October 26, 2010 - The Monetization of Lumber

Featured Trades: (LUMBER), (WY), (CUT), (RYN)

4) The Monetization of Lumber. If you want to see how widespread the commodities boom has become, take a look at the lumber market, which has popped 47% since June. This is in the face of new home starts that are flat on their back, posting the worst numbers in modern history.

Suffice it to say that the lumber market has changed beyond all recognition. The monetization of lumber is now a big driver, as investors scour the globe for dollar alternatives and hard asset surrogates. China has stepped into the market as a big buyer, as it has everywhere else. You only need to spot some visitors from the People's Republic at a Chinese restaurant in Portland to tack another five cents on to lumber prices.

The strong loonie is pricing supplies from the Frozen Wasteland of the North out of the market. Prices are also getting an assist from the mountain pine beetle, where a long term draught is enabling them to devastate Western forests, cutting into supplies.

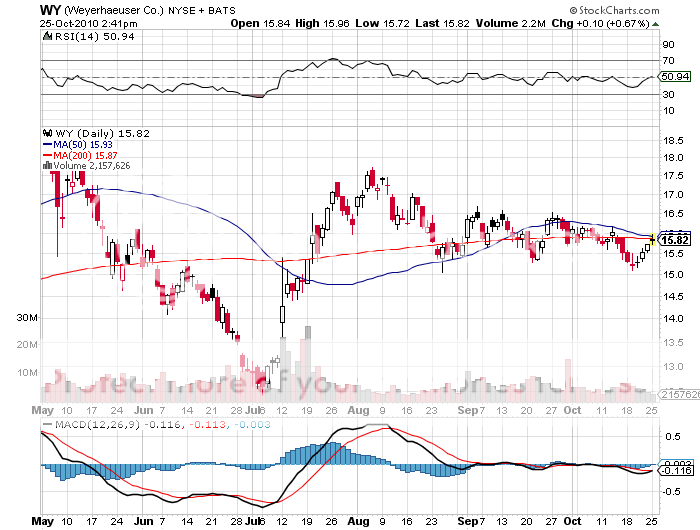

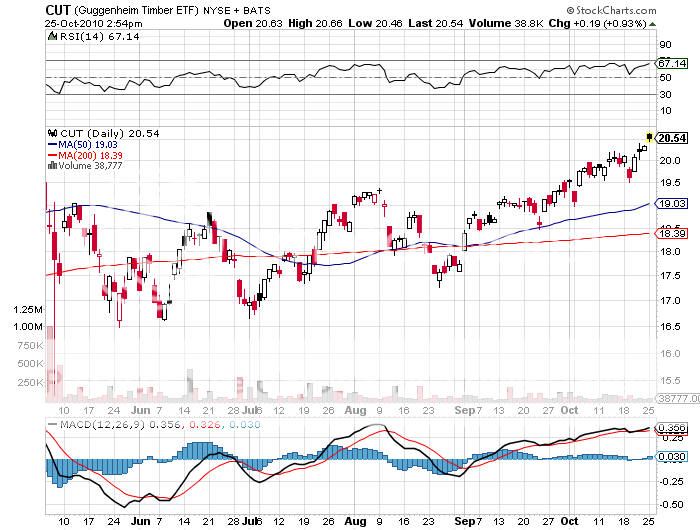

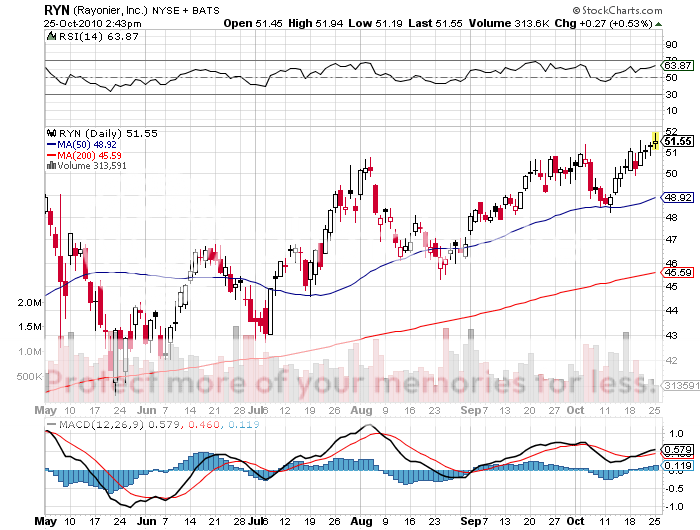

The US industry is much less elastic than it has been in the past, as so much capacity has been shut down and scrapped, thanks to the housing crisis. Add the lead lumber equity plays to your 'buy on dips' list of US commodity plays. These include the recently trustified Weyerhaeuser (WY),? the lumber ETF (CUT), and Rayonier (RYN).

Lumber Futures Have Been On Fire