The Capital Cure

Imagine you're the CEO of a major pharmaceutical company. You've got blockbuster drugs that are raking in billions, a cushy corner office, and a corporate jet at your disposal. Life is good.

But then, you look at the calendar and realize that your patents are about to expire. Suddenly, that jet feels more like a crop duster, and your corner office starts to feel like a broom closet.

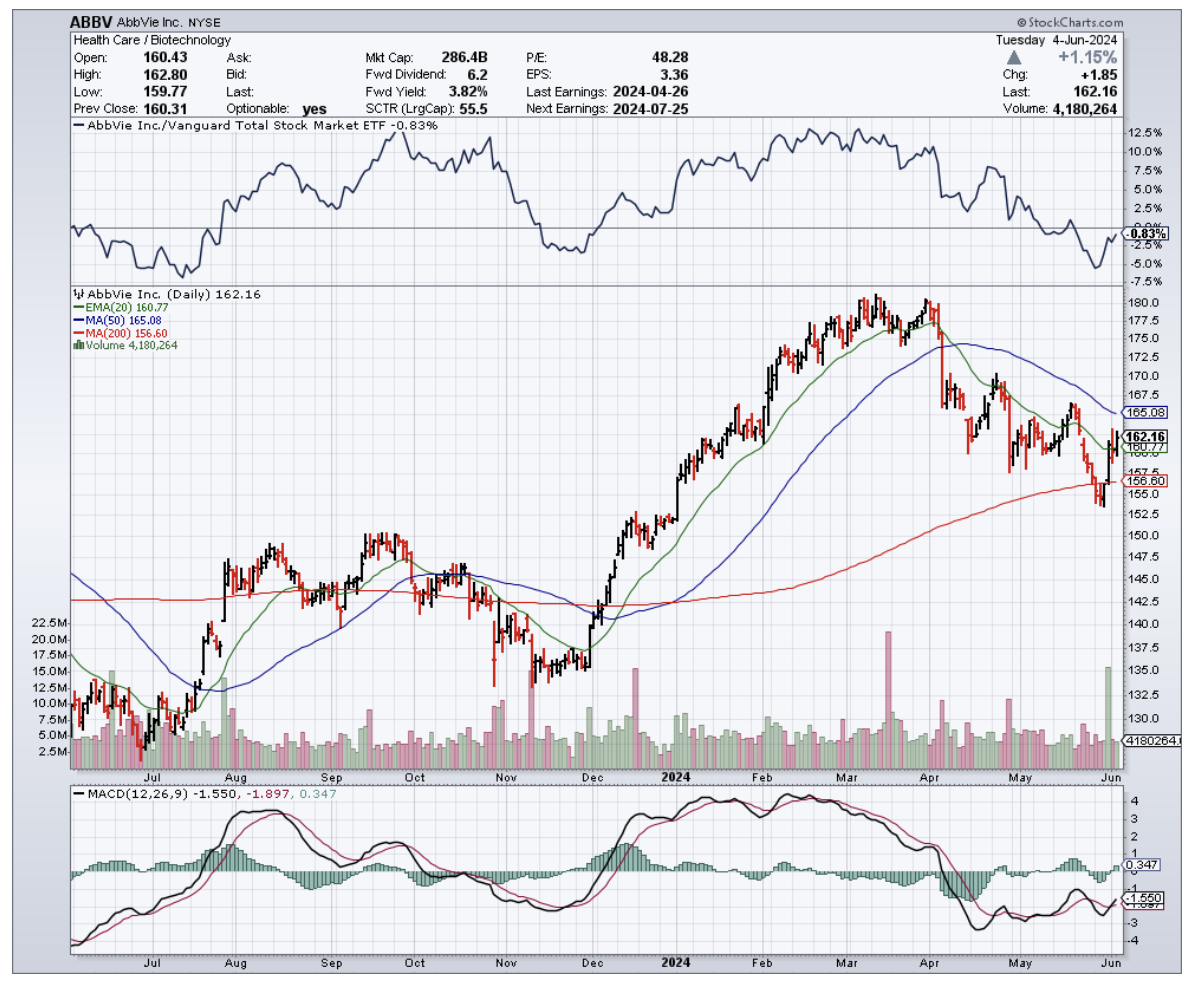

That's the reality facing Big Pharma right now. These pharma big shots are sweating bullets over losing their golden geese like AbbVie's (ABBV) Humira and Merck's (MRK) Keytruda.

