January 8, 2024

(WHERE SHOULD INVESTORS BE LOOKING IN 2024?)

January 8, 2024

Hello everyone,

Inflation data and bank earnings take center stage this week.

Week ahead calendar (all times ET)

Monday, Jan. 8

3:00 PM - Consumer credit (November)

Tuesday, Jan. 9

6:00 AM - NFIB Small Business Index (December)

8:30 AM - Trade Balance (November)

Wednesday, Jan. 10

10:00 AM - Wholesale Inventories final (November)

3:15 PM - New York Federal Reserve Bank President and CEO John Williams gives keynote remarks for “2024 Economic Outlook”, New York.

Thursday, Jan. 11

8:30 AM - CPI (December)

8:30 AM - Hourly Earnings final (December)

8:30 AM - Average Workweek final (December)

8:30 AM - Initial Claims (week ended Jan. 6)

2:00 AM - Treasury Budget (December)

Friday, Jan. 12

8:30 AM - PPI (December)

Earnings: Citigroup, Wells Fargo, JPMorgan Chase, Bank of America, Delta Air Lines, The Bank of New York Mellon, United Health Group, BlackRock.

Last Friday, I talked about the must-own technology stocks for 2024. But what else is there besides the big tech stocks? Mad Hedge (MH) and Morgan Stanley (MS) (where John Thomas used to work) seem to agree on some other great ideas for stocks to own in 2024.

So, what does the research say?

You could dip your toe into the following: Spotify, T-Mobile, BlackRock.

T-Mobile (TMUS): MS is betting on wireless growth this year. MS analyst Simon Flannery likes the company’s robust capital return program and its “network and value offerings.” He goes on to comment that the “ongoing capital return program implies about $12bn in stock repurchases for 2024, with a new larger program likely late next year.”

There are also the benefits it is enjoying because of its 2020 merger with Sprint. Margins are being supported by ongoing productivity initiatives and merger synergies, with AI providing an additional opportunity going forward. Shares are up 13% over the past year.

BlackRock (BLK): Exposure to growth opportunities (fixed income, index, ESG, private markets) and the best mix of product, distribution breadth, and scale to capture rotation into fixed income.

Spotify (SPOT): all eyes will be on pricing power. We’ve seen the first round of price increases in streaming music and the first move towards optimizing royalty payments. The price hikes are likely to deliver a major boost to revenues. Shares of Spotify are up 137% over the last year. There is a long global runway for streaming music adoption.

