February 3, 2025

(WILL TRUMP’S POLICIES BE THE BEGINNING OF REAL MARKET ANGST OR WILL THE AI ENVIRONMENT DETERIORATE? – OR WILL IT BE BOTH?)

February 3, 2025

Hello everyone

WEEK AHEAD CALENDAR

MONDAY FEB. 3

5:00 a.m. Euro Area Inflation Rate

Previous: 2.4%

Forecast: 2.5%

9:45 a.m. S&P PMI Manufacturing final (January)

10:00 a.m. Construction Spending (December)

10:00 a.m. ISM Manufacturing (January)

Earnings: Tyson Foods, Palantir Technologies, NXP Semiconductors NV, Clorox.

TUESDAY FEB. 4

10:00 a.m. Durable Orders (December)

10:00 a.m. Factory Orders (December)

10:00 a.m. U.S. Job Openings

Previous: 8.1M

Forecast: 7.8M

Earnings: Apollo Global Management, KKR & Co, PayPal, PepsiCo, Merck & Co, Regeneron Pharmaceuticals, Marathon Petroleum, The Estee Lauder Companies, Pfizer, Advanced Micro Devices, Alphabet, Match Group, Prudential Financial, Simon Property Group, Electronic Arts, Enphase Energy, Mondelez

WEDNESDAY FEB. 5

8:30 a.m. Trade Balance (December)

9:45 a.m. PMI Composite final (January)

9:45 a.m. S&P PMI Services final (January)

10:00 a.m. U.S. Services PMI (January)

Previous: 54.1

Forecast: 54.3

Earnings: Walt Disney Co., Emerson Electric, Stanley Black & Decker, Boston Scientific, Uber Technologies, Yum! Brands, T. Row Price Group, MetLife, Align Technology, Qualcomm, Ford Motor, Allstate, O’Reilly Automotive.

THURSDAY FEB. 6

7:00 a.m. UK Rate Decision

Previous: 4.75%

Forecast: 4.50%

8:30 a.m. Continuing Jobless Claims (01/25)

8:30 a.m. Initial Claims (02/01)

8:30 a.m. Unit Labor Costs preliminary (Q4)

8:30 a.m. Productivity preliminary (Q4)

Earnings: Hilton Worldwide, Air Products & Chemicals, Honeywell International, Eli Lilly & Co, Tapestry, ConocoPhillips, Fastenal, Hershey, Ralph Lauren, Microchip Technology, Take-Two Interactive Software, Amazon.com, Expedia Group, Monolithic Power Systems, Fortinet.

FRIDAY FEB. 7

8:30 a.m. Hourly Earnings preliminary (January)

8:30 a.m. Average Workweek preliminary (January)

8:30 a.m. Manufacturing Payrolls (January)

8:30 a.m. U.S. Nonfarm Payrolls

Previous: 256k

Forecast: 170k

10:00 a.m. Michigan Sentiment (February)

10:00 a.m. Wholesale Inventories (December)

3:00 p.m. Consumer Credit (December)

Another busy week is upon us. More than 120 S&P 500 companies are scheduled to report. Some of them include Amazon, Alphabet, Walt Disney and PepsiCo.

So far, the reporting season has been good. Most companies have beaten expectations, according to FactSet data. What investors will be paying close attention to in the earnings this week is the future guidance of each business.

