November 6 Biweekly Strategy Webinar Q&A

Below, please find subscribers’ Q&A for the November 6 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

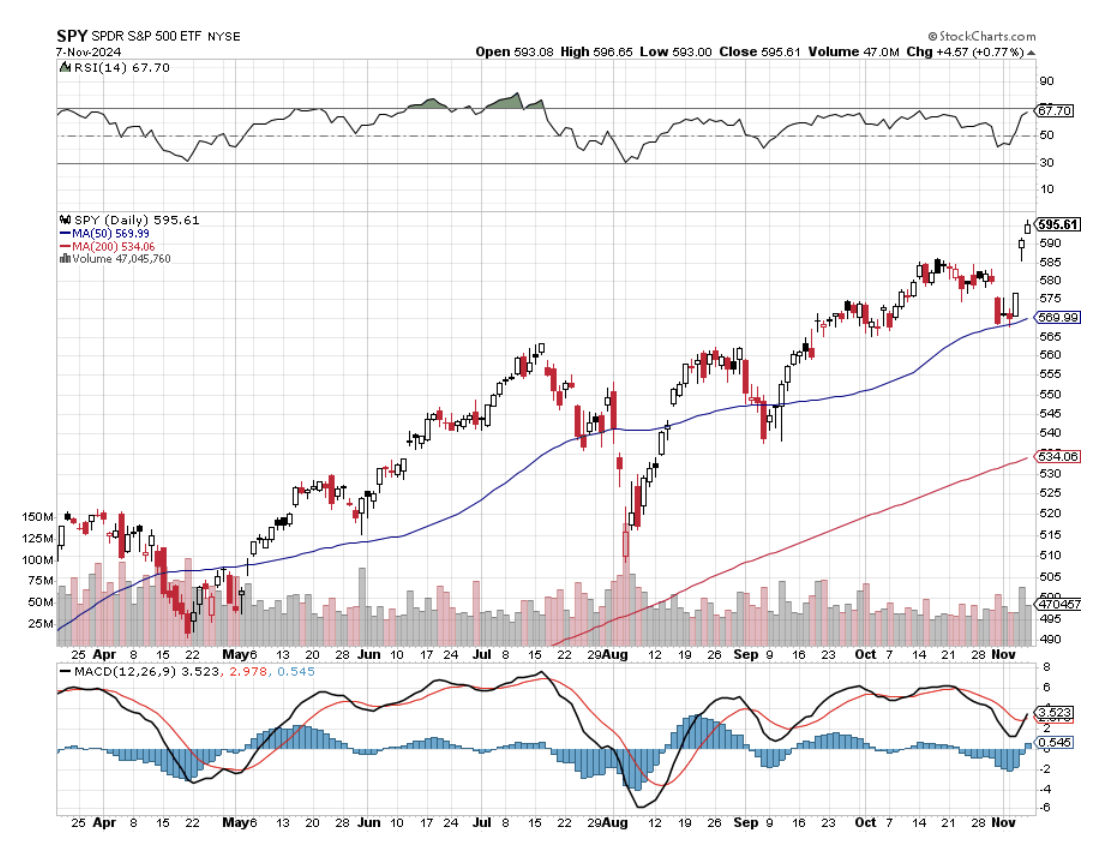

Q: What do we do in the market now in view of the Trump Victory?

