Trade Alert - (NVDA) May 6, 2024 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (NVDA) – TAKE PROFITS

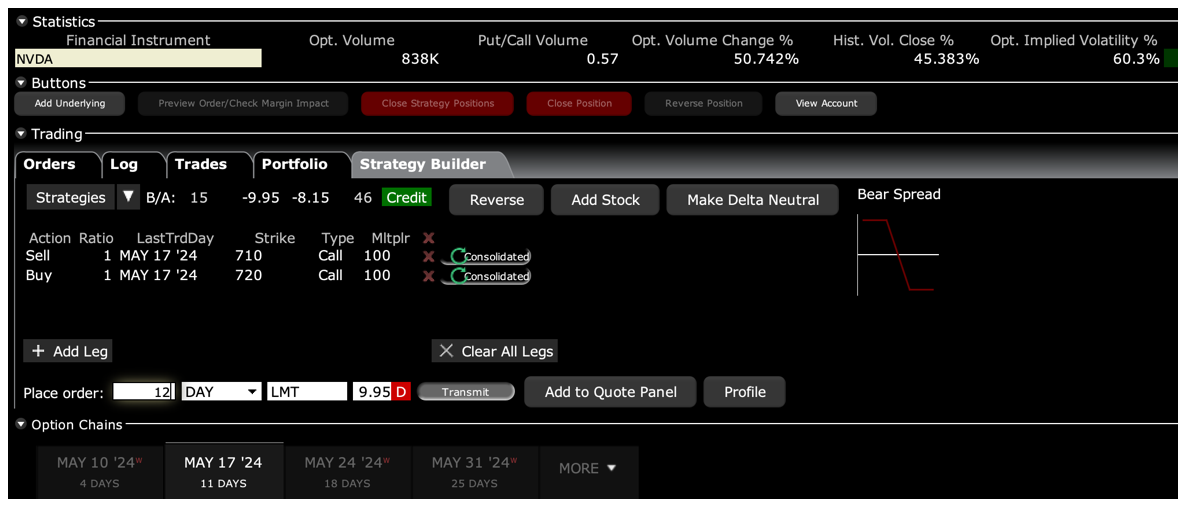

SELL the NVIDIA (NVDA) May 2024 $710-$720 in-the-money vertical Bull Call debit spread at $9.95 or best

Closing Trade

5-6-2024

expiration date: May 17, 2024

Number of Contracts = 12 contracts

We just nailed the recent $165, or 22% rally in NVIDIA shares. With 95.83% of the maximum potential profit in hand, the risk/reward of continuing 9 more trading days until the May 17 option expiration is no longer favorable.

The sky-high implied volatility for the options of 63% made this easy to do so as we were paid richly to take a position. By comparison, the implied volatility for the S&P 500 is a lowly 12.2%. That’s the implied you get when markets grind up almost every day.

This was a rare case where I bought high and sold higher.

I am therefore selling the NVIDIA (NVDA) May 2024 $710-$720 in-the-money vertical Bull Call debit spread at $9.95 or best.

As a result, you get to take home $1,380 or 13.07% in 19 days. Well done and on to the next trade.

NVIDIA is so far ahead of the competition that no one will catch up for years. What the (NVDA) bears don’t get is that the company has a moat so wide it is impossible to cross. Their enormous lead in software is the result of crucial platform decisions made 20 years ago. The key staff are all looked up with ultra-cheap equity options with strike prices around $1-$2.

To learn more about the company please visit their website at https://www.nvidia.com/en-us/

This was a bet that NVIDIA would not fall below $720 by the May 17 option expiration in 9 trading days.

Here are the specific trades you need to close out this position:

Sell 12 May 2024 (NVDA) $710 calls at………….……................…$209.00

Buy to cover short 12 May 2024 (NVDA) $720 calls at……………$199.05

Net Cost:………………………….………..………….…...........................$9.95

Profit: $9.95 - $8.80 = $1.15

(12 X 100 X $1.15) = $1,380 or 13.07% in 19 days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.