7When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - Western Digital Corporation (WDC) – SELL – TAKE PROFITS

SELL the Western Digital (WDC) September 2019 $65-$70 in-the-money vertical BEAR PUT spread at $4.93 or best

Closing Trade

8-7-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 22 contracts

Western Digital (WDC) opened the session up quite resiliently spiking 1.5%, but then the summer swoon took a hold and traders dumped the stock.

The stock is down 3% and Micron is faring even worse.

Time to take profits in this fast-moving market that isn’t for the faint of heart.

U.S. President Donald Trump slapping on Chinese tariffs and the backlash will be felt by semi chips who extract the bulk of revenue from China.

Central Bank Governor Jerome Powell offering less than dovish rhetoric was the trigger that is fueling this snap decision.

Western Digital (WDC) is a company that I have hated for quite a while, a legacy tech company stuck in a cloud-based world.

You all remember the old Western Digital. Spun off from Emerson Electric Company, Western Digital was the world's largest manufacturer of chips for handheld calculators during the 1970s, the cutting-edge consumer technology product of its day. When the personal computer industry showed up, it moved rapidly into hard drives.

Since then, it hasn't really done anything new except build bigger and faster hard drives in physically smaller sizes. The problem with that approach is that the world has been moving towards solid state storage now for years.

The hard drive is about to become one of the great dodo birds in the history of technology. Western Digital's shares are virtually unchanged in three years, completely missing the 2016-2018 tech melt-up.

Markets are moving quickly and prices are all over point so important to set a limit order.

Sell 22 September 2019 (WDC) $70 put at………….….........……$18.33

Buy to cover short 22 September 2019 (WDC) $65 put at…….$13.40

Net Proceeds:………………………….………..………….…..................$4.93

Profit: $4.93 - $4.37 = $0.56

(22 X 100 X $0.56) = $1,232 or 12.32%

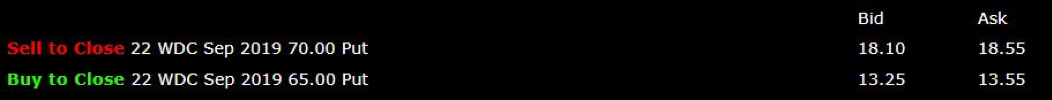

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.