November 3, 2010 - From Junk to Gold

Featured Trades: (JUNK BONDS), (JNK)

SPDR Lehman High Yield Bond ETF

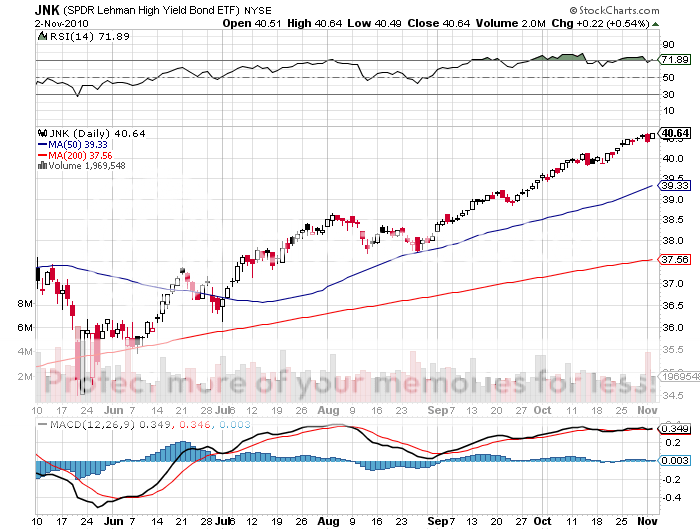

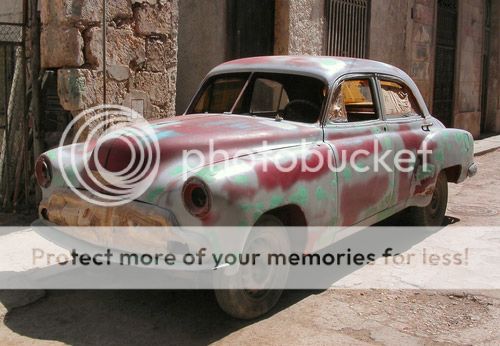

3) From Junk to Gold. Investors who bought beat up jalopies at the going out of business sale 18 months ago, ended up getting delivered a Rolls Royce. I piled readers into the junk bond ETF (JNK) 18 months ago because the market was discounting a future default rate of 17%, which I thought was extremely unlikely (click here for the call). What have we actually realized? A minimal 0.3%.

As a result, yield seeking, risk averse buyers have been piling into the fund, taking yields down from 18% to 6%. We could have a little more upside to go. As absolute returns have plunged, spreads over Treasuries have also been shrinking, but have yet to reach historical minimums. I am not a buyer here, but would not be surprised to see others chase this market further.

Investors in past years would have been laughed at as neophytes or suckers for taking on extra junk risk with such little potential upside. In this low return world, they are now considered all-seeing sages. It is a perfect example of how zero interest rates are skewing investment decisions everywhere.