What’s Up with Gold?

Have you ever held a basketball underwater in a swimming pool and let go? It flies to the upside and pops you in the nose. That is exactly what Gold is doing.

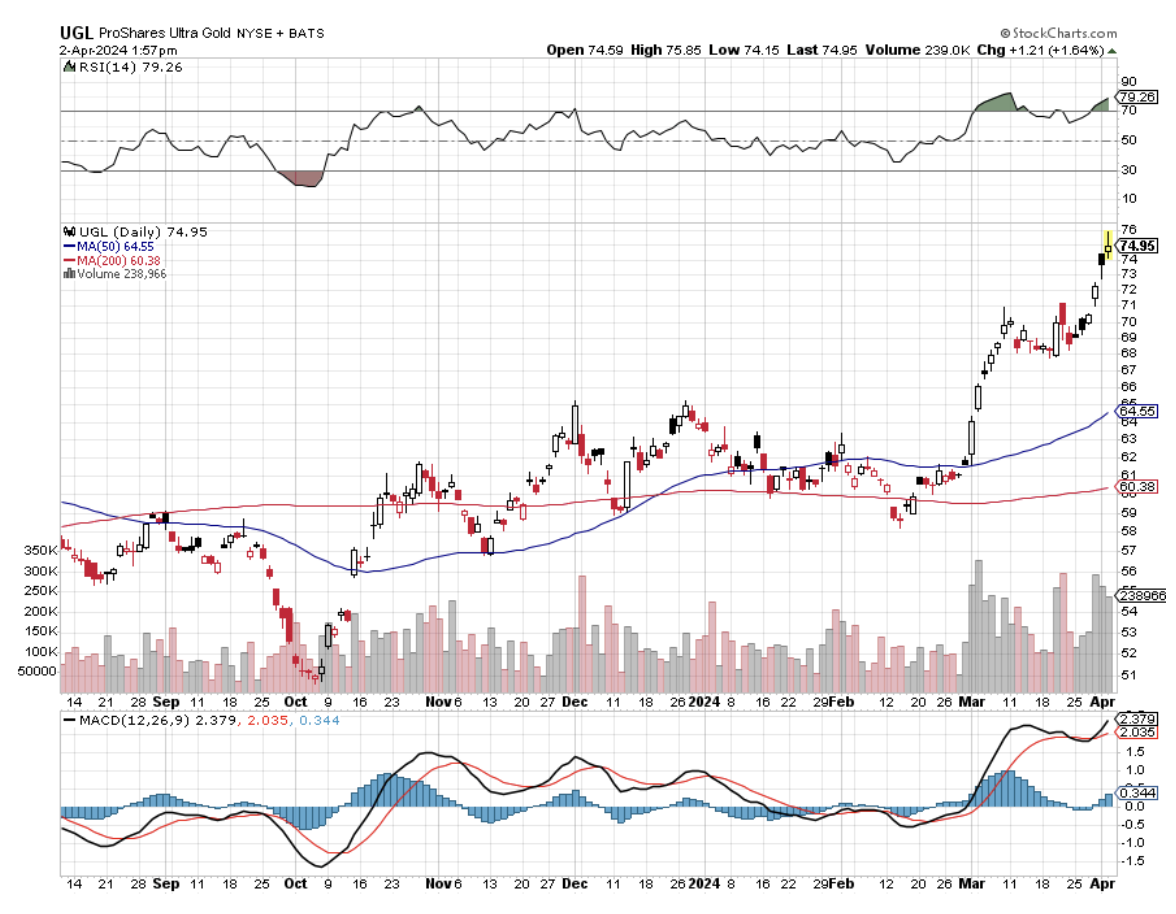

After the barbarous relic peaked at $2,080 in May 2023, it traded like an absolute pig, giving up 8.7% in a matter of weeks.

Gold actually perfectly timed the bottom in all risk assets on October 15, 2022, when the current bull market began.

Since then it has behaved like a paper asset, tracking the S&P 500 almost tick for tick, adding a quick 28%. Although it has trailed big tech (what hasn’t), it has handily beaten many other asset classes, such as bonds (TLT), the US dollar (UUP), commodities (CORN), and energy ($WTIC).

So, what’s up with gold?

The upward pressure on the barbarous relic is coming in from all directions.

