December 8, 2023

(THE PRESIDENTIAL ELECTION YEAR AND THE STOCKMARKET)

December 8, 2024

Hello everyone,

Welcome to Friday and Non-farm payrolls.

What typically happens to stocks in a presidential election year?

If we look at history, it will give us a guide as to what we can expect.

Stocks are riding high into the end of 2023. All three major averages are coming off five straight weeks of gains, while the S&P has reached fresh highs for the year. The Dow has advanced more than 8%, while the S&P has surged more than 18% and the tech-heavy Nasdaq Composite has rocketed 35% this year.

If we look at history, does it show us that there will be a repeat performance in 2024 when incumbent President Joe Biden runs for re-election? Stock Trader’s Almanac data shows that election years are typically weaker than pre-election years. On average, stocks during pre-election years advance 10.4%, while in election years, they gain 6%.

That still means another positive run for equities – only a more modest rise. We could see the S&P at around the 4,843 level in the S&P 500 at the end of next year.

Chief investment strategist at CFRA Research, Sam Stovall, comments that investors should expect a good year. And he points to history to argue his point here, because historically he argues that we’ve had positive returns in the presidential election year of first-term presidents with a very high frequency of gain and an abnormally high return.

Additionally, he adds that investors should not rule out the Federal Reserve's possibility to cut rates during an election year, as the central bank has either raised or lowered interest rates every election year since 1992.

Investors should take special note of how markets behave during the July 31 to October 31 period. In data going back to 1944, analysts find a rising stock market usually points to the re-election of the incumbent, while a falling market suggests a replacement.

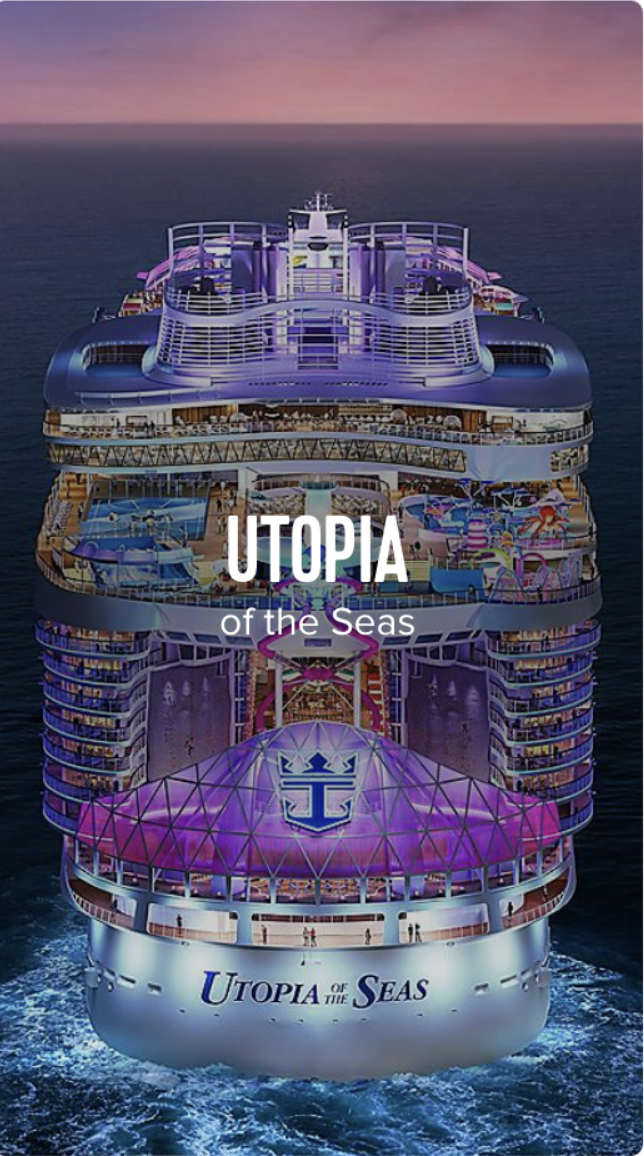

Cruising is back and one stock in particular looks attractive.

2023 has been a great year for cruise lines as people have returned to this form of travel/tourism for their vacation after the height of the pandemic. And demand is expected to continue in 2024. Around 35.7 million passengers are expected to take a cruise next year, up from 31.5 million in 2023 and 6% higher than 2019, according to the Cruise Lines International Association.

Shares of Royal Caribbean have jumped 140% so far this year and hit a 52-week high Thursday. Carnival is up about 120%, while Norwegian Cruise Line Holdings added 51%.

Despite these huge moves up, many Wall Street analysts are still bullish. Analysts argue that a $135 price target on Royal Caribbean is quite possible as demand is strong.

Cruises have a low-cost advantage. While prices have been rising, cruises are about 25% to 30% cheaper than a land-based vacation.

If people are looking for relative value, it is still a cruise.

As long as fundamentals remain stable in the economy, cruise lines should continue their growth post-pandemic.

Cheers,

Jacquie