November 2, 2010 - Catching Up With Charles Nenner

Featured Trades: (CHARLES NENNER)

1) Catching Up With Charles Nenner. I managed to catch up with my friend, technical analyst to the stars, Charles Nenner, and quiz him about his recent relative silence. It has been many months since he predicted that the yen was going to soar from ?95 to ?80, that you should dump your longs before a plunge in the S&P 500 from 1240 to 1,000, or that the Australian dollar would rocket from 78 to 100 cents.

The wily Dutchman explained that he was been sitting on the fence because there is really nothing to do here, echoing sentiments from my own piece on market turning points last week (click here for 'Contemplations in Risk'). His longs in NASDAQ, the ags, and emerging markets were working fine, but he was not inclined to initiate new longs here, and there was no point in stepping in front of the train on the short side.

Charles' daily, weekly, and monthly cycles were drawing sharply diverging conclusions. Take a look at the stock indexes, where the weekly cycles show the Dow and S&P 500 possibly peaking this week, the NASDAQ not until January, and the emerging markets not for the foreseeable future. The best thing is to wait for these conflicts to resolve over time before making any big calls. After all, no one stood over Beethoven and demanded he finish his symphony by Friday.

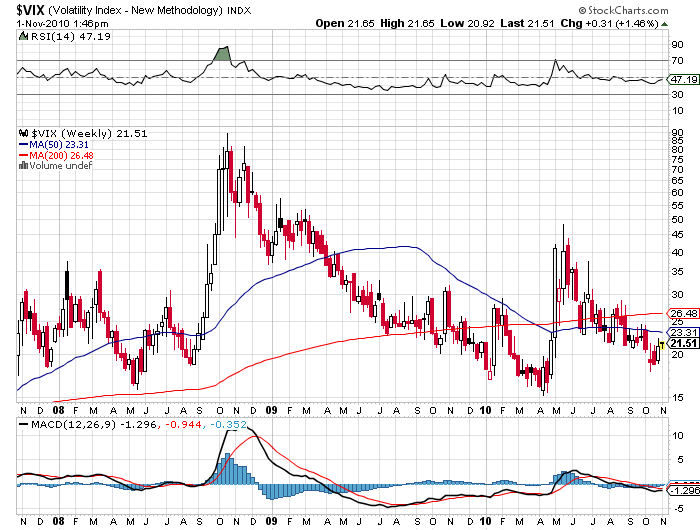

Charles thinks we are about to enter a period of major dollar strength, but not yet. One area that is starting to look interesting was the volatility index (VIX), which seems to be bottoming out in the high teens, presaging times that the Chinese describe as 'interesting.' One could easily envision a scenario where the dollar is strong, and everything else goes to hell in a hand basket. I plan to get together with Charles in early January to review his 2011 calls across all markets. Premium subscribers can look forward to getting e-mailed a strategic advanced peak.