Trade Alert - (GLD) August 13, 2024 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (GLD) – TAKE PROFITS

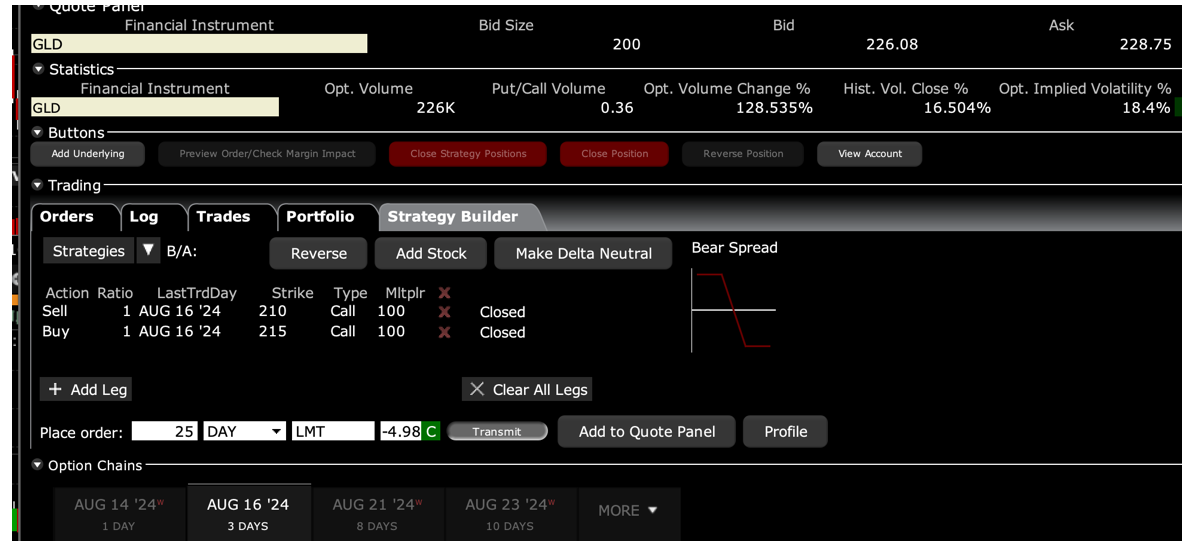

SELL the SPDR Gold Shares (GLD) August 2024 $210-$215 vertical BULL CALL debit spread at $4.98 or best

Closing Trade

8-13-2024

expiration date: August 16, 2024

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Since we added this long position in gold a month ago, the yellow metal has move within pennies of an all-time high.

We have an important number coming up at 8:30 AM EST on Wednesday, August 14. That is the July CPI report. A hot CPI could cause (GLD) to tank $10.

Since options markets are discounting a large move up or down to follow it behooves us to take what easy profits we can.

This position is the low-hanging fruit as we have 96.92% of the maximum potential profit in hand. The risk/reward of continuing three more days until the August 16 option expiration is no longer favorable.

The Fed is planning an interest rate cut of 25 basis points and all falling interest rate plays in the stock market are in play. Falling rate plays and flat technology could be the trade for the rest of 2024.

It is all very gold-positive.

Therefore, I am selling the SPDR Gold Shares (GLD) August 2024 $210-$215 vertical BULL CALL debit spread at $4.98 or best.

As a result, you get to take home $1,575 or 14.48% in 23 trading days. Well done and on to the next trade.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 2 cents with a second order.

The bull case for gold is simple. Falling interest rate mean less yield competition for gold, which yields nothing. China and Russia have been stockpiling gold for years to avoid international financial sanctions. A global gold shortage is developing with new mine costs rising. Gold also offers protection against rising US debt, which is expected to hit $35 trillion shortly.

On top of all this, Chinese speculators have shifted their interest from real estate, which has crashed, to precious metals. This adds a large retail element that has never existed before.

SPDR Gold Shares (GLD) is a play on physical gold. They are shares in a corporation that owns 400-ounce gold bullion bars held by a London trust. It is far safer owning gold through the (GLD) than through owning your own physical gold bars via a third-party custodian. If the custodian goes under, which is frequent, your gold is gone. With (GLD) your credit risk is with State Street, a highly-rated firm with a strong balance sheet.

For details about SPDR Gold Shares (GLD) please visit their website at https://www.spdrgoldshares.com.

This was a bet that (GLD) will not fall below $215 by the August 16 option expiration in 26 trading days.

Here are the specific trades you need to close out this position:

Sell 25 August 2024 (GLD) $210 calls at………….….......……$14.00

Buy to cover short 25 August 2024 (GLD) $215 calls at……$9.02

Net proceeds:………………………….………..………….…............$4.98

Profit: $4.98 - $4.35 = $0.63

(25 X 100 X $0.63) = $1,575 or 14.48% in 23 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.