Tesla (TSLA) stock is now toxic.

Many are surprised.

TSLA stock was once the darling of tech that could do no wrong.

The stock fetched a high premium punching above its weight.

That was then and this is now.

Then CEO of Tesla Elon Musk bought Twitter and everything changed.

He took a financial hit from the acquisition and investors are still not sure this purchase will weigh down his other companies.

Even more concerning is Musk’s entrance into American cultural wars and political punditry where he has tweeted fiercely about controversial topics lately.

This area is a black hole for tech entrepreneurs.

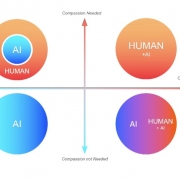

Losing half of a customer base is not a good business strategy and Musk is finding this out the hard way.

He has tweeted that the reason for his behavior is to “save mankind” or “nothing else matters.”

Try telling that to owners of Tesla shares.

They have been losing money hand over fist lately as Tesla shares have cratered while other tech stocks experience a mild renaissance.

Tesla has deflated by half a billion dollars in market cap lately.

Tech shares lurched upwards yesterday fueling a strong rally after weak inflation data.

However, there was one stock that was noticeably lagging big time.

Tesla was down 4% as investors used it as a good reason to dump the stock. Tesla shares are down again today – it’s almost like Groundhog Day.

There has also been a massive uptick in Democrats dumping Tesla shares and posting their actions on Instagram while claiming to have sold their Tesla car.

Musk alienating Tesla owners’ way of thinking and way of life spells lower future revenue.

Musk is simply shutting off the path for more Joe Biden-loving investors, and that’s bad news for the stock short-term since most owners of Tesla shares are Democrats.

There are also other issues percolating under the hood.

Slumping demand in China is forcing the electric-vehicle maker to slow production and delay hiring at its Shanghai factory.

Activist Tesla investor, Ross Gerber, is calling for the board to add a director who would represent retail shareholders.

This is after news reports of Musk sleeping at San Francisco’s Twitter headquarters.

Investors also feel that part of the reason Tesla shares have sold off is because the CEO isn’t paying attention to Tesla while he works on Twitter.

Musk reiterated that he “continues to oversee both Tesla & SpaceX, but the teams there are so good that often little is needed from me.”

“Tesla Team has done incredibly well, despite extremely difficult times,” he said earlier in the day, citing the European energy crisis, real estate downturn in China, and US interest rates as macroeconomic challenges.

The volatile recent stretch muddies the close of a year in which Tesla is still expected to achieve record sales and retain its crown as the world’s largest EV maker.

It hasn’t been immune, however, from the slowdown in China’s car market and recessionary conditions in Europe.

Tesla expects to come up just short of the 50% growth in vehicle deliveries that the company has repeatedly said it’s expecting over several years.

Tesla’s plant in Austin, Texas is scaling slower than expected, with a new form of lithium-ion battery cells not yet ready for volume production.

In China, Tesla plans to cut production on the Model Y and Model 3 production lines in Shanghai by about 20%.

There are some silver linings.

The company recently started delivering its long-awaited Semi truck several years late and plans to finally start producing its first pickup, the Cybertruck.

Tech investors need to be careful about TSLA for the time being and understand that it doesn’t command a hefty premium like it once did.

I believe that there are plenty of other tech companies to focus on when tech stocks start to buck the negativity of 2022.

Profitable software stocks with a strong balance sheet should be at the top of your list.