April 17, 2024

(INVESTORS INTERPRETATION OF DATA MOVES THE MARKET – OPPORTUNITIES ARE SETTING UP)

April 17, 2024

Hello everyone,

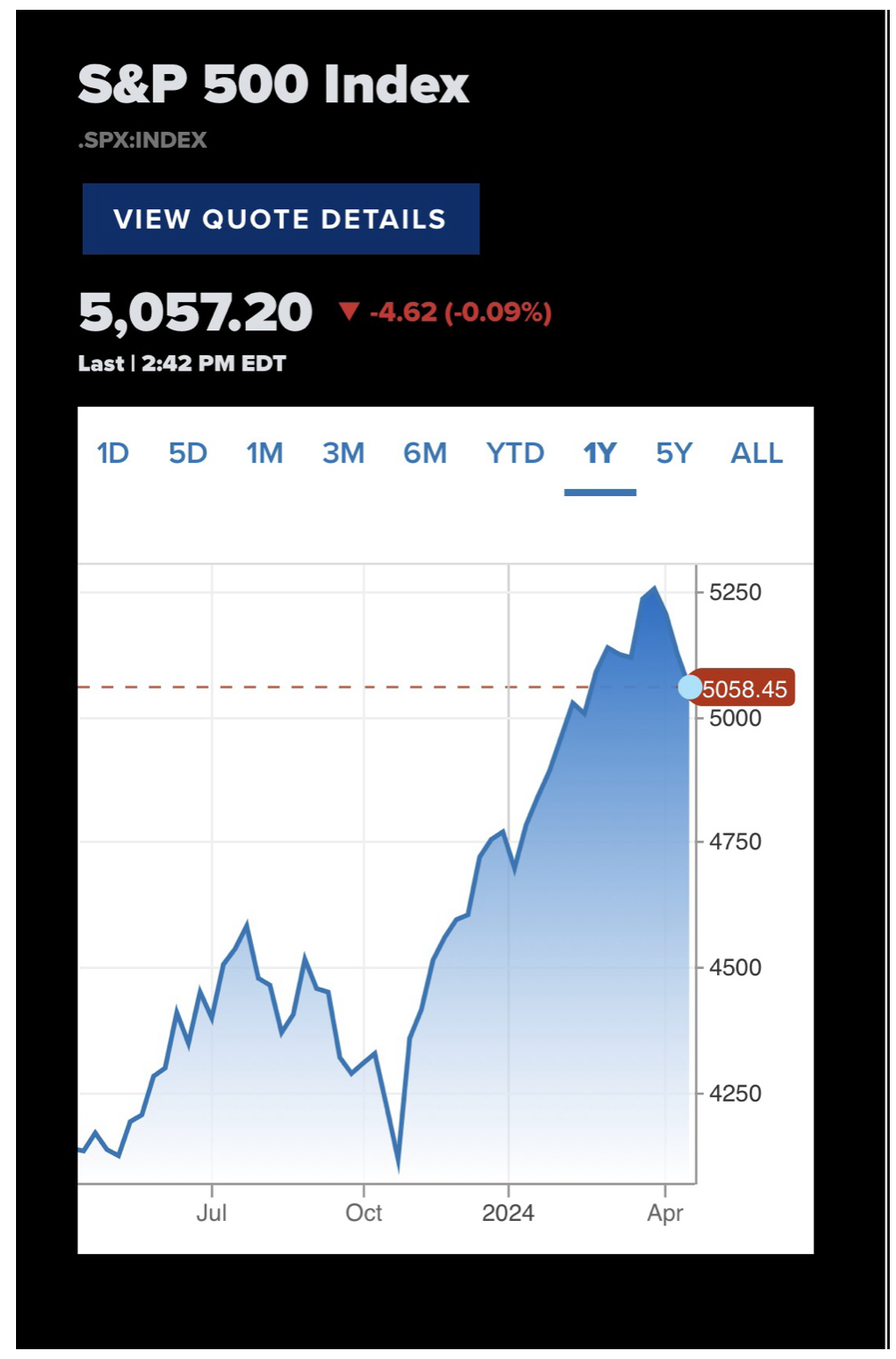

The stock market correction. What’s it all about?

Lingering inflation concerns. We know it will be higher for longer. Fed will react to economic data eventually.

Rising Treasury yields.

Turmoil in the Middle East.

Healthy correction in a bull market.

Corrections are common in bull markets and the speed of recovery is relatively fast. There have been 24 corrections since World War II with an average decline of 13.9% and lasting about four months, and it took the S&P 500 four months to recover all that was lost in the decline, according to Sam Stovall, chief investment strategist at CFRA Research.

A 10% decline is defined as a correction in one of the major stock indexes. A 20% or greater decline indicates we have moved into bear market territory.

CFRA Research shows us that if we go back to 1990, the market fell an average of 14.7% in a correction and was able to recoup the losses in the correction in only three months.

So, for long-term investors – it’s better to hang on than to jump.

With the S&P 500 now sitting below its 50-day moving average, we may have further downside to go. We will probably see relief rallies, but while the S&P 500 is below 5114, the risk is to the downside.

The way to look at this correction is as a healthy consolidation after a very strong return in the first quarter. It doesn’t change the fundamentals. We should continue to rally into year-end, but it won’t be a straight line.

So, where should we be looking for opportunities?

There will be continued demand for AI and AI-related technologies. Therefore, we should have our focus on AI software and semiconductor companies. Additionally, let’s not forget global commodity producers and miners, particularly those related to copper.

Miners (Copper) (FCX)

AI – Nvidia (NVDA), Microsoft (MSFT), Advanced Micro Devices (AMD), Amazon (AMZN),

Taiwan Semiconductor Manufacturing Co (TSM), Applied Materials (AMAT), Dell Technologies (DELL), Meta Platforms (META)

Miners (BHP), (RIO), (CVX)

Of course, this is not a complete list of every company in the categories I’ve mentioned. But it’s a good place to start.

This is a very sad sign of the times. In just about every shop and place of business I go into today, these signs are present.

Cheers,

Jacquie