Trade Alert - (SLV) May 6, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SLV) – BUY

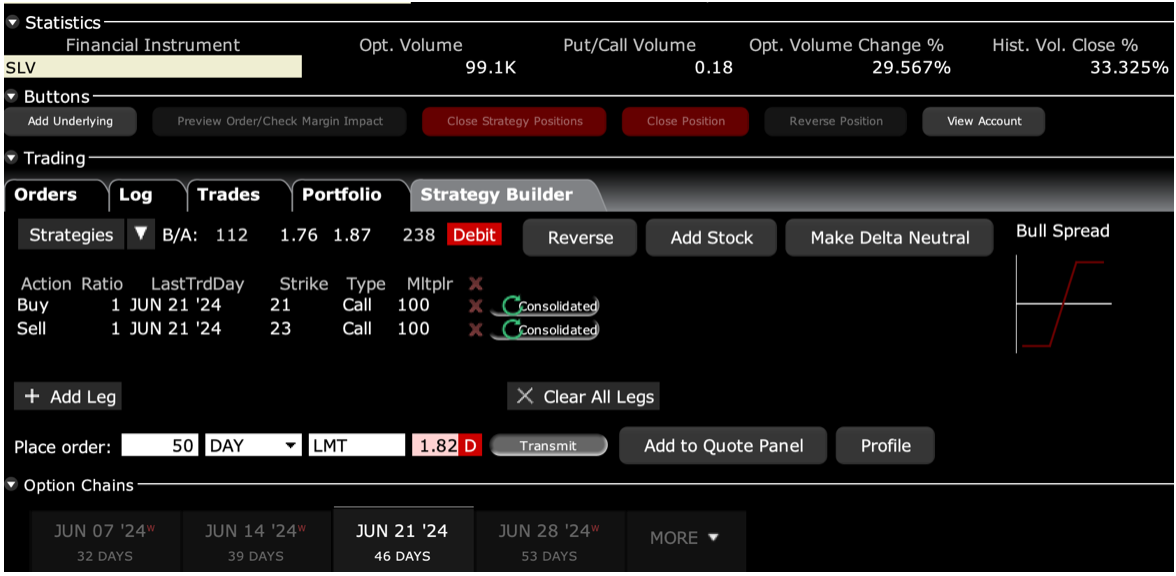

BUY the iShares Silver Trust (SLV) June 2024 $21-$23 vertical BULL CALL debit spread at $1.80 or best

Opening Trade

5-6-2024

expiration date: June 21, 2024

Portfolio weighting: 10%

Number of Contracts = 50 contracts

I believe that there is a major rotation in the market underway, out of technology stocks that have been leading all year into commodity stocks. We have already seen major upside breakouts in gold and silver and copper is jumping on the bandwagon.

If you can’t do options buy the stock. My long-term target for (SLV) is $50, up from today’s $24.88.

The April Nonfarm Payroll Report out Friday indicates that the economy is modestly weakening, hiring is slowing, and inflation about to moderate. That has caused interest rates to fall and bond prices to rise, as I expected. That also invites a weaker US dollar and stronger foreign currencies, gold, and silver.

The bull case for silver is simple. The electrification of the grid means that industrial demand for the white metal is about to soar. Silver is used in the national grid, solar panels, and EV’s. It also has many applications in electronics.

