Jacquie's Post Trade Alert - (OXY) July 3, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

TRADE ALERT Occidental Petroleum (OXY) BUY

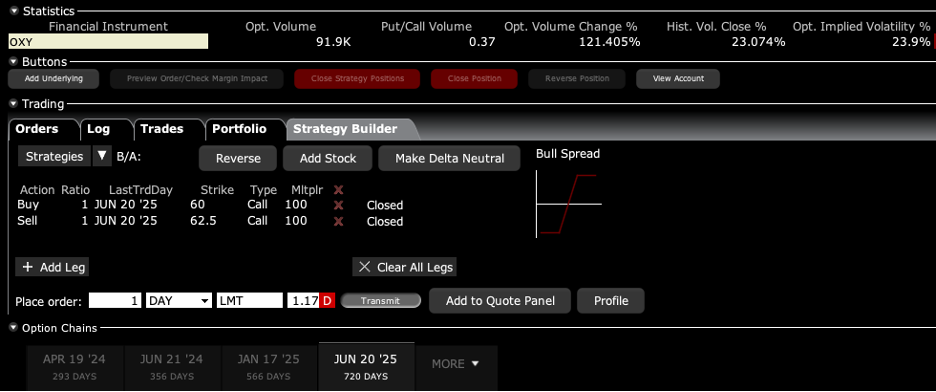

Buy the Occidental Petroleum (OXY) $60-$62.50 June 20, 2025, out-of-the-money vertical Bull Call spread LEAPS at $1.17 or best

Opening Trade: 07/03/2023

Expiration Date: June 20, 2025

Number of Contracts: 1

Occidental Petroleum (OXY) is a well-run company that is investing in advanced technology, which will produce excellent returns well into the future. And Warren Buffett certainly agrees with that.

Berkshire Hathaway is solidly invested in (OXY) with a 23.6% stake in the company, or about 211.7 million shares worth about $13 billion.

Berkshire also owns $10 billion in OXY’s preferred stock with warrants to purchase $5 billion more shares at $59.62.

So, why should we be like Buffett and invest in Occidental Petroleum (OXY)?

There is deep diverse inventory with a concentration in the Permian.

OXY made a huge purchase of Anadarko Petroleum back in 2019, which gave it the No. 1 position in the high-producing Permian Basin in Texas, along with a leading position in the DJ and Uinta basins in Colorado.

The fracking revolution in the U.S. gave rise to the potential of unconventional U.S. wells which can be drilled in a relatively short space of time and Buffett appear to like the prospect of quick return projects, particularly within the low-cost Permian Basin spanning Texas and New Mexico. The Permian, has a deep, low-cost inventory, containing many years of potential short-cycle oil projects.

OXY holds some of the largest acreage holdings in unconventional U.S. basins of any operator.

OXY also has 10 operational platforms in the Gulf of Mexico. Along with conventional oil projects in Oman and Algeria, these projects generate significant free cash flow for the company.

Leading Technology and well productivity.

The advanced technology at OXY has led to some of the most efficient drilling practices in the industry. At the time of the Anadarko acquisition, OXY noted that despite only having 4% of total Permian Basin wells, it had 23% of the best-performing wells at the time.

Furthermore, it is noted that well productivity is increasing every year with 2022 wells returning 205% more barrels of oil equivalent per day than 2015 wells.

