(MORGAN STANLEY SEES OPPORTUNITIES IN THE CHINESE EV MARKET)

March 15, 2024

Hello everyone,

The electric vehicle industry in China could be in for a shake-up after selling off this year. According to Morgan Stanley, a couple of stocks are poised to deliver significant returns.

According to the investment bank, LiAuto(LI) and Xpeng(XPEV) offer significant investment opportunities, rating both of them overweight. While China has faced falling international investment and property headaches, negative forces influencing EV stocks may be already reflected in the prices. Analysts believe the Under-owned autos group should be back in focus in 2Q.

The auto sector in China has sold off about 30% year-to-date as companies work through a huge inventory due to seasonal market weakness. According to Morgan Stanley, EV penetration fell from a peak of 40% in December to 33.5% this year as makers of internal combustion engine cars pushed sales aggressively ahead of the Chinese New Year.

Even though Chinese EV makers have had a rough start to the year, analysts believe these companies are expected to launch a record number of new models and accelerate expansion plans in Europe, Latin America, and Southeast Asia, at the same time as they’re seeing lower battery costs.

Morgan Stanley sees LiAuto has booked several profitable quarters in a row, demonstrating solid execution of model launches and effective cost management. And the investment bank has boosted the total sales volume for the company by 12% in 2024 and 8% in 2025, which reflects stronger demand for new models. Morgan Stanley’s price target for LiAuto is $74.

Xpeng has also successfully launched several new models and has a strong pipeline, with Morgan Stanley expecting monthly sales to accelerate compared to the second half of 2023. The price target of $18 for Xpeng implies an upside of about 90% from its previous close of $9.52.

This Post shows you what Morgan Stanley understands about the EV Chinese market. If you plan to purchase any Chinese stocks, you are buying them with the full knowledge that this is still a risky market and should be approached with caution. i.e. dip your toe in/buy small parcels.

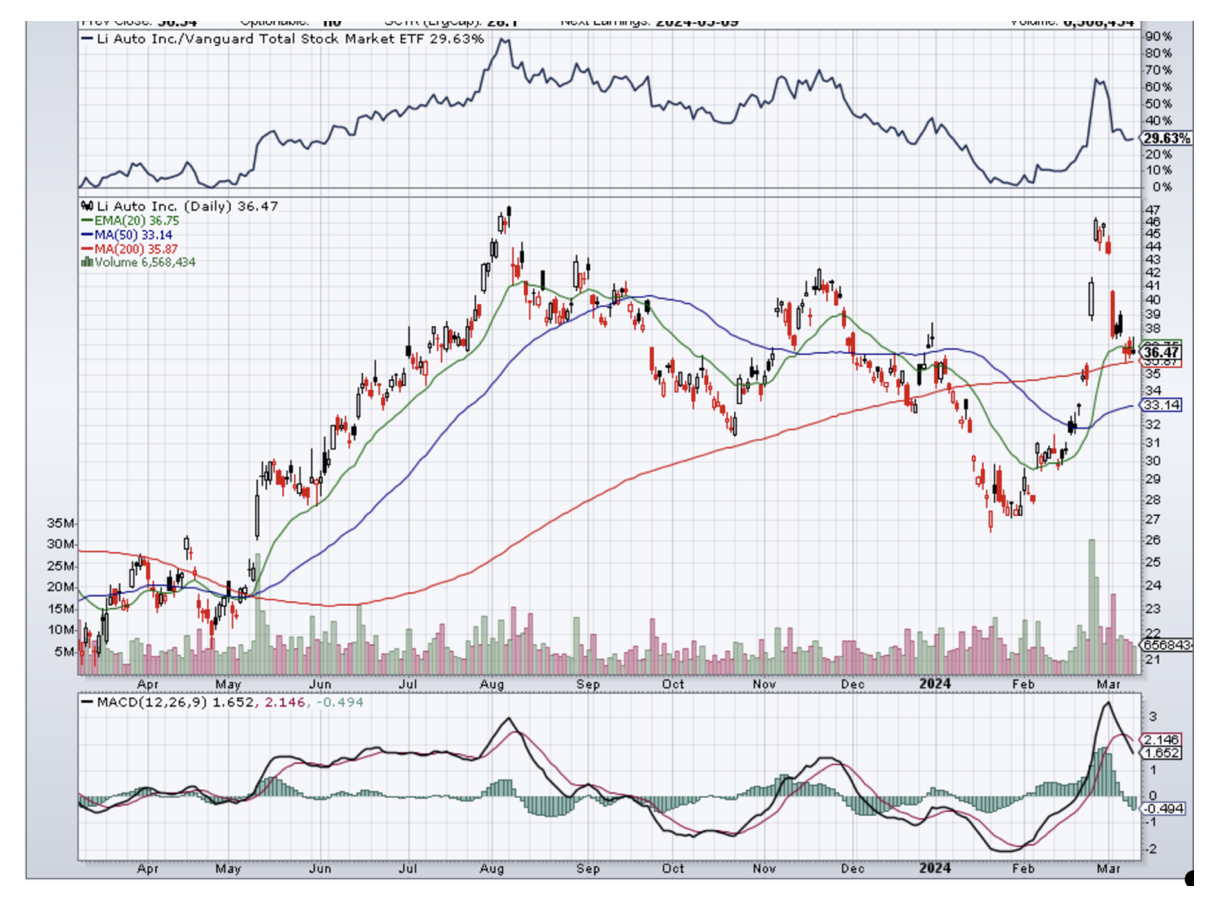

Daily chart

Weekly chart

Daily chart

Weekly chart

Cheers,

Jacquie