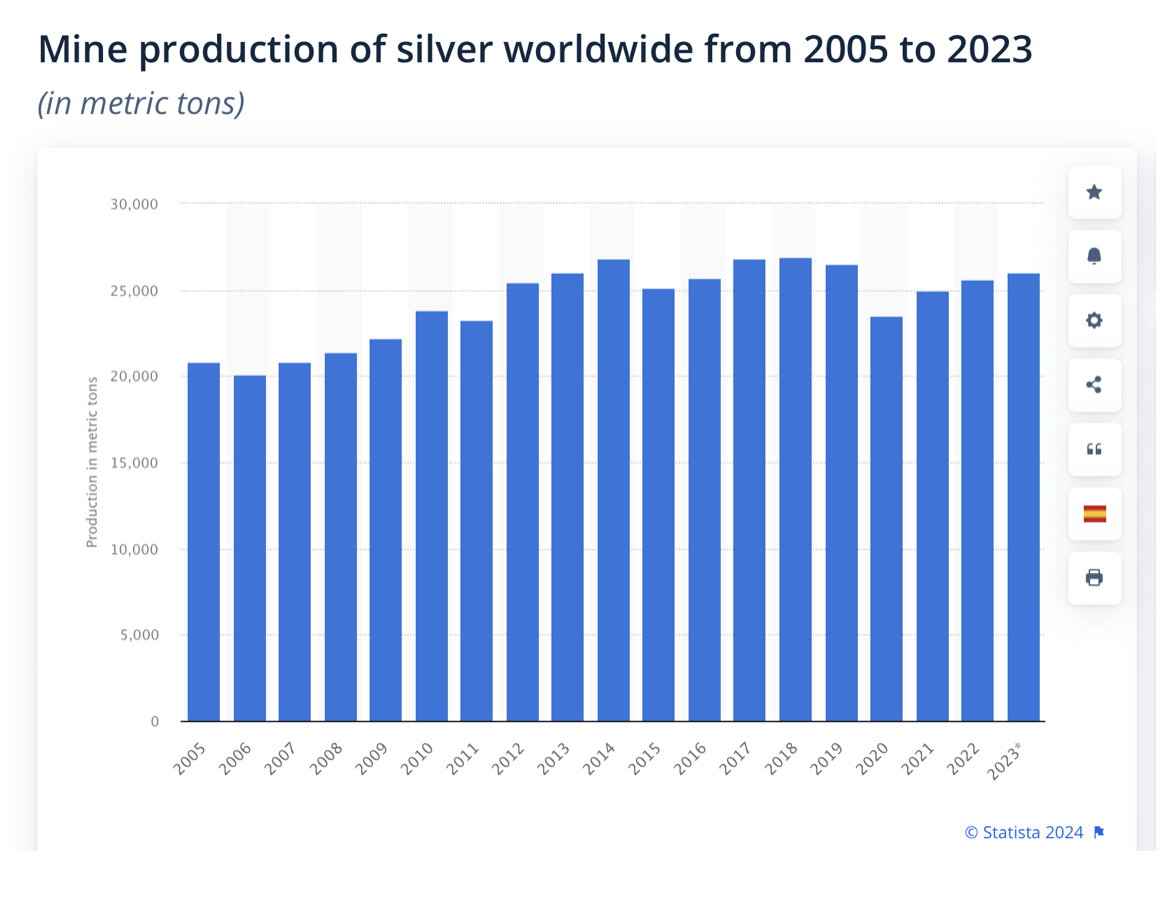

In the meantime, silver production has been almost level at 26,000 tonnes a year for the last decade. In 2023, only 23,000 tonnes were produced globally, setting up a potential short squeeze. The charts show that after a one-month rest, silver is ready to take off again.

Therefore, I am buying the iShares Silver Trust (SLV) June 2024 $21-$23 vertical BULL CALL debit spread at $1.80 or best.

Don’t pay for than $1.90 or you will be chasing.

The iShares Silver Trust (SLV) is a play on physical silver.

Silver is an investment much like other precious metals. It has been regarded as a form of money and a store of value for more than 4,000 years. You can find silver relics of the Pharos used in Egypt’s National Museum at the foot of the Great Pyramid.

Silver lost its role as a legal tender in developed countries when the use of the silver standard came to an end in 1935. Some countries still mint silver coins and collector coins, such as the American Silver Eagle with nominal face values. The main demand for silver was for industrial applications (40%), jewelry, bullion, and ETF’s. Global silver reserves amounted to 610,000 metric tonnes at the end of 2023.

The (SLV) is part of the Blackrock family of ETF’s, with $10.6 billion in assets under management, and an expense ratio of 0.50%. It is priced off of the open market for silver bullion traded on the LBMA, or the London Bullion Metals Exchange. The silver is held in the exchange vaults in London. The world’s largest banks are the market makers in the LBMA, including:

Citibank N A.

Goldman Sachs International.

HSBC Bank Plc.

JP Morgan Chase Bank.

UBS AG.

Morgan Stanley & Co International Plc.

The LBMA headquarters are next door to the Bank of England and down the street from my old office at Morgan Stanley in the City of London. LMBA holds 25,612 metric tonnes of silver, valued at $20.2 billion, which equates to approximately 823,451 silver bars. For more information about the LBMA visit their website at https://www.lbma.org.uk/prices-and-data/london-vault-data

For details about the actual holdings of The iShares Silver Trust please visit their website at

https://www.composer.trade/etf/SLV?utm_source=google&utm_medium=cpc&utm_campaign=PMax_trad&utm_content=&utm_term=&gad_source=1&gclid=Cj0KCQjw_-GxBhC1ARIsADGgDjt_AWiX36L8mFWNqigaa09SsGZi_z0a-7vXOOJblY5C-ToIK-lzVkoaAhG8EALw_wcB

This is a bet that the (SLV) will not fall below $23.00 by the June 21 option expiration in 28 trading days.

Here are the specific trades you need to execute this position:

Buy 50 June 2024 (SLV) $21 calls at………….………$4.00

Sell short 50 June 2024 (SLV) $23 calls at…………$2.20

Net Cost:………………………….………..…………..….....$1.80

Potential Profit: $2.00 - $1.80 = $0.20

(50 X 100 X $0.20) = $1,000 or 16.00% in 28 trading days.

If you are uncertain about how to execute a bear put options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.