Trade Alert - (MSFT) - EXPIRATION

Trade Alert - (MSFT) - EXPIRATION

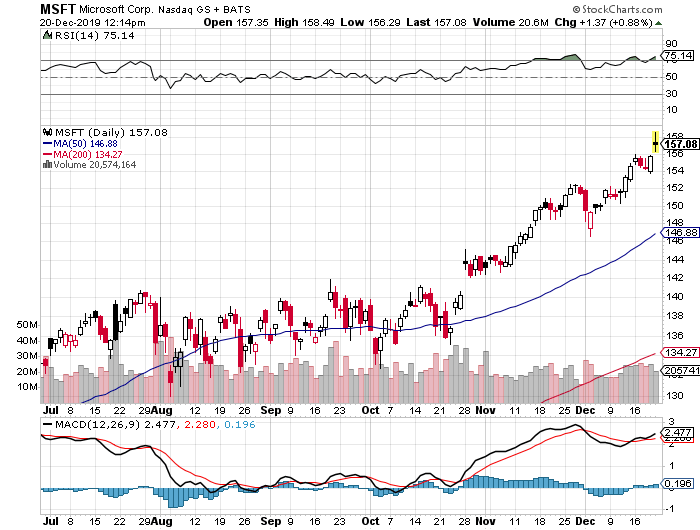

EXPIRATION of the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread at $3.00

Closing Trade

12-20-2019

expiration date: December 20, 2019

Portfolio weighting: 10%

Number of Contracts = 38 contracts

Provided that (MSFT) does not fall $20.08, or 12.73% by the close today, our position in the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread will expire at its maximum profit at $3.00.

As a result, you have earned $1,520, or 15.38% in 22 trading days. If you bought the shares instead, keep them. They are going much higher.

You don’t get any better quality than Microsoft (MSFT) in the tech world. It is the safest stock in which to invest today. This is a stock that you want to hide behind the radiator and keep forever. It is also one of the great turnaround stories of the decade.

In addition, this particular combination of strikes prices gave you huge support at the 50-day moving average at $140.67. Please note this option spread will be profitable whether the market goes up, sideways, or down small over the next four weeks.

This was a bet that Microsoft shares would NOT fall below $137.00 by the December 20 option expiration date in 22 trading days.

This was also a bet that we are not already in a recession, which I believe is still at least 12 months off.

You don’t need to do anything, as the expiration process is now fully automated. The profit will be deposited into your account and the margin freed up on Monday morning.

Well done, and on to the next trade!

EXPIRATION 38 December 2019 (MSFT) $134 calls at…….……$23.08

EXPIRATION short 38 December 2019 (MSFT) $137 calls at…….$20.08

Net Cost:………………………….…………..…..….….....$3.00

Profit: $3.00 - $2.60 = $0.40

(38 X 100 X $0.40) = $1,520 or 15.38% in 22 trading days.

The optics today look utterly different from when Bill Gates was roaming around the corridors in the Redmond, Washington headquarter, and that is a good thing in 2018.

Current CEO Satya Nadella has turned this former legacy company into the 2nd largest cloud competitor to Amazon and then some.

Microsoft Azure is rapidly catching up to Amazon in the cloud space because of the Amazon-effect working in reverse. Companies don’t want to store proprietary data to Amazon’s server farm when they could possible destroy them down the road. Microsoft is mainly a software company and gained the trust of many big companies especially retailers.

Microsoft is also on the vanguard of the gaming industry taking advantage of the young generation’s fear of outside activity. Xbox related revenue is up 36% YOY, and its gaming division is a $10.3 billion per year business. Microsoft Azure grew 87% YOY last quarter.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here at

https://www.madhedgefundtrader.com/ltt-vbpds/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.