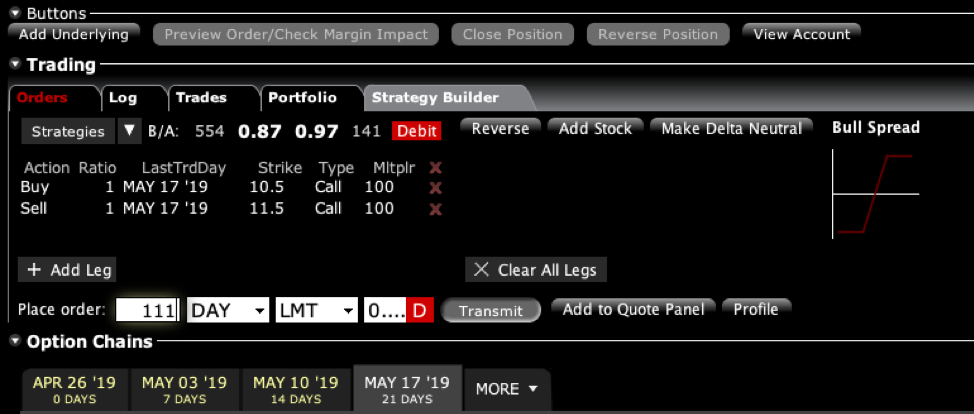

Here are the specific trades you need to execute this position:

Buy 111 May 2019 (FCX) $10.50 calls at…….………..…$2.10

Sell short 111 May 2019 (FCX) $11.50 calls at……....…$1.20

Net Cost:……….......………………………....……..…….......$0.90

Potential Profit: $1.00 - $0.90 = $0.10

($0.10 X 100 X 111) = $1,110 – 11.11% for the notional $100,000 model portfolio in 15 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.