Trade Alert - (TSLA) June 27, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) - BUY

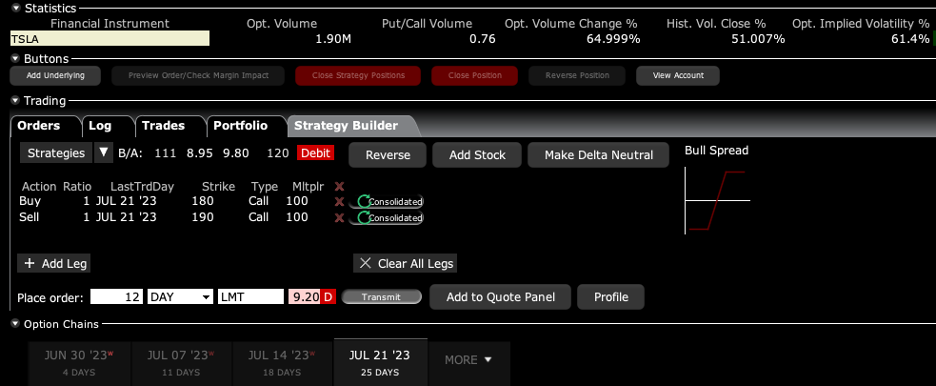

Buy the Tesla (TSLA) July 2023 $180-$190 in-the-money vertical bull call debit spread at $9.10 or best

Opening Trade

6-27-2023

expiration date: July 21, 2023

Portfolio weighting: 10%

Number of Contracts = 12 contracts

Tesla has finally retreated from its straight-line move up giving us an entry point for a front-month trade. The shares are off $39, or 13.92% from the recent $380 high.

In addition, the implied volatility for Tesla options has shot back up from 43% to 64.5%.

With the S&P 500 Volatility Index ($VIX) now at $14.00, there are few trades out there right now and I’m thinking of going on strike. This is the one trade to do.

Options this far in the money are illiquid so you may have to play around a bit with strike prices and prices to get done.

Therefore, I am buying the Tesla (TSLA) July 2023 $180-$190 in-the-money vertical bull call debit spread at $9.10 or best.

Don’t pay more than $9.40 or you’ll be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

After markets have big moves like we saw since January, you tend to get no moves for a couple of months. Too much performance and market action were pulled forward in H1.

Among the highest implied volatility in the market at 64.5%, a deep in-the-money call spread strategy is the best way to play this.

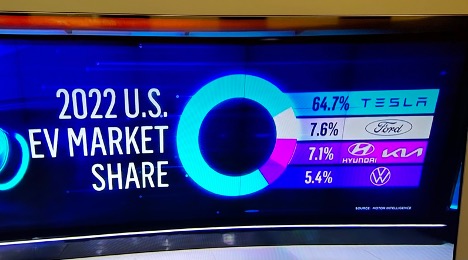

Tesla is now the most widely owned stock in the world and accounts for a staggering 6% of the options market.

If you don’t do options, buy the stock on a bigger dip. Even if the (SPY) revisits its 2022 low at $355, I doubt that Tesla falls much from here.

An onslaught of new Tesla positives is hitting the market in 2023. The new Cybertruck comes out and there is a two-year waiting list out the gate and deposits in hand for 1.5 million vehicles.

The company is generating such enormous cash flows that it is likely to carry out $10 billion in share buybacks, especially with the price this low. There are no real competitors on the horizon, except for a handful with big losses outside of China.

All the new negatives are now in the price, the China lockdowns, the product recalls, the Shanghai shutdown, recession fears, and even Elon Musk himself going from a premium to a discount are now in the price. At the end of the day, Tesla really is a consumer discretionary stock.

Tesla will remain the top EV maker for the next decade easily.

This is a bet that Tesla (TSLA) will not trade below $190 by the July 21 option expiration day in 18 trading days.

Here are the specific trades you need to execute this position:

Buy 12 July 2023 (TSLA) $180 calls at………....…$67.00

Sell short 12 July 2023 (TSLA) $190 calls at…….$57.90

Net Cost:…………………………...............……….………$9.10

Potential Profit: $10.00 - $9.10 = $0.90

(12 X 100 X $0.90) = $1,080, or 9.89% in 18 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.