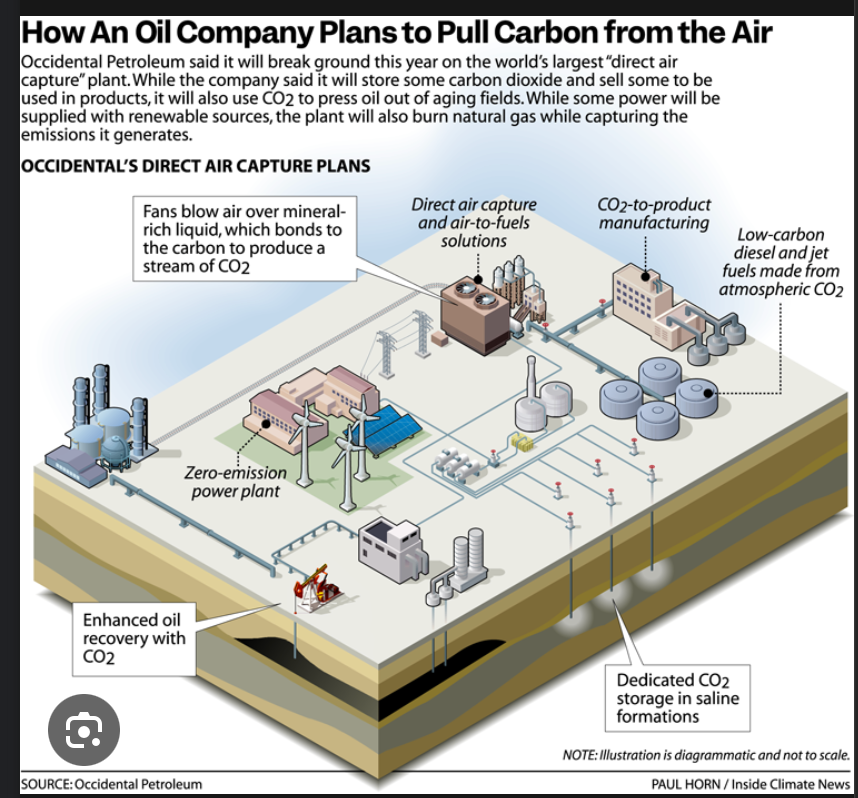

Technology is helping extract oil and gas. One advanced technique is called enhanced oil recovery, or EOR, which uses carbon dioxide injection into wells. The CO2 displaces the oil and gas trapped in the porous rock, then gets trapped in the rock itself, taking carbon out of the atmosphere while boosting production and well efficiency. OXY has been using EOR since the 1980s and already has lots of carbon infrastructure, such as injection wells, pipelines, and CO2 storage.

Carbon capture technology

OXY has a lot of experience using CO2 injection in its operations, so it’s in a great position to invest in new carbon capture technology.

OXY is looking to invest in several carbon-removal and recycling technologies. This year OXY will begin construction on its first direct air capture (DAC) plant in Texas. OXY has also bought 400 acres of land for several carbon sequestration hubs.

The company plans to spend between $200 million to $600 million on carbon sequestration projects this year out of a roughly $5.8 billion 2023 capital budget program, which will make OXY a top player in carbon sequestration technology in the coming decades.

Occidental Petroleum has current and future upside.

OXY looks cheap today - it’s deep inventory of quick return projects and high-productivity technology bodes well for the next 10 years.

Meanwhile, OXY’s capacity and ability to invest in low-carbon technologies points to an additional act beyond that.

I am therefore buying the Occidental Petroleum (OXY) $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $1.17 or best.

Don’t pay more than $1.60 or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Occidental Petroleum (OXY) June 2025 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $1.17 or best is showing a bid/offer spread of $1.00-$2.00, which is typical. Enter an order for one contract at $1.10, another for $1.20, another for $1.30 and so on. Eventually you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if Occidental Petroleum (OXY) does NOT rise by 6.29% in 24 months, the value of your investment goes to zero. The way to play this is to buy LEAPS in ten different names. If one out of ten increases ten times, you break even. If two of ten work you double your money, and if three out of ten work you triple your money.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (OXY) $60 calls at………….….....……$12.00

Sell short 1 January 2025 (OXY) $62.50 calls at…….……$10.83

Net Cost:………………………….………................………….….....$1.17

Potential Profit: $2.50 - $1.17 = $1.33

(1 X 100 X $1.33) = $133 or 113.67% in 24 months.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.