A Surprise Uppercut

Remember when Muhammad Ali got knocked down by Joe Frazier? Well, Merck (MRK) just had its Ali moment, courtesy of a plucky little biotech named Summit Therapeutics (SMMT).

Ivonescimab, a cancer drug developed by this relatively under-the-radar biotech company, just gave Merck's golden goose, Keytruda, a serious run for its money—and not by a small margin.

In a recent announcement, Summit Therapeutics revealed that Ivonescimab reduced the risk of disease progression or death by a whopping 49% compared to Keytruda. Let that sink in for a moment

In the trial, aptly named HARMONi-2 (these folks love their capitalization), Ivonescimab held tumor progression at bay for a median of 11.1 months. Keytruda? A mere 5.8 months.

Needless to say, Summit just landed a haymaker that has Merck seeing stars.

Now, before you rush to dump your Merck stock faster than a hot potato, let's put this in perspective. The trial was conducted in China with Summit's collaboration partner, Akeso. It's a significant result, no doubt, but we're not talking FDA approval just yet.

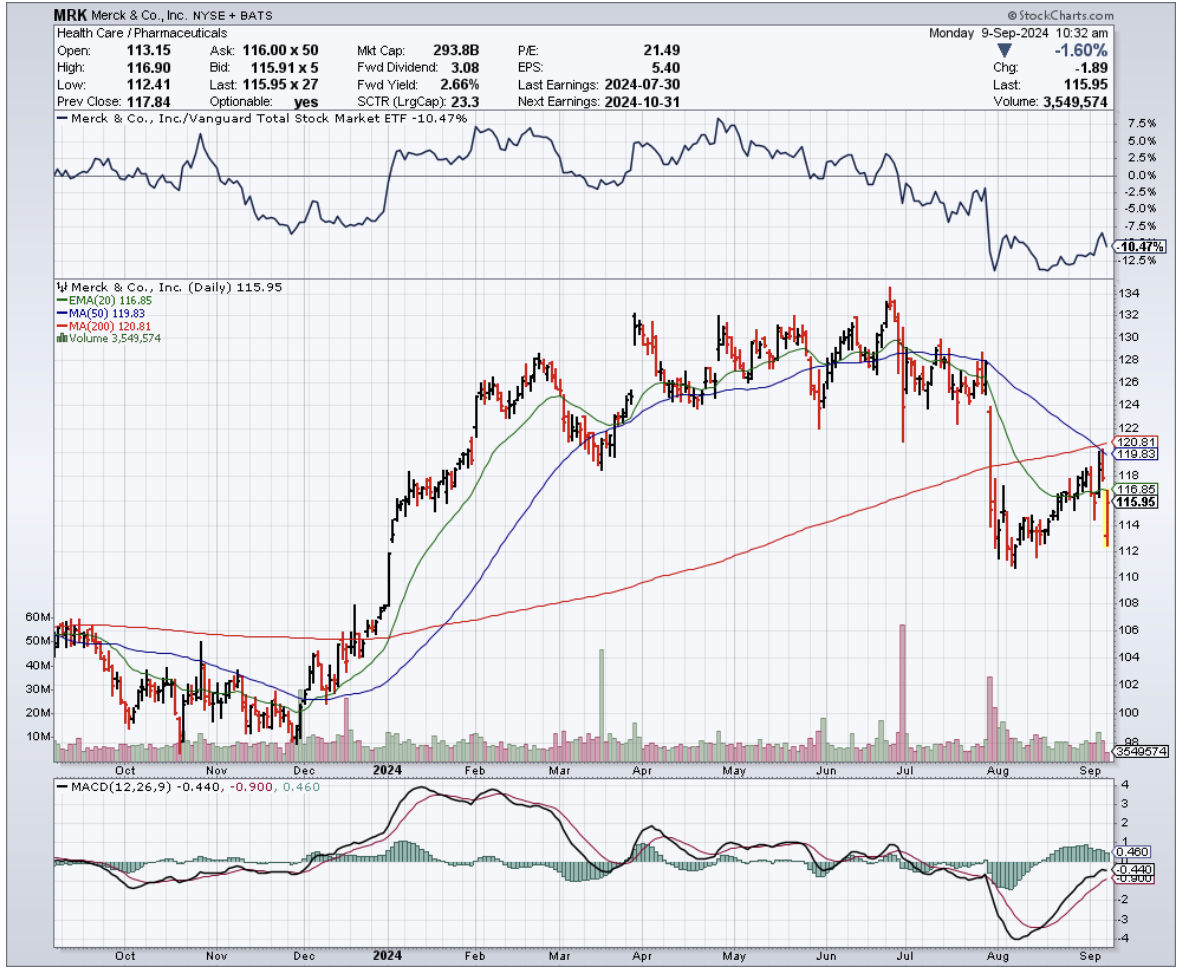

Still, Wall Street took notice. Summit's stock shot up 61% in Monday's premarket while Merck's stock took a hit.

But here's where it gets interesting. Merck's been the undisputed heavyweight champ of pharma for years, with Keytruda as its championship belt. This wonder drug has been laying billion-dollar eggs for nearly a decade, and the nest keeps growing.

In 2022, the Keytruda market was valued at $20.8 billion, and by 2023, it raked in a staggering $25.01 billion.

With AbbVie’s (ABBV) Humira out of the running, projections for 2024 now peg Keytruda as the top-ranked drug worldwide, with sales expected to surpass $27 billion.

By 2032, it's expected to soar to $45.9 billion, with a compound annual growth rate (CAGR) of 9.20% from 2024 to 2032.

Just last quarter, Keytruda accounted for a whopping 45% of Merck’s $16.1 billion revenue—that’s $7.3 billion from a single drug. Talk about putting all your eggs in one basket.

And therein lies the rub. Keytruda's patent expires in 2028. That's not tomorrow, but in the pharma world, it's just around the corner.

It's like watching the countdown timer on a bomb in an action movie - you know it's coming, but you can't look away.

Merck's not blind to this. They've been diversifying as fast as they could.

Their next largest product, Gardasil, brought in $2.5 billion last quarter, growing at a modest 4%. Not Keytruda numbers, but nothing to sneeze at.

They're also betting big on new drugs. There's Winrevair, a treatment for pulmonary arterial hypertension that could bring in up to $11 billion by 2029.

Then there's Capvaxive, a pneumococcal vaccine that could hit $1 billion in sales by 2027. And let's not forget their $5.5 billion deal with Daiichi Sankyo for three antibody-drug conjugates.

So, what's the play here? Merck's trading at 15 times next year's earnings. That's like finding a designer suit at a thrift store price.

The stock's up 5.3% this year, lagging behind the S&P 500's 16% growth. Some might see a bargain, others a warning sign.

Here's my take: Merck's got challenges, no doubt. But they've also got a track record of success and a pipeline that could make a pharmacist drool.

If you've got the patience of Job and the stomach for biotech's wild rides, Merck could be a solid long-term play.

But don't take your eyes off Summit Therapeutics. They’ve just proved they can punch above their weight class.

Besides, in this high-stakes arena of biotech, where one breakthrough can knock the competition to the mat, it’s the unexpected contenders that often deliver the biggest surprises. So, keep your eyes on the ring—the next round promises to be a thriller.