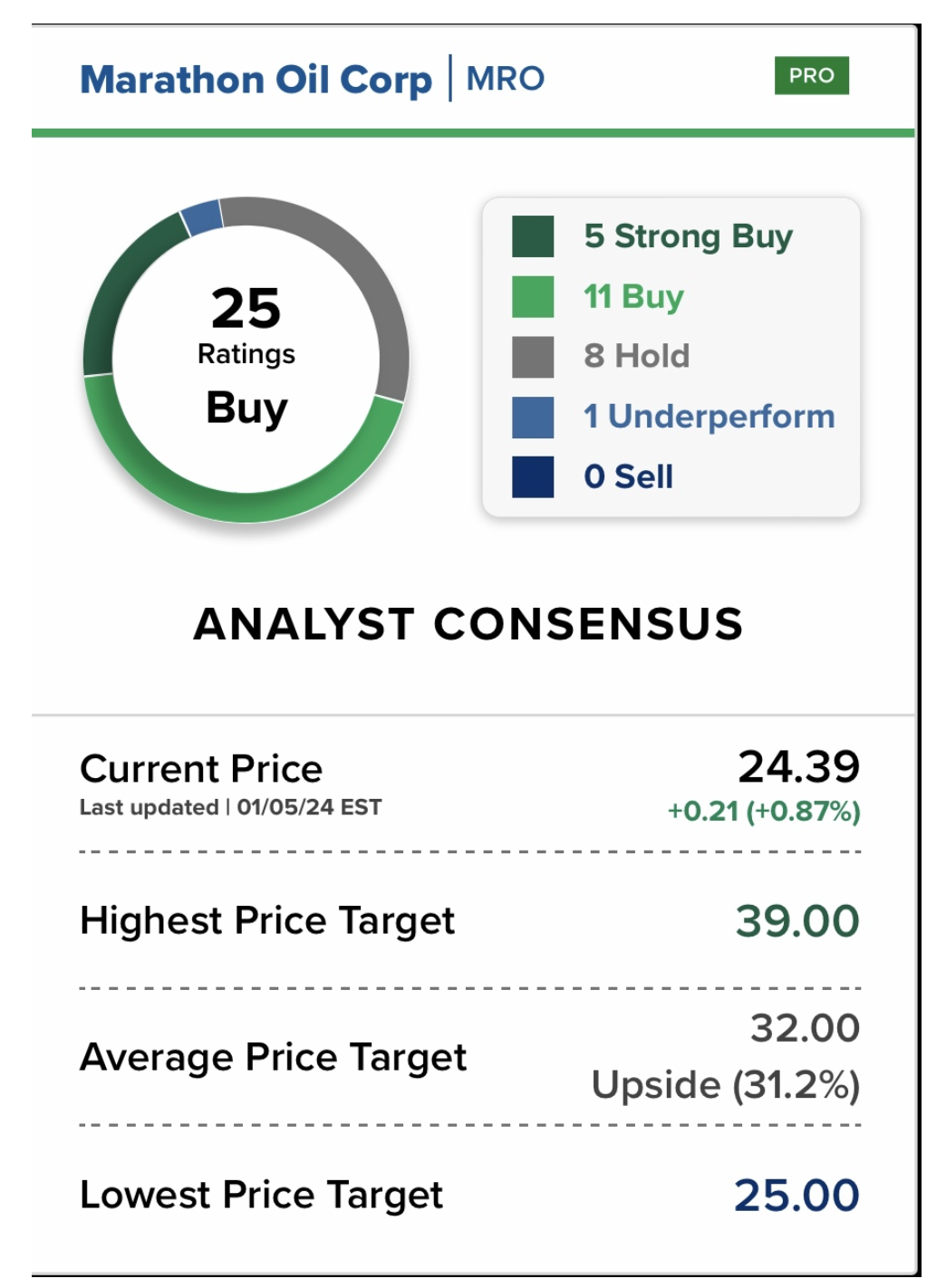

It’s important to understand that markets will broaden out this year and beyond. So, we need to start looking beyond the Magnificent Seven and the tech sector. Analysts are optimistic about a rebound in some energy names, including oil and gas companies Haliburton (HAL) and Marathon Oil (MRO). Additionally, Exxon Mobile (XOM), Occidental Petroleum (OXY), and Chevron (CVX) are certainly ones to watch. Shares of several energy stocks declined last year. The overall sector was a laggard, losing 4.8%, as U.S. crude oil ended last year more than 10% lower due to worries that the market is oversupplied from historic oil production outside OPEC. Analysts are more optimistic about the sector for this year due to expectations that U.S. production growth will slow this year, helping lift prices. Let’s keep in mind also that any heavy-duty spat with Iran that disrupts the Strait of Hormuz would send crude prices significantly higher. Think 20% price rise or more.

