It’s been a historic and unprecedented last few weeks in the world of technology.

99.9% of crypto projects are effectively a zero after this weekend.

Cryptocurrency has now descended into a death spiral due to a fraud so large that it makes many who got caught up in the mess sick to their stomach.

This “trigger” event has massive ramifications for the technology industry and is highly positive for the health of the tech sector.

Enter Former CEO of FTX, the former second biggest crypto exchange, Sam Bankman-Fried or SBF.

His crypto exchange FTX filed for bankruptcy just days ago.

SBF was stealing customer deposits to invest in his lifestyle and bought off everyone he thought was useful, including politicians, regulators, sports athletes, and famous actors.

SBF even bailed out many crypto-related companies during the recent downturn that were confirmed Ponzi schemes or frauds just to onboard them onto an even bigger scam.

In the end, a bank run collapsed SBF’s crypto empire and exchange.

It was only after the house was on fire that normal investors found out that his business was rotten to the core.

How did SBF hide this?

FTX and SBF literally replaced these funds on their balance sheet with their own in-house crypto coin that was produced and created by FTX.

This self-made coin was called FTT and FTT represented $7.4 billion of “liquid” funds for FTX on their balance sheet.

Therefore, when mass demands for withdrawals took place, FTX didn’t have the capital to distribute back to account holders because the value of FTT had sunk 95%.

The $18 billion in liabilities was only propped up by $900 million of real liquidity with $470 million comprising of Robinhood (HOOD) stock shares.

Ultimately, FTX faced an $8 billion shortfall to fill in short notice or go under.

Any reader holding any crypto on any exchange should request immediate withdrawal of funds as soon as possible.

Don’t be the last one to ask for your money back. Get out while you can!

There is a good chance that every crypto exchange was faking their balance sheet with fake coins that have fake values while claiming these coins are liquid as US dollars.

That means weak balance sheets could plant the seeds of more bank runs putting extreme stress on liquidity and forcing them to halt withdrawals.

Any project related to FTX is now a zero.

This industry is truly broken and will take a generation to heal itself or might never come back.

I understand the FTX debacle as a highly positive event for the tech sector and tech stocks moving forward because it makes legitimate tech stocks look great.

FTX has set a low bar for tech stocks to jump over.

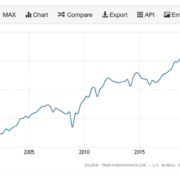

The Nasdaq market needed the fluff removed after the tech bubble had a 2-year accelerated bull market until 2022 and that came after a 10-year garden variety bull market in tech stocks.

FTX was the fluff. Avoid stocks such as Coinbase (COIN), Robinhood (HOOD), and MicroStrategy (MSTR).

Normal tech stocks will benefit after many incremental investors now believe crypto is completely fake.

This will forever be known as the colossal event that brought crypto to its knees.

I do believe that many of the leftover Bitcoin survivors will migrate into tech stocks moving forward because that’s the closest derivative to crypto.

Tech companies need to go through a lot of soul-searching to get their mojo back and a recession is always a good time to separate the good from the bad. Now, this is even better.

Crypto’s demise means venture capitalists will start to open the checkbook for non-crypto tech instead of spilling their money down a black hole.