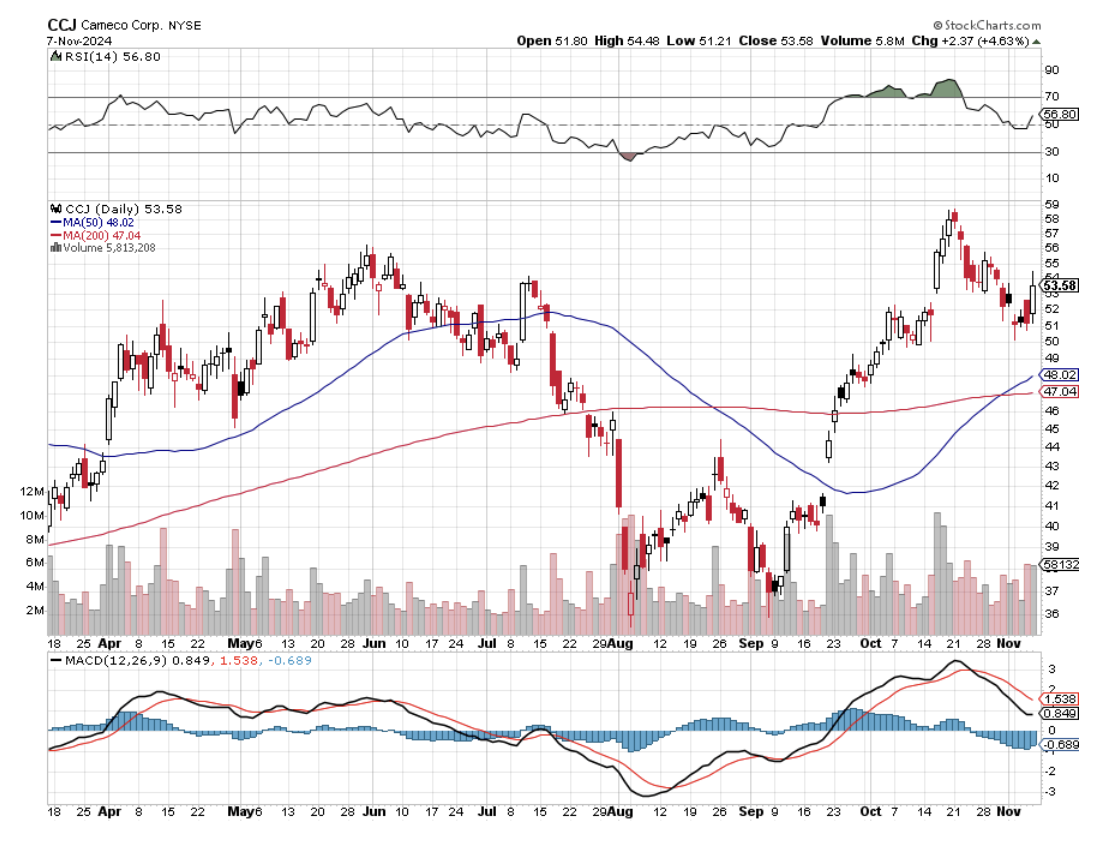

The driving theme of the market has completely changed overnight. Falling interest rate plays are dead. The new theme is deregulation. The good news is that there are a lot of cheap deregulation plays out there, especially in financials. Deregulation is also a factor with (NVDA), where the government was lining up for an antitrust suit. New nuclear stocks like (CCJ) and (VST) also do well with a lighter regulatory touch.

Q: How will the defense industry perform under Trump?

A: Poorly. If we cease supplying Ukraine with weapons and withdraw from our international commitments, there’s no need for weapons at all. We’ll just have to be happy with the 50-year-old weapons that we have right now. And, of course, that's one of the reasons why Putin was such a big supporter of Trump. Avoid (LMT) and (RTX). Other stocks were already selling off as Trump rose in the polls.

Q: Will housing be a loser with the housing shortage?

A: Yes, it will, because you won’t find home buyers if they don’t have any money—if interest rates and mortgage payments are too high, those buyers are absent from the market. They can’t afford to step up to the current price levels and mortgage levels.

Q: Do you really think the Fed may not cut interest rates?

A: All of the announced Trump policies are highly inflationary, and one of the Fed’s primary missions is to control inflation. But, it comes down to: is the Fed going to look forward or look back? Historically, it is very much a “look back” organization, so they will probably wait on their higher interest rates. And that is what uncertainty is all about; all of a sudden, you go from very firm convictions of what’s going to happen next—what stocks to buy, what sectors to play—to “I don’t know!”. With a Harris win, at least you had some certainly. With Trump, we don’t know what he really wants to do, can do, or be allowed by the courts. It will take time to figure all this out.

Q: Why did none of these issues occur during Trump’s first term?

A: Well, virtually all of Trump’s first term, interest rates were at zero because the Fed was still doing quantitative easing, trying to recover from the ‘08 financial crisis, but also recovering from the pandemic. The amazing thing about the Biden administration is that the stock market did so well during the 5% interest rates that prevailed practically for his entire term.

Q: Do you have a “BUY” target for iShares 20+ Year Treasury Bond ETF (TLT) on the downside after the Trump win?

A: The answer is we are going to retest the low of the year, which is $82 in the TLT, and last time I checked, we were at $89.78—so down seven points. But again, we now have a lame-duck government, so no dramatic action with a split Congress. We basically have until January 20th, when the new government comes in, to find out what they will actually try to do. I think you'll find that the “campaign Trump” and the “in-office Trump” are two totally different people.

Q: Okay, what about the iShares 20+ Year Treasury Bond ETF (TLT) LEAPS position you put out two weeks ago? Should we sell or hold?

A: Well, if you want to be cautious, go cash—sell. But this is a LEAPS that has another 15 months to expiration, and there's a pretty decent chance we'll be going into recession sometime next year, especially if interest rates and inflation take off. That could make your LEAPS trade very attractive—it could drive interest rates down to 3.5%, which is virtually where they were in September. Since September, bonds have basically given up their entire rally for the year on the possibility of a Trump win. So, you know, would I put on that trade today? No. Will I put it on at $82, I probably will. We'll just have to see what the new world looks like.