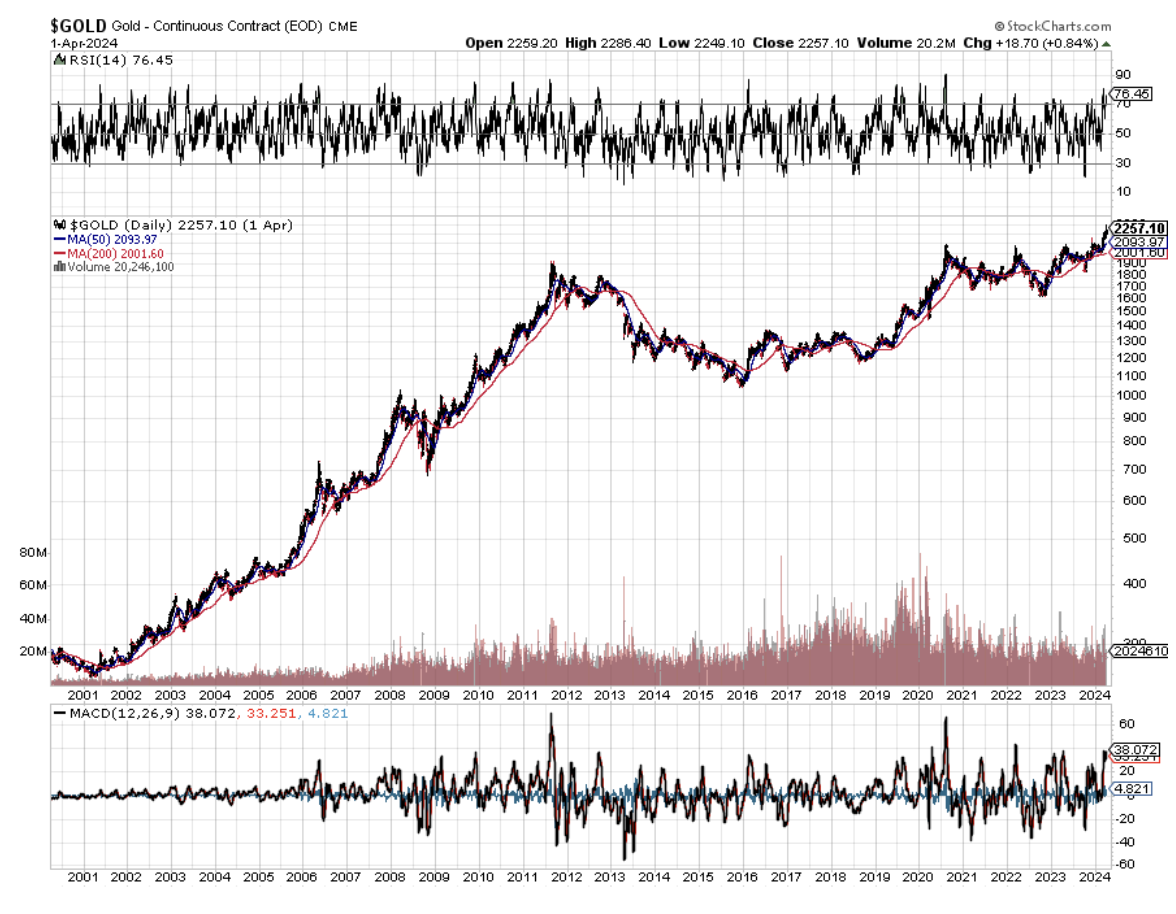

The most important is that we have reached the end of the Fed tightening cycle. Interest rates are far and away the biggest driver of prices for the yellow metal and there is a rising consensus that the next big move is down, not up.

New bull arguments have also come to the fore. The war in Europe has prompted massive buying of all precious metals by panicky individuals, including silver (SLV), with a collapse of the US dollar imminent, also driven by lower US interest rates.

And how will Europe eventually end the crisis? With a Russian defeat, which will lead to a global economic boom and massive government spending. And while they are losing the war, both Russia and China are stockpiling gold to bypass trading sanctions. Exporting gold from China currently carries the death penalty.

How far will the gold get this time? The gold bugs say we’re going to break the old high and power on through to the inflation-adjusted high at $2,300. After that, we’re looking at $3,000 an ounce.

But there is a trade here in precious metals space for the nimble. My pick has been to buy lagging silver, which offers much more bang per buck if the sector starts to build a head of steam.

Here are the handy formulas to remember. Gold stocks (GOLD), (NEM) go up four times faster than the underlying metal because of their high leverage. Silver stocks go up twice as fast as gold and silver stocks rise four times faster than the underlying silver.

It all boils down to one conclusion: buying Wheaton Precious Metals (WPM) for subscribers are already long. (WPM) doesn’t actually own any silver mines but strips off royalty streams from third-party silver mine operators just like a REIT.