Take a Pass on the Newest SPAC eToro

The spike in retail investing has been a boon for online brokerage platform eToro.

The Israeli-headquartered company went public through an SPAC (special purpose acquisition company).

Shares of FinTech Acquisition Corp V (FTCVU), which eToro will trade under, rose over 30% on the news.

Let’s look into the investment thesis of eToro.

The secular trends are highly supportive with a confluence of circumstances — the acceleration of digital technologies, commission-free stock investing, and low-interest rates — increasing retail engagement in the capital markets.

In a way, this brokerage celebrates the rise of the retail investor.

How do eToro’s numbers look?

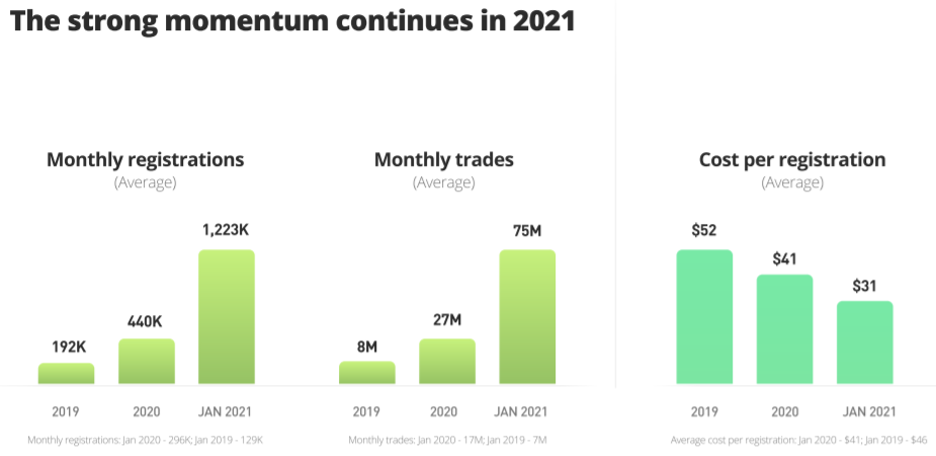

eToro had 147% annual revenue growth from 2019 to 2020 indicating that the surge of voluminous trading was real.

That spike coincided with the shelter-at-home economy.

People were just sat at home with nothing to do with even sports betting offline and online trading became the new sports betting.

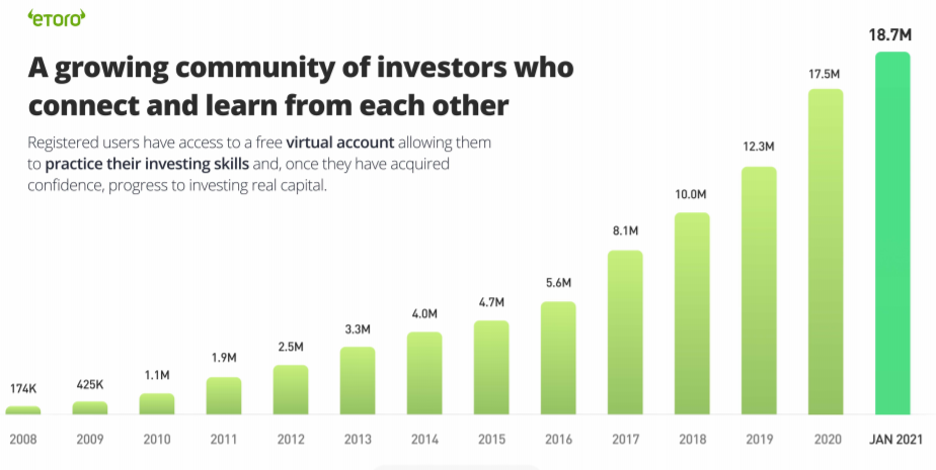

The platform boasts over 20 million registered users from more than 100 countries.

Five million of those were added last year alone as retail engagement rose worldwide.

eToro already offers crypto services in the U.S. and plans to launch stock investing in the second half of 2021.

From 2016 to the end of 2020, revenue rose 1,000% highlighting the astronomical growth in its products.

eToro’s projections are ambitious predicting a rise of revenue of 150% from the start of 2020 to 2025.

To reach their 2025 targets, the tech company would need to grow around 30% per year.

So what are the key takeaways from this “social investment network” trading business?

Well, I love that total revenue grew 147% in the past year, but I hate the -34% annual revenue growth the year prior to that in 2018.

That is a massive red flag.

Another overwhelming ding against them is that eToro has minimal business in the lucrative U.S. market, and most of its revenue is procured from Asia and Europe.

They just announced their foray into U.S. equities, and I must ask, why didn’t they do this years ago?

In an interview with a major television network, eToro CEO Yoni Assia, when asked if there is potential in the US market, he began his answer with eToro’s exploits of creating a cryptocurrency platform for the U.S. market and claimed the North American revenue grew “triple digits” last year but failed to offer any real numbers.

This is another red flag.

His first inclination should not be hyping up a North American cryptocurrency platform, and instead should have focused his intentions on building a stable business on the equity, bonds, and mutual fund side which has more stable cash flow.

Claiming a “triple-digit” growth rate, to me, means that eToro’s North American business is so minimal that the puniest of growth translates into a quadrupling or quintupling of growth or whatever you want to call it.

Another overstep is that the company claims it’s a “social trading network” hoping to hype itself up by attaching it to a branch of social media which is really a step too far.

eToro is grasping at many straws because they are more of an imposter than the real deal.

Another worrying sign that this trading platform is targeting the wrong revenue stream is if you browse eToro’s official American website by clicking (https://www.etoro.com/en-us/), visitors are met with an oversized graphic of Hollywood actor Alec Baldwin pointing to a phone that has the bitcoin logo on it.

A serious trading platform would never, in a million or trillion years, decide to post Baldwin as the first graphic potential customers would see visiting their homepage, forcing me to believe that the company is eyeing the high churn rate but short-term pump and dump of a customer type of strategy.

This strategy is very high risk and EXTREMELY LOW QUALITY.

Usually, the strategy coalesces around an underlying thesis of selling it before the wheels fall off but reaching for any type of growth in the short term.

I cannot in good faith recommend eToro as a sound tech investment.

There are better tech companies out there to invest in for the long haul and any short-term appreciation in eToro will be temporary.

I admit this is a legitimate tech company, but the way they do business is off-putting.

Selling the idea that a trading platform can be buoyed by crypto is beggar’s belief.

It’s still only a small sliver of the real money out there.

Don’t get thrown off by the glitzy marketing, hyped-up numbers, and vague rhetoric from upper management.

Oh yeah, lastly, why invest in eToro when its stronger competitor with a large footprint in the U.S. is planning to go public themselves?

Take a pass on eToro for the betterment of your wallet.