June 26, 2023

(JUNE 21, 2023 WEBINAR SUMMARY)

June 26, 2023

Hello everyone,

Hope you all had a great weekend.

This Post will summarize John’s most recent Webinar, which was last Wednesday, June 21, 2023.

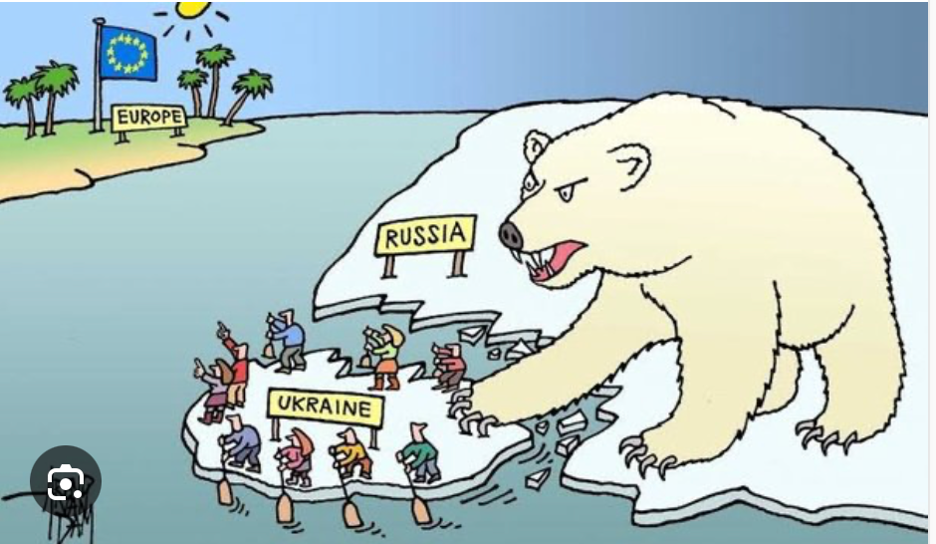

Firstly, John issued an Emergency Geopolitical alert on Saturday, June 24 about a possible coup underway in Russia. The Wagner Group is marching on Moscow with the intent of overthrowing the government. John said that Putin took off in a plane which then disappeared from radar, meaning he has either been shot down or is flying low to keep his destination secret.

It could mean the end of the Ukraine war.

Nothing to do here as intelligence pours in over the weekend. The U.S. has satellites overhead and human intel on the ground.

Expect market volatility on Monday. The markets are ripe for a black swan induced sell-off.

John will be monitoring the situation closely.

Webinar: The Fed Speaks (June 21, 2023)

Luncheons

July 6, 2023, New York

July 13, 2023, Seminar at Sea

July 19, 2023, London

July 27, 2023, Cortina d’Ampezzo

August 4, 2023, Vienna, Austria

Trade Alert Performance

June 0.47% MTD

2023 year to date +62.52%

+659.61% since inception

40 out of 44 trade alerts are profitable

Method to My Madness

Not much has changed. Lots of money in 90-day T-bills

Looking for a strong second half in stocks.

Expect a big rotation out of cash into industrials, commodities, and energy. Summer will present a great buying opportunity.

We shall wait and see what happens after the dust settles in Russia.

The best time to invest is after a 10% down move in the markets or a sideways consolidation, which is a time correction.

Global Economy – in Flux

Fed leaves rates unchanged at 5.00% - 5.25%.

Inflation plunges to 4.00 YOY. Much more than expected and the 11th consecutive decline.

Possibility of 2 more ¼ point rate rise to come.

ECB hikes interest rates from 3.25% to 3.50%.

Market Timing Index = extreme risk.

Tech stocks are peaking.

Investment in tech is broadening beyond the “Magnificent Seven” to industrials, commodities, and energy.

The Volatility Index hits a 2023 low of $13.50.

NVDA and TSLA hit new 2023 highs.

Airbnb – a good stock to own.

Buy gold on dips – it's sensitive to a decline in interest rates. Silver also.

John advises not to buy Bitcoin.

Instead, he wants everyone to focus on the following:

John Deere (DE) -buy on the next dip.

Caterpillar (CAT) LEAPS candidate

Boeing (BA) buy on the dip.

Freeport McMoran (FCX) buy on the dip.

U.S. Steel (X) – LEAPS candidate

Union Pacific (UNP) – buy on the dip.

Amgen (AMGN) at multi-year lows – LEAPS candidate

Goldman Sachs (GS) buy on the dip.

Morgan Stanley (MS) -buy on the dip.

BlackRock (BLK) buy on the dip.

Berkshire Hathaway (BRKB) buy on the dip.

Bonds

Bonds rally on Fed interest rate decision to one-month high at $103.75.

Keep buying 90-day T-bills now pushing a 5.2% risk-free yield.

Still looking like a 2.50% yield by end of 2023.

Junk bonds JNK and HYG are great high-yield plays (8%)

Still likely to hit $120 by year-end.

Any run to $100 on TLT you should be putting on LEAPS 2 years out.

Foreign Currencies

Dollar dumps on Fed decision of no interest rate rise.

Japanese Yen held back by low-interest rate policy.

Investors flee to safe haven short-term investments.

Economic data is pointing to a recession and 10 months of falling inflation is another indicator of a slowdown.

Dollar strength will be temporary. Look for new dollar lows by end of 2023.

Buy FXE, FXY, FXB, and FXA on dips.

Energy and Commodities

Even with a mild recession crude could lose $20 very quickly.

The Oil collapse is signalling a recession as is weakness in all other commodities. One of the worse performance assets in 2023.

Buy USO on dips as an economic recovery play.

China expects an LNG price spike later this year due to coming supply shortages and a recovering economy.

If you could only buy two stocks, John would recommend Tesla (TSLA) and Nvidia (NVDA). But you need a 10% correction before you do anything.

Mid-cap stocks that will do well. Airbnb (ANBN), Snowflake (SNOW), and Palantir (PLTR).

Buy UNG LEAPS 12/13 call spread 18 months out.

OXY – LEAPS candidate.

FCX – buy LEAPS on dips – target $100.

CCJ – buy on the dip.

Precious Metals

No Fed action to lower interest rates undercuts precious metals.

Interest rates rise in Europe and Australia aren’t helping either.

Gold is headed to $3000 by 2025.

Silver is the better play with a higher beta.

Russia and China stockpiling gold to sidestep international sanctions.

Severe short squeeze in copper developing, leading to a massive price spike later in 2023.

Barrick Gold – buy on the dip.

Newmont – buy on the dip.

SLV, SIL, and WPM – buy on the dip.

Real Estate

U.S. Housing starts to rocket up 21.7% to a 1.63 million annualized rate, the most since 2016.

The structural housing shortage is being felt acutely.

30-year fixed rate mortgage jumps back to 7.0%.

A tidal wave of millennial buyers underneath the market.

Home builder sentiment is up for the 10th straight month as it will be for the next decade.

CCI – bouncing along the bottom.

John will be traveling in July, but still working and monitoring the markets. It’s basically a working holiday for him. John’s next webinar will be in mid-August.

Have a good week.

Cheers,

Jacquie