DEAR PALANTIR: IT'S NOT YOU, IT'S YOUR P/E RATIO

(PLTR), (MSFT), (AMZN), (GOOG), (ORCL)

Back in the early days of my career, I watched countless "revolutionary" tech companies come and go, each promising to change the world with their shiny new algorithms. But Palantir (PLTR) caught my eye for an entirely different reason - they were actually getting their hands dirty with real-world problems while everyone else was still writing whitepapers.

Let me put this in perspective. While most tech firms were trying to convince their first customers to sign proof-of-concept agreements, Palantir was already knee-deep in the kind of work that makes three-letter agencies sit up and take notice.

Their Gotham platform became such a fixture in intelligence circles that it's practically government-issued equipment now, like those ubiquitous office coffee machines, only significantly more sophisticated.

The numbers tell the story better than I ever could. In their latest quarter, Palantir raked in $727 million in revenue, up 30% year-over-year.

That translated into a GAAP net income of $144 million - not bad for a company that some skeptics dismissed as just another government contractor with a fancy PowerPoint deck.

But here's where it gets interesting. Their U.S. commercial business shot up 54% compared to last year.

That's not just growth - that's the kind of acceleration that makes venture capitalists spill their artisanal lattes. It reminds me of the early days of Microsoft (MSFT), when suddenly every business decided they needed Windows, whether they understood it or not.

Speaking of relationships, Palantir has been building quite the rolodex. They're working with everyone from Amazon's (AMZN) AWS to Microsoft's Azure, Google's (GOOG) GCP, and Oracle's (ORCL) Cloud. It's like being invited to all the cool kids' parties and actually showing up to each one.

This Switzerland-of-software approach has helped them spread their AI capabilities faster than a viral tweet.

The government business, though - that's their secret weapon. Remember when I mentioned those three-letter agencies? Palantir's Gotham platform has become so embedded in the intelligence community that trying to remove it would be like trying to extract coffee from the Pentagon's budget.

They're not just selling software – they're providing the digital infrastructure that modern intelligence operations run on.

Meanwhile, their commercial "boot camp" approach to onboarding new clients is pure genius.

While other tech companies treat implementation like a drawn-out Victorian courtship, Palantir gets companies up and running faster than you can say "digital transformation."

I've seen so many enterprise software rollouts in my day, and most of them move at the pace of continental drift. Not Palantir's.

And the numbers? They're even better than the execution. Their adjusted free cash flow exceeded $1 billion on a trailing 12-month basis.

Their "Rule of 40" score - a metric that combines revenue growth and profitability - hit 68. For those keeping score at home, that's like batting .400 in the major leagues.

Looking ahead, Palantir isn't just positioned for growth - it's positioned for dominance.

They're expanding into next-generation autonomous solutions, JADC2, and manufacturing OS modules. It's like watching a chess player who's already thinking five moves ahead while everyone else is still learning how the pieces move.

The question isn't whether Palantir is good at what they do - they clearly are. In a market where AI capabilities separate the winners from the also-rans, Palantir isn't just playing the game - they're changing the rules.

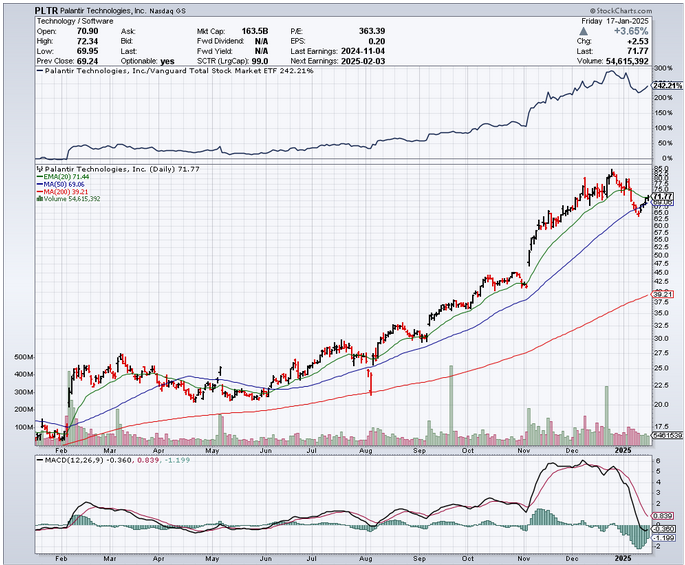

But at $153 billion with a heart-stopping forward P/E of 176, even the best technology can make for a terrible investment.

And let's not forget - their heavy reliance on government contracts means they're just one budget cut away from a really bad quarter.

I've watched too many market cycles to chase stocks at these levels. The time to back up the truck on Palantir will come - probably during the next tech selloff when the momentum crowd dumps everything indiscriminately.

That's when you'll want to pounce on this AI powerhouse. For now, keep your powder dry and put this one on your shopping list for when prices better match reality.