That’s roughly $300 billion in products about to get kicked to the curb.

But these guys didn't get to the top by sitting on their hands. They've got a war chest of $1 trillion, and they're not afraid to use it.

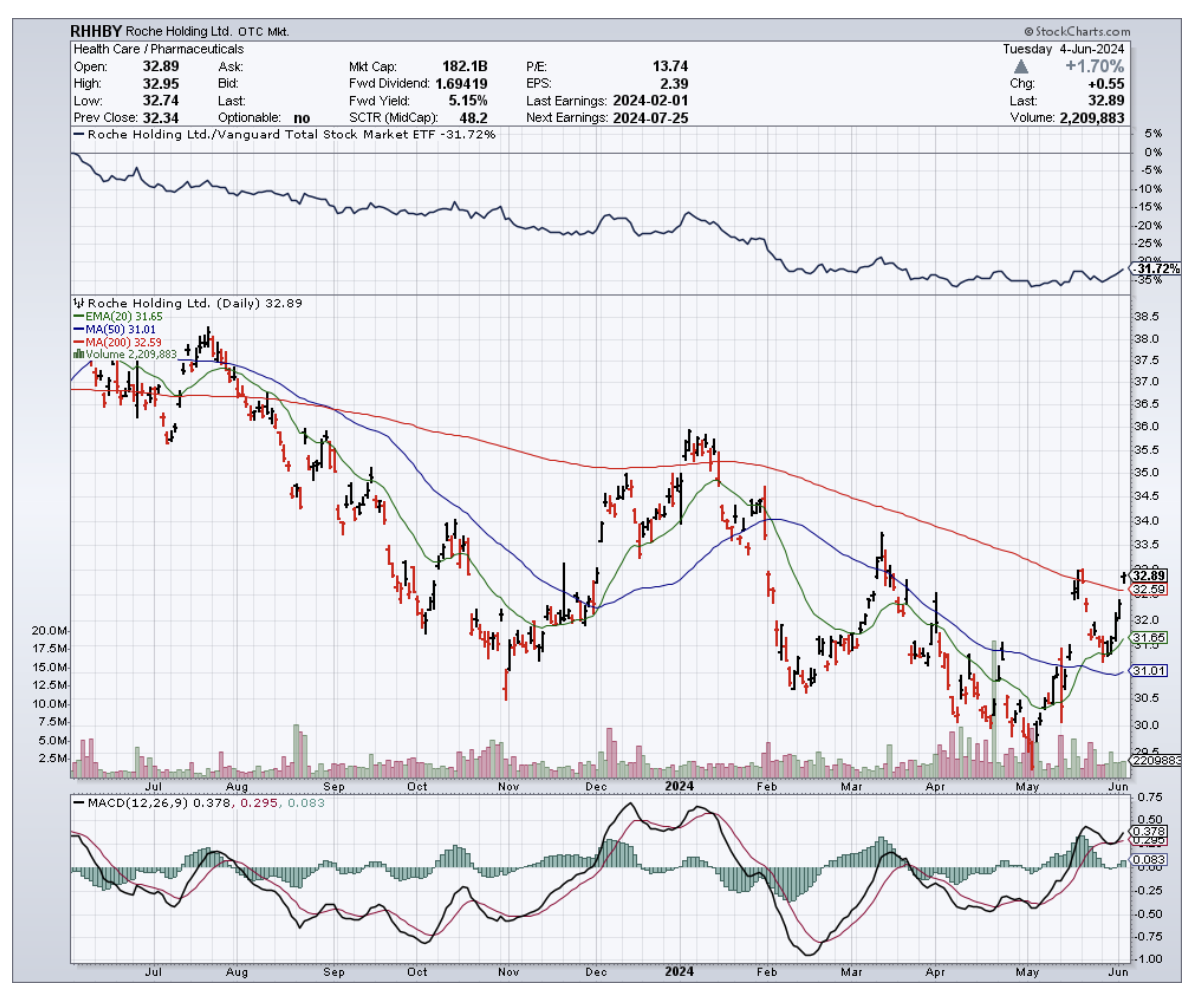

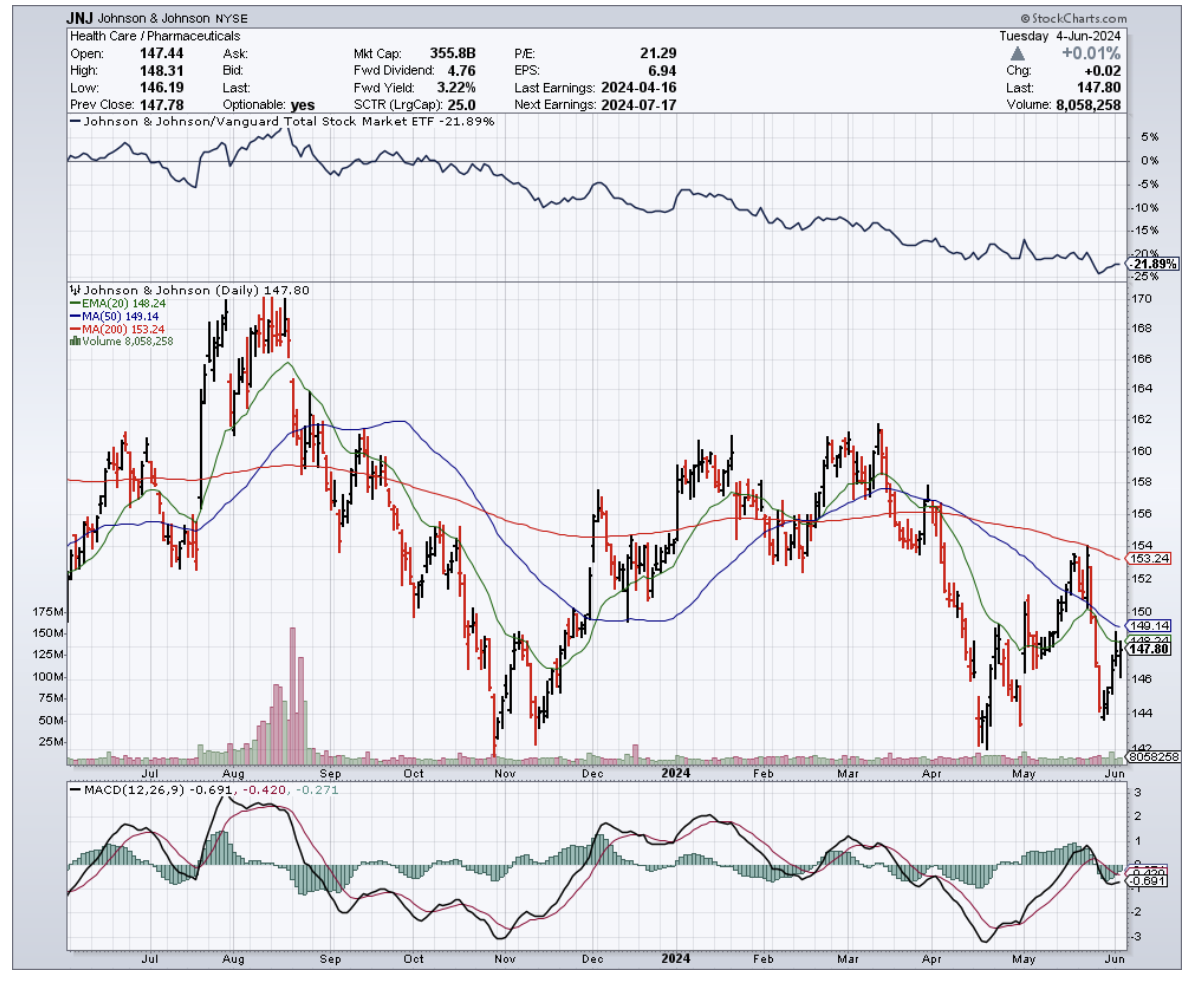

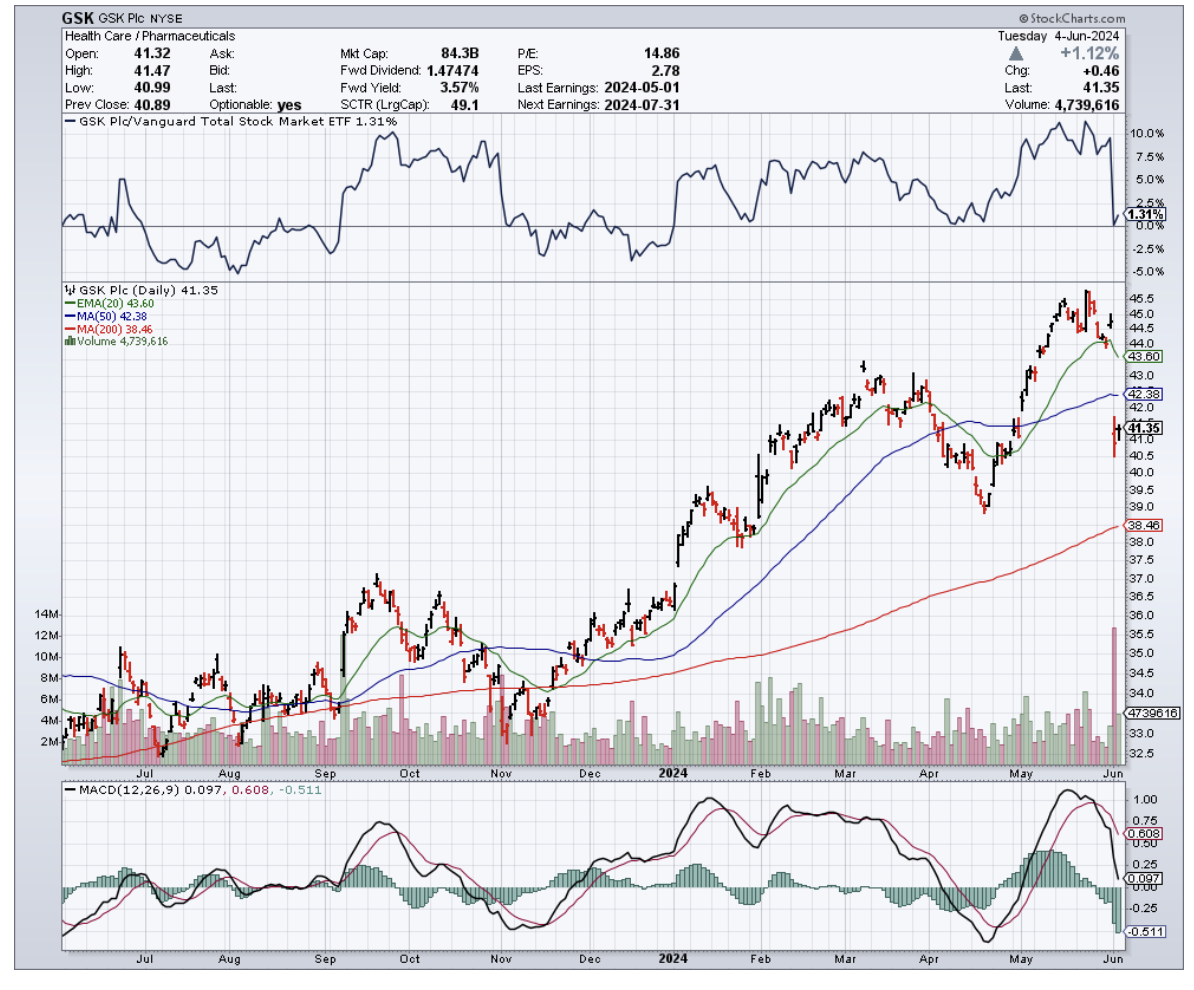

Major pharmaceutical giants like Pfizer (PFE), Roche (RHHBY), Johnson & Johnson (JNJ), AstraZeneca (AZN), and GlaxoSmithKline (GSK) are about to go on the mother of all shopping sprees.

