Trade Alert - (AAPL) August 5, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AAPL) – BUY

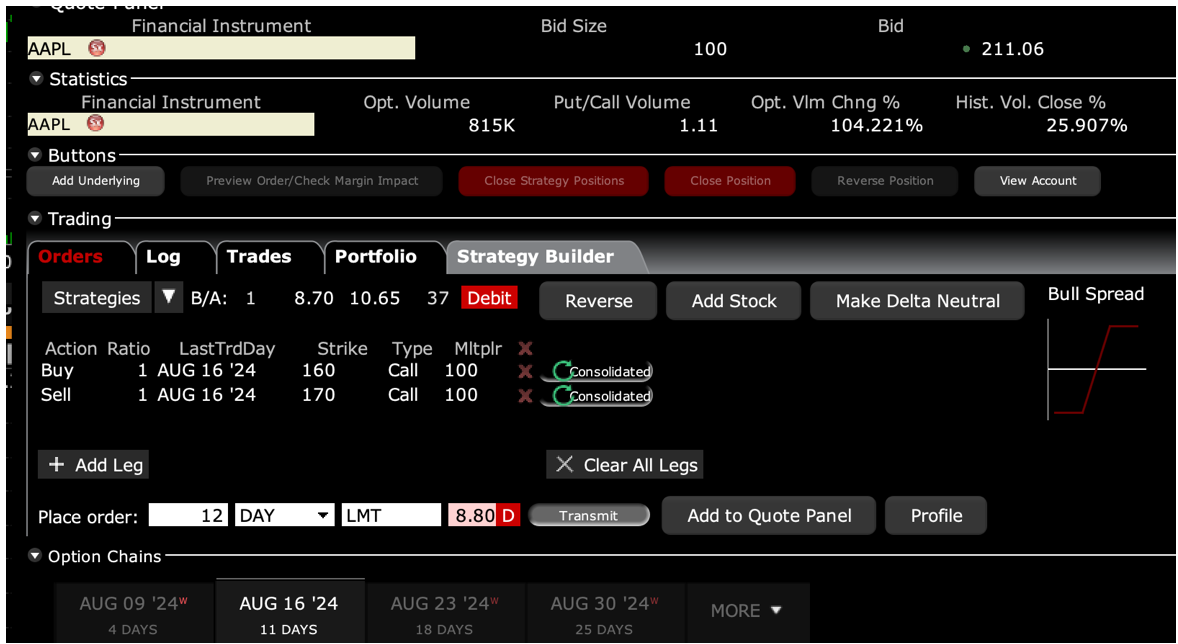

BUY the Apple (AAPL) August 2024 $160-$170 in-the-money vertical Bull Call debit spread at $8.80 or best

Opening Trade

8-5-2024

expiration date: August 16, 2024

Number of Contracts = 12 contracts

With Warren Buffet having unloaded $84 billion in Apple shares over the last quarter, that takes $84 billion worth of selling pressure off of (AAPL). Apple may decline more in this summer correction, but I am willing to bet big that it doesn’t drop below $170. With a Volatility Index of $56, we have a huge margin of error.

I am therefore buying the Apple (AAPL) August 2024 $160-$170 in-the-money vertical Bull Call debit spread at $8.80 or best.

Don’t pay more than $9.50 or you’ll be chasing on a risk/reward basis.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

To learn more about the company, please visit their website at www.apple.com.

This is a bet that Apple will not fall below $170 by the August 16 option expiration in 9 trading days.

Apple Inc. (formerly Apple Computer, Inc.) based in Cupertino, CA is the second largest publicly listed company in the United States (after Microsoft) with a market capitalization of $2.64 trillion. It dominates smartphones with a 66% US market share and accounts for 90% of global profits.

It designs, develops, and sells a variety of consumer electronics, computers and their software, and online services. Its products include the iPhone, iPad, Apple Watch, Mac computers, the artificial reality Vision Pro headset, and Apple TV. It is also entering the movie production and distribution business. In my early days, I knew the co-founders Steve Jobs and Steve Wozniak.

Here are the specific trades you need to execute this position:

Buy 12 August 2024 (AAPL) $160 calls at………….…….…$51.00

Sell short 12 August 2024 (AAPL) $170 calls at……………$42.20

Net Cost:………………………….………….............…................$8.80

Potential Profit: $10.00 - $8.80 = $1.20

(12 X 100 X $1.20) = $1,440 or 13.64% in 9 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.