Trade Alert - (FB) April 17, 2020 - TAKE PROFITS - EXPIRATION

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FB) – EXPIRATION

EXPIRATION of the Facebook (FB) April 2020 $145-$155 in-the-money vertical Bull Call spread at $10.00

Closing Trade

4-17-2020

expiration date: April 17, 2020

Portfolio weighting: 10%

Number of Contracts = 11 contracts

14 OUT OF THE LAST 15 TRADE ALERTS HAVE NOW CLOSED OUT PROFITABLE.

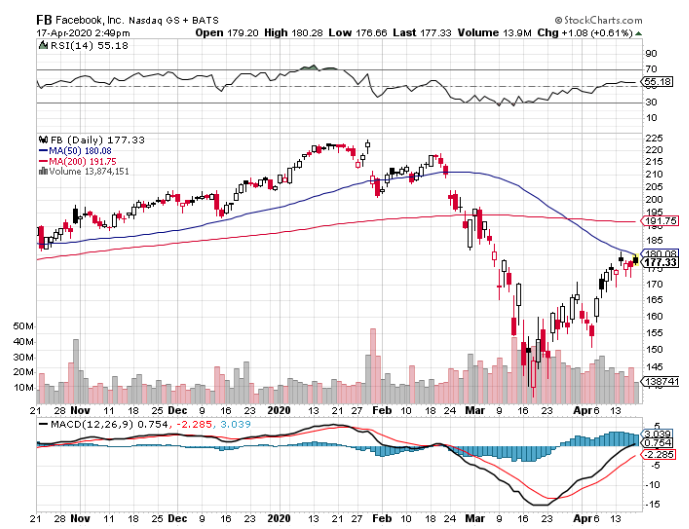

Our long position in Facebook worked out well.

We received several assists. The government announced a back-to-work program hours before the worst Weekly Jobless Claims in history. It’s part of their never-ending strategy to get stocks back up to the old highs before the election.

Also on Thursday, we received leaked, anecdotal evidence that Gilead Sciences’ (GILD) Remdesivir brings speedy recovery in the most severe Corona cases. That was worth a 650-point rally in the Dow.

As a result, you got to earn $880, or 8.69% in 4 trading days. Well done and on to the next trade.

You don’t have to do anything with an option expiration. The profit should be deposited into your account and the Margin freed up on Monday. If it isn’t, get on the phone with your broker immediately.

I think the days of cataclysmic $1,500-$2,000-point Dow days in the Dow are behind us, so it is safe to start putting on these very short term plays.

This was a bet that Facebook (FB) will not trade below $155 by the April 17 option expiration day in 4 trading days.

Here are the specific trades you need to exit this position:

EXPIRATION of 11 April 2020 (FB) $145 calls at……..……$32.33

EXPIRATION of short 11 April 2020 (FB) $155 calls at.....$22.33

Net Proceeds:………………..........….….………..………….….....$10.00

Profit: $10.00 - $9.20 = $0.80

(11 X 100 X $0.80) = $880 or 8.69% in 4 trading days.