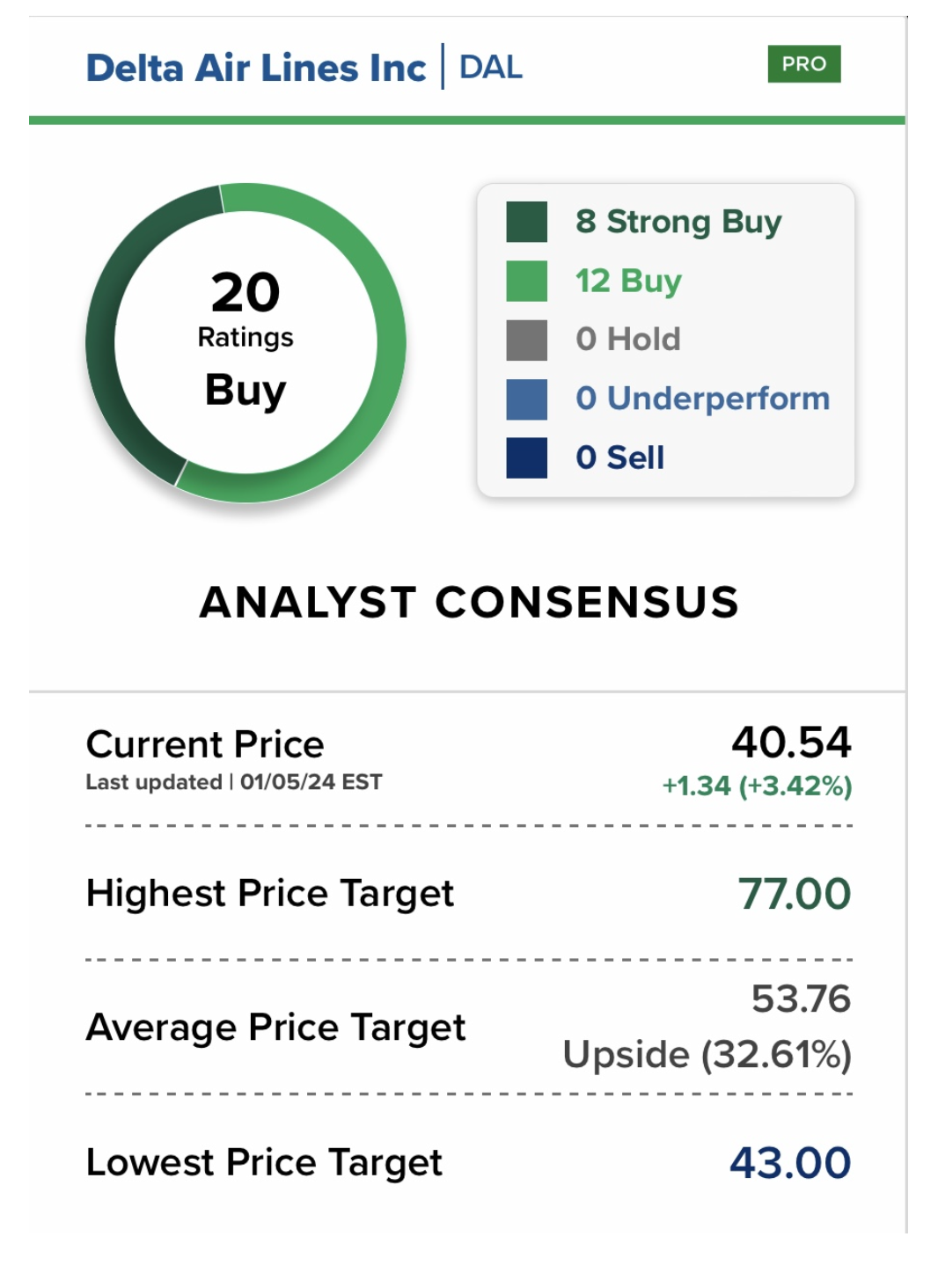

Airlines are also in for a strong year according to analysts. Their average price targets suggest shares of Delta Air Lines (DAL) and United Airlines Holdings(UAL) have upside of more than 31% and 42%, respectively. Delta is well positioned in international markets which should continue to outperform domestic markets. Also, Delta continues to focus on improving its balance sheet. A good tailwind is the fact that Delta pays wages aligned with the industry average and only has one union for its pilots, giving the airline an advantage over peers that are heavily unionized.

Fractionalizing bond investing

Yields from fixed income have made investors money using less risk. It’s going to get better in a few weeks and more investors will be able to participate. In the very near future investors will be able to buy slices of it.

What does that mean?

The digital brokerage firm, Public, announced its fractional bond offerings in December. In a nutshell, investors will be able to purchase pieces of corporate bonds, Treasury’s, and eventually, municipal bonds. The general idea is to open opportunities to more investors. In other words, the Public appears to be targeting those investors who don’t want to spend upward of $1000 on single corporate bonds.

The consequence – fractionalizing bond investing allows that ticket size to come down and allows more people to participate and build diversified bond portfolios. Right now, the minimum investment is $100.

Our Road Trip

The government has provided toilet blocks at 1-hour intervals (roughly every 100km) along the Bruce Highway. Maybe safer than risking a snake bite in the tall grass.

Flat top (6.5km east of Mackay) and round top islands sit just off the coast of Mackay. Yes, they are really called this.

Strolling along the beach in Mackay.

On the beach in very windy conditions just before a storm hit.

Bike riding for 2 hours around Mackay.

Cheers,

Jacquie