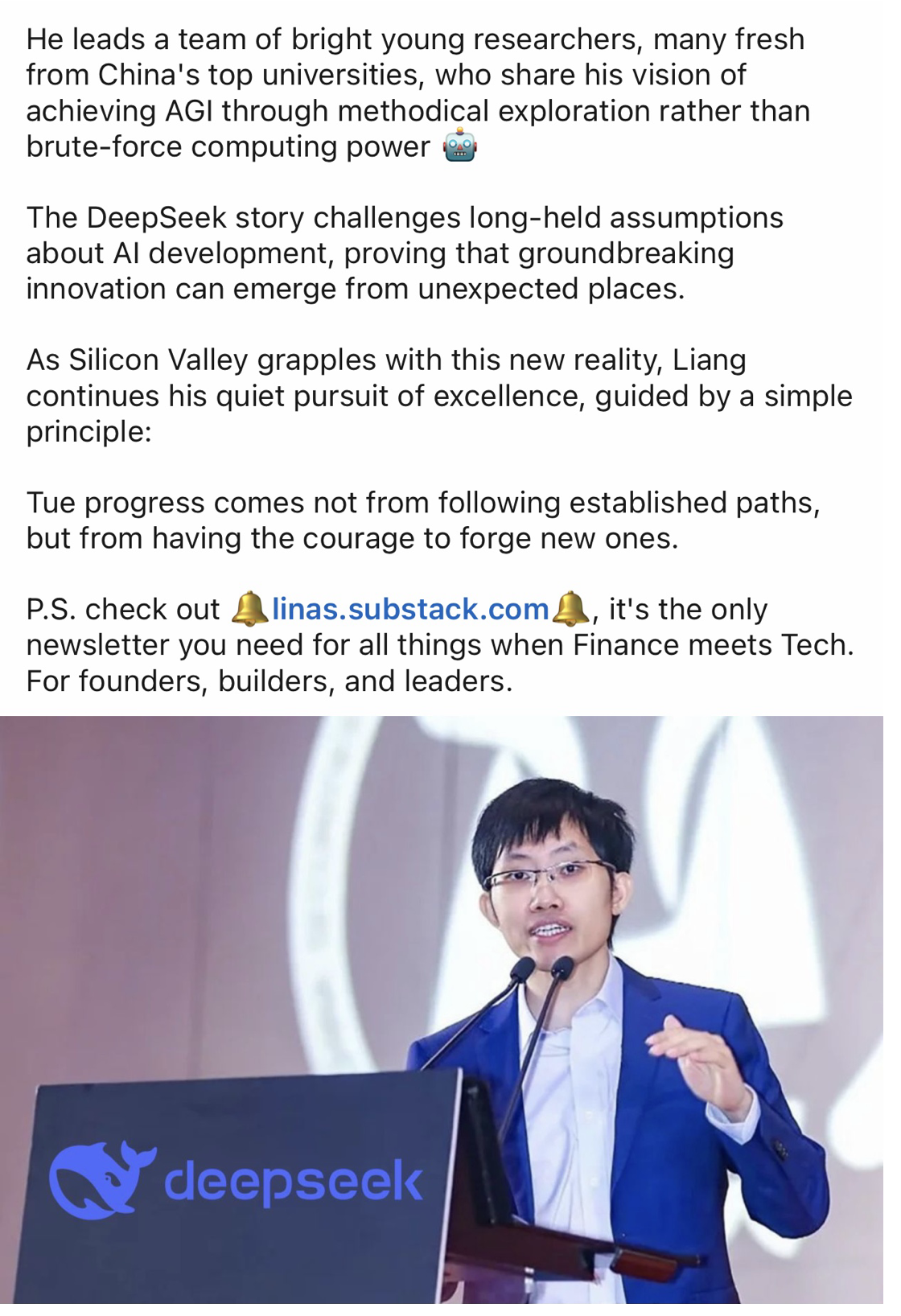

Policy will be market-moving this week. President Trump tapped the green light with tariffs in Canada, Mexico, and China. The impact of these tariffs could be far-reaching and could even trigger retaliatory tariffs from the targeted countries. A high level of uncertainty will be felt in the market.

Nonfarm payrolls are due out on Friday. It is expected that the economy added 165,000 jobs last month, down from 223,000 new hires the prior month. The unemployment rate is forecast to have remained unchanged at 4.1%

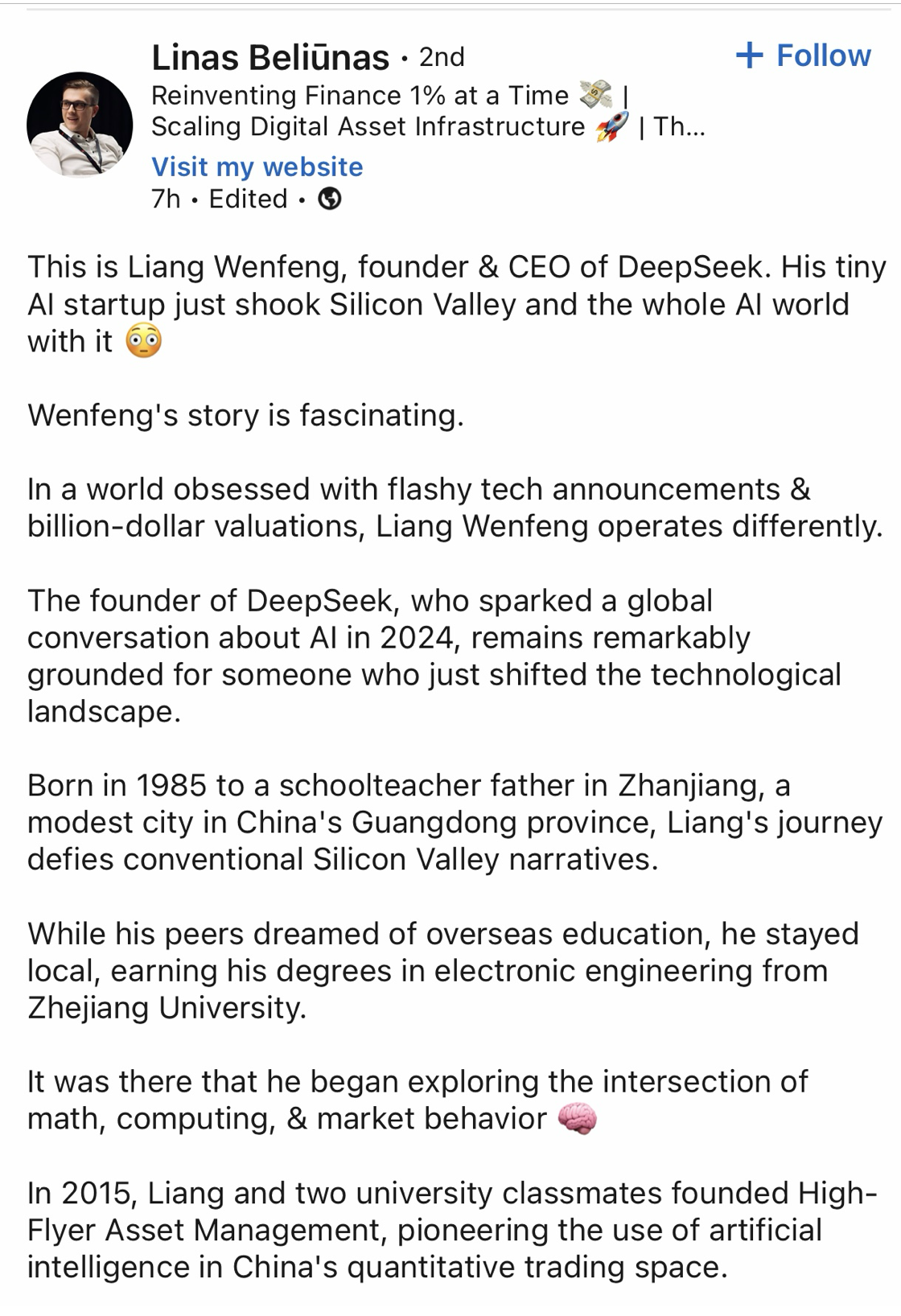

Another perspective on AI

Last week, Deep Seek - even with everything we don’t know about it, - stopped investors in their tracks and caused discomfort and disquiet, to say the least. So much so, that seeds of doubt over everything investors thought they knew about artificial intelligence has become the new narrative.

Everything is being questioned, including the stock market valuations on AI stocks.

Investors are rethinking their Nvidia investment. Are Nvidia’s chips worth the price? This question caused the shares of the AI leader to plunge 17% last Monday, stripping around$600 billion in market value from the stock.

And what about AI data centre operators - Amazon, Microsoft, and Alphabet? Will they be able to justify the fees and spending if Deep Seek is so cheap?

Furthermore, Deep Seek has also called into question the projections about electricity demand related to more AI usage. Are they vastly exaggerated? Power producers took it on the nose last Monday with stocks like Constellation Energy, Vistra, and Talen Energy among others, being smacked lower.

Last Monday, certainty was challenged. Valuation multiples will need to find a new level.

President Trump introduces tariffs.

We are now beyond talk, as the first steps of implementation of Trump’s tariffs to match Trump’s promised policy agenda took place on the weekend. On Friday, Trump said he would implement a 25% tariff on Canada and Mexico and a 10% on China on Saturday. No exemptions are known yet.

Until the market becomes familiar with the details, uncertainty will influence the market environment. Jitters could become very evident in sectors that could be hit hard by a trade battle with America’s closest trading partners, such as autos, industrials, food and beverage companies.

If the administration builds on existing steel and aluminum tariffs with Mexico and Canada, that could create volatility given Trump’s plans to build new power infrastructure and re-energize the manufacturing sector.

How will Canada and Mexico respond? Will they issue their own tariffs? Canada could slap tariffs on critical minerals, natural gas, and electricity. Furthermore, the country could also ban U.S. dairy, cattle, and fresh meat. And some provinces could choose to ban the purchase of U.S. alcohol, which would certainly cause ripples amongst some stocks.

Mexico, too, could implement an offensive approach by targeting U.S. corn or soybean exports, before expanding its retaliation into other areas.

One thing is for sure, the market could be very turbulent.

MARKET UPDATE

S&P500

The index will be choppy, particularly with the introduction of tariffs on several countries. This will create uncertainty in various markets/sectors. The ranging action of the index shows a bigger picture topping action.

Support = ~ $5955/65. The base of the rising wedge since October 2023 lies around $5750/75. Any break/close below here argues a major top has formed and the market is rolling over (9-12 months or more). I strongly recommend everyone take some profits now and enter a limit order for a put option or bear put spread to come into play on the SPY on any break and close below $5770. Also, buy SDS as protection. If you are short-term focused, you should take profits on stocks. I am expecting a strong bear move in the market either this month or next month.

GOLD

Gold reached a new all-time high. The metal will continue to range and could continue to nudge to the upside for now.

Resistance = ~$2817/25

Support = ~$2785/90 and $2737/40

BITCOIN

Topping movement continues to play out here. I would expect any upside to be limited. Resistance remains at ~$109.30/$109.80k. Support is seen at around~ $91/$92, and below there at ~ $85,000k.

QI CORNER

HISTORY CORNER

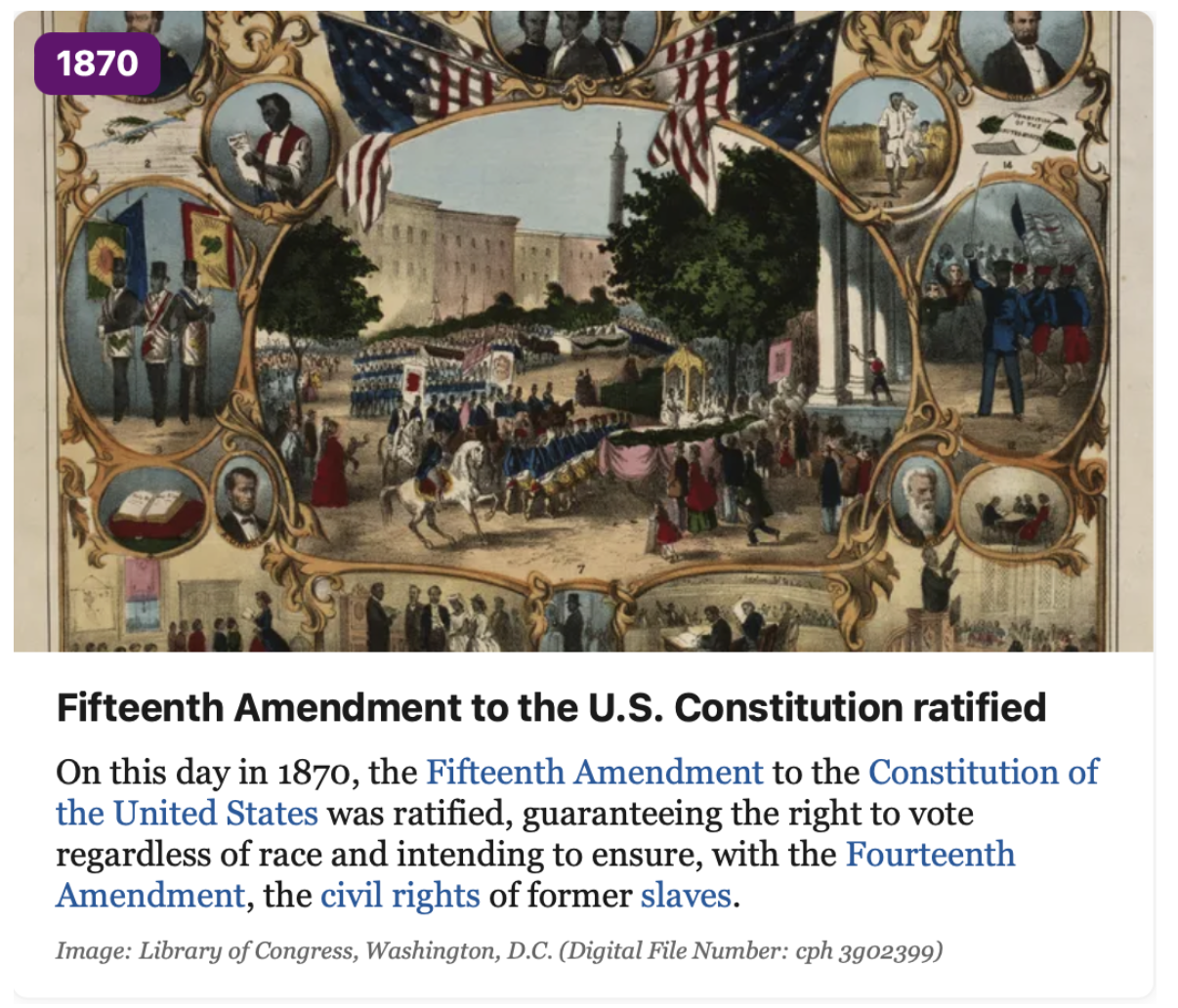

On February 3rd

SOMETHING TO THINK ABOUT

Cheers

Jacquie