Why the rush? Because they're staring down the barrel of a patent cliff that's going to make the Grand Canyon look like a pothole.

We're talking $198 billion worth of branded drugs going off the patent cliff between 2021 and 2025. That's a gut-wrenching 56% jump from the last five years.

But don't think for a second that they're just going to sit back and watch their profits go up in smoke. No sir, they're on the hunt for the next big thing, and they've got their sights set on some juicy targets – and biotech is at the top of their list.

Leading the biotech charge are mRNA pioneers Moderna (MRNA) and BioNTech (BNTX), each sitting on a gold mine of potential blockbusters taking on everything from flu to cancer vaccines.

Underdogs like CRISPR (CRSP) biotech stars Intellia (NTLA) and Beam Therapeutics (BEAM) are also squarely in Big Pharma's acquisition crosshairs for their cutting-edge work in genetic disease treatments.

But beyond the headliners, don't overlook the sleeper hits that could catalyze the next big boom.

Oncology, in particular, is a prime hunting ground, accounting for 37% of pharma M&A deal value in 2023 as the $392 billion global cancer drug market continues to boom.

Companies like Turning Point Therapeutics (TPTX) and Zentalis Pharmaceuticals (ZNTL), with their promising targeted therapies for various solid tumors, are particularly attractive prospects.

Mirati Therapeutics (MRTX), focused on KRAS inhibitors, and Blueprint Medicines (BPMC), specializing in precision therapies, have also caught the eye of big pharma with their innovative approaches.

Additionally, companies with late-stage assets like MacroGenics (MGNX), Mereo BioPharma (MREO), and Tyra Biosciences (TYRA) could offer promising near-term revenue opportunities for acquiring companies looking to bolster their oncology portfolios.

Close behind are rare disease treatments, snagging 16% of new drug approvals and 9 of the top 100 deals last year in this $262 billion market ripe for more growth.

This lucrative sector has captivated pharma giants, who see potential in companies like Sarepta Therapeutics (SRPT) and Vertex Pharmaceuticals (VRTX), leaders in rare disease therapies with strong financial performance and consistent growth.

Aside from these, smaller biotechs like Amicus Therapeutics (FOLD) and Ultragenyx Pharmaceutical (RARE), focused on developing innovative therapies for a range of rare diseases, are attracting attention for their potential to address unmet medical needs and deliver substantial returns on investment.

But the real wild card everyone wants a piece of is cell and gene therapies. This medical Wild West is projected to explode to $66.8 billion by 2030, with the FDA already greenlighting 6 cutting-edge therapies like next-gen CAR-T treatments from Caribou Biosciences (CRBU) in 2023 alone.

Notably, the buying frenzy is very much already underway. In fact, 2023 saw the biggest biotech M&A spree in a decade, with a staggering $122.2 billion changing hands as the FDA approved 50% more new therapies.

Pharma mega-mergers also hit $135.5 billion as firms raced to reload pipelines.

Interestingly, these deals are only the tip of the iceberg. As Wall Street predicts, with record-smashing deals, sky-high demand, and new approvals surging, "biotech's got plenty of reasons to be cautiously optimistic."

Especially if interest rates finally cooperate, throwing gasoline on the M&A bonfire and making biotech the belle of the ball as soon as late 2024.

So keep your eyes peeled and your powder dry. I suggest you add these innovative biotech names to your watchlist, and you might just discover the next blockbuster drug or breakthrough therapy that could reshape medicine – and deliver explosive returns in the process.