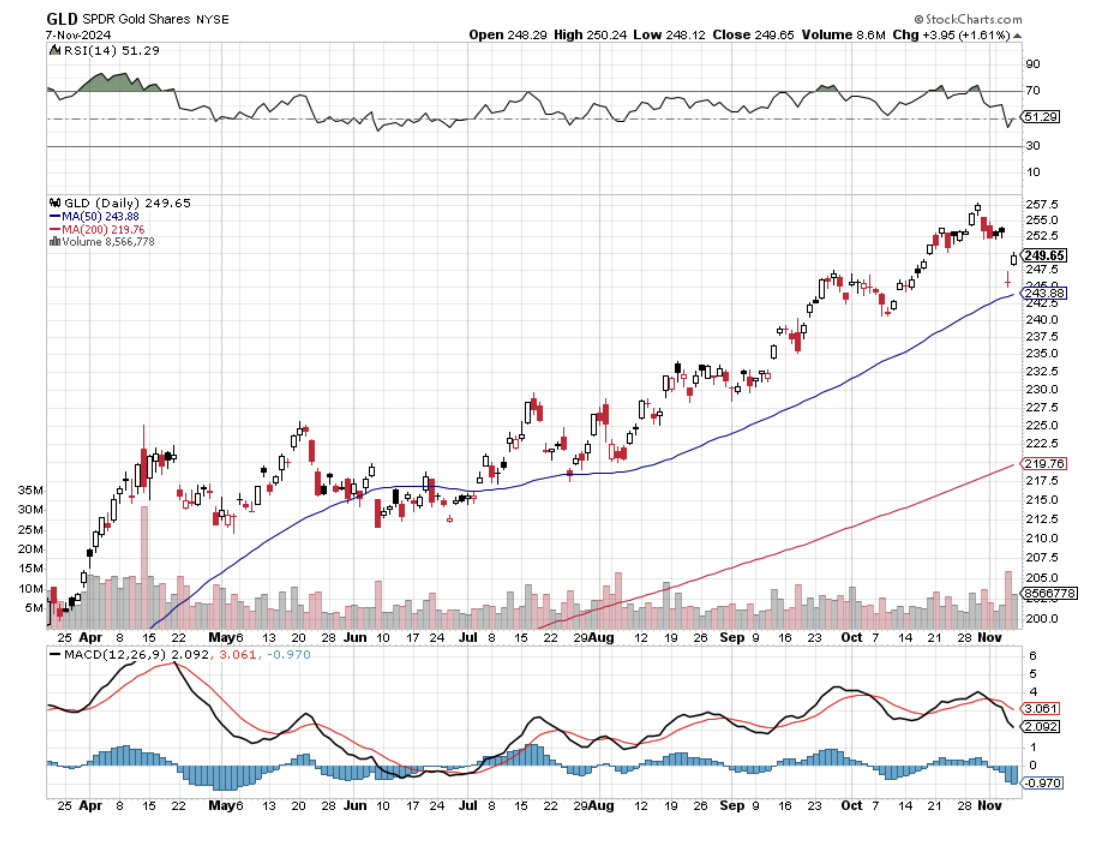

Q: What's the direction for gold (GLD) and silver (SLV)?

A: Down. Those two plays were dependent on falling interest rates, which are now gone. Now that they're going back up again, it kind of trashes the entire gold-silver trade. So, at some point, gold will drop to a point where the flight to safety bid offsets the fear of rising interest rates. You still have a lot of Chinese savings in gold going on and central bank buying. That's where you get back in. Where that is is anybody's guess.

Q: Any thoughts on Crown Castle International (CCI)?

A: It is an interest-rate play. We did really well with CCI from April to September, when the 10-year treasury went from 4.5% to 3.5%. Run that movie in reverse, and it doesn't do very well. We've had a big sell-off on (CCI) this morning. So it's getting killed on the prospect of rising rates and inflation.

Q: Do smaller stocks do better under Trump?

A: No. Smaller stocks are much more dependent on interest rates than large stocks because they're very heavy borrowers at high rates. So, any rally there should be sold into.

Q: Should I bet the ranch on crypto here?

A: Absolutely not. $6,000 is where you should have bet the ranch on crypto, not at $75,000. Crypto is barely moving today, despite promises by Trump to completely deregulate the sector. So, no, I am definitely not a buyer of crypto here.

Q: What about the gold trade alert that I sent out yesterday?

A: That was on the assumption that Harris would win, and she didn't. If you want to be conservative, get out of the position now. We have five weeks to expiration on that position, so it really depends on where gold finds its bottom—it could hold up here or a little bit lower, and we'll still be at the max profit. If we go into free fall, I'm going to just stop out of the position and write that one off as me being too aggressive before the election when I had the perfect positions going into it, being long JP Morgan (JPM) and Nvidia (NVDA).

Q: Is the Occidental Petroleum (OXY) spread okay?

A: For energy, I would say yes, probably. But we'll have to see how sustainable this current rally is.

Q: So, wait on the currency plays, like (FXA), (FXE), (FXB), and (FXC)?

A: Absolutely, yes. It's another wait for the dust to settle trade.

Q: What will the price of crude oil do from here?

A: Probably go down more with large new supplies coming out of the U.S.

Q: Why are financial stocks up huge?

A: Deregulation. Financials are among the most regulated industries in the world. If you don't believe me, try running a hedge fund someday, where they're breathing down your neck every five seconds for audits, reports, and so on. They also win on the revenue side with restrictions coming off mergers and acquisitions with the end of antitrust enforcement.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader