Why Technical Analysis is a Disaster

At my Mad Hedge Miami Beach Luncheon, I heard an amazing piece of information from a guest.

Fidelity recently conducted a study to identify their best-performing clients.

They neatly fell into two groups: people who forgot they had an account at Fidelity and dead people.

It all underlines the futility of trading the markets without true professional guidance, something many aspire to but few actually accomplish.

Of the many thousands of online newsletters and trade mentoring services, I only know of three that actually make money for clients.

Those would be mine and two others, and I’m not talking about who the other two are.

It is an industry filled with professional marketers, charlatans, and conmen.

Let me point out a few harsh lessons learned from this most recent meltdown and the rip-your-face-off rally that followed.

The next five months are ones of historical seasonal market strength.

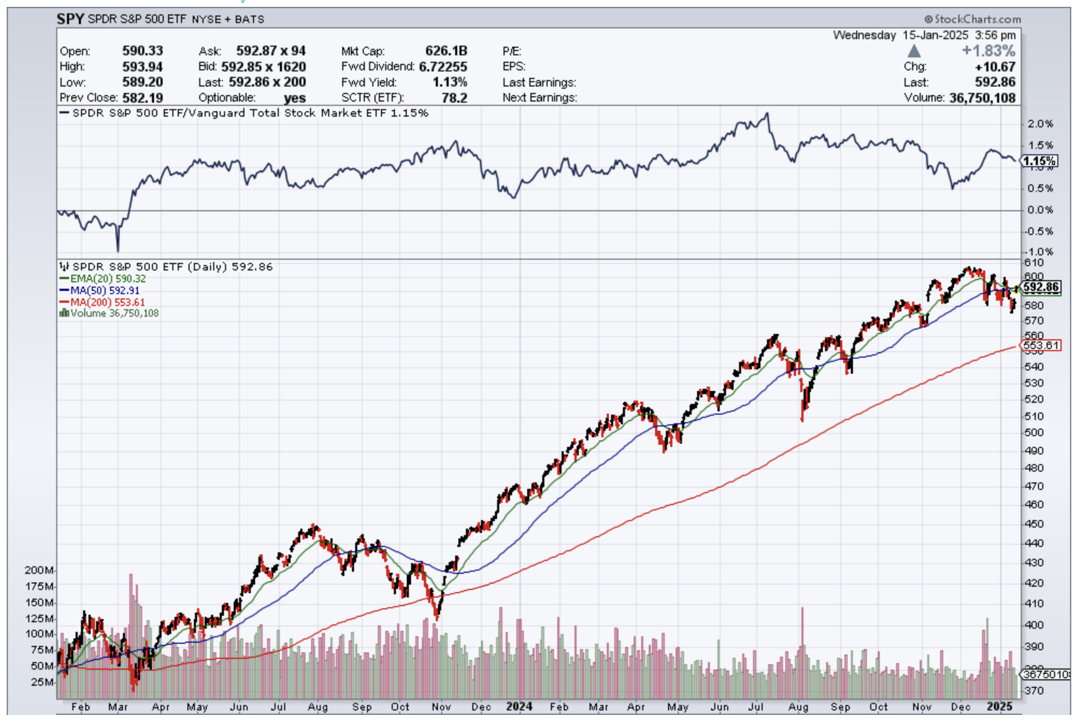

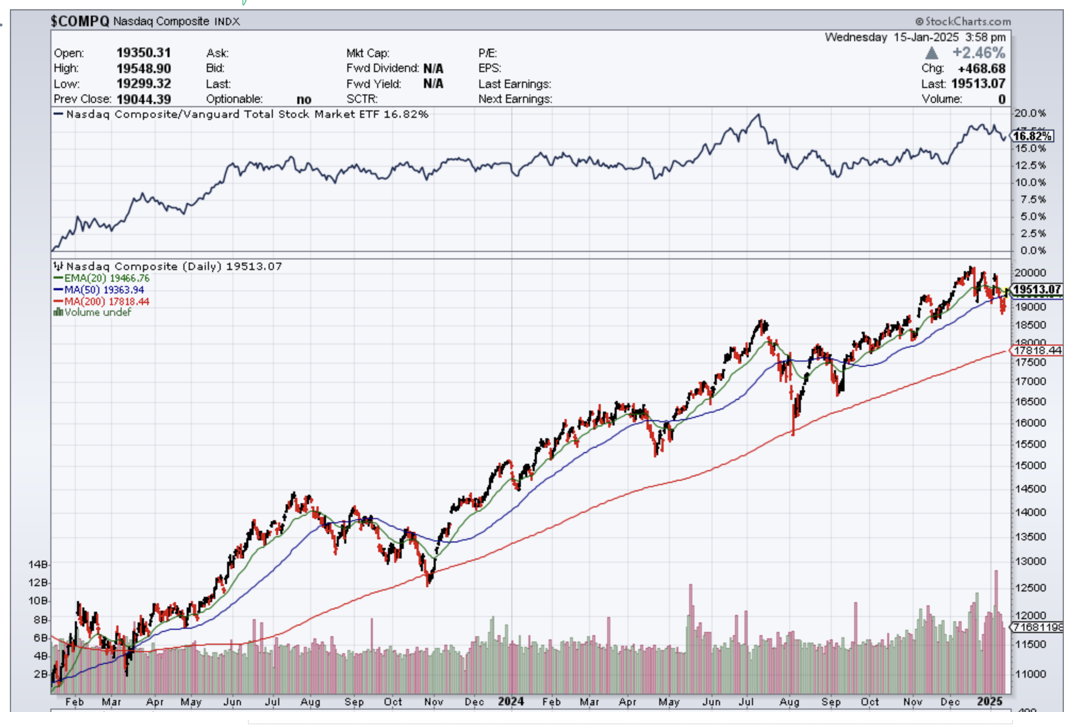

The big lesson learned this summer was the utter uselessness of technical analyses. Usually, these guys are right only 50% of the time. This year, they missed the boat entirely.

The biggest losers?

Algorithms, which used the decisive breakdown of the (SPY) in August to go heavily short.

If you did, you lost your shirt. The market just shed a couple more points, reversed, and then kept going, and going, and going.

This is why technical analysis is utterly useless as an investment strategy. How many hedge funds use a pure technical strategy and a stand-alone basis?

Absolutely none, as it doesn’t make any money.

At best, it is just one of 100 tools you need to trade the market effectively. The shorter the time frame, the more accurate it becomes.

On an intraday basis, technical analysis is actually quite useful.

Leave it for the kids.

This is why I advise portfolio managers and financial advisors to use technical analysis as a means of timing order executions, and nothing more.

Most professionals agree with me.

Technical analysis derives from humans’ preference for looking at pictures instead of engaging in abstract mental processes. A picture is worth 1,000 words, and probably a lot more.

This is why technical analysis appeals to so many young people entering the market for the first time.

Buy a book available for $5 on Amazon, and you can become a Master of the Universe.

Who can resist that?

The problem is that high-frequency traders also bought that same book from Amazon a long time ago and have designed algorithms to frustrate every move of the technical analyst.

Sorry to be the buzz kill, but that is my take on technical analysis.

I have a much better solution than forgetting you have a trading account, or dying.

Take Cunard’s round-the-world cruise.

I have been sailing with Cunard since the 1970s when the original Queen Elizabeth was still afloat.

I’ve lost count of how many Transatlantic voyages I have taken across the pond.

For a mere $16,669 you can spend 117 days circumnavigating the globe with Cunard from Southampton, England in their cheapest inside cabin (click here for the link.)

That includes all the food you can eat for four months.

On the way, you can visit such exotic destinations as Bora Bora, The Seychelles, Reunion, and Moorea.

Not a bad deal.

By the time you get home, you will probably earn enough in your investment account to pay for the entire trip.

Hope you enjoyed your cruise.

Correction? What Correction?