November 15, 2010 - Taking Toyota Out for a Spin

Featured Trades: (TOYOTA), (TM)

2) Taking Toyota Out for a Spin. After silver's meteoric rise last week to nearly $30, I decided to take some profits and launch my own personal stimulus program. So I cashed in a chunk of my position, shoveled $50,000 in cash into a backpack, and sent a friend off to buy a new car. As the price of the white metal soared past $27, $28, and $29, I kept calling her on her cell phone, and kept directing her to increasingly more expensive dealers. First, it was Hyundai, and then Ford. My confused friend finally ended up at Toyota, where she picked a new Highlander Limited Hybrid, a seven passenger, 280 hp V-6, four wheel drive SUV that gets 28 miles per gallon. It also talks to you.

I had more than transportation on my mind when I sent her on the errand. Nearly 40 years ago, when I was starving in Japan while waiting for the financial journalism thing to start paying off, I took a weekend job in Hakone to teach managers at Toyota Motors (TM) how to speak English. Their Plan was to learn our impossible language and then start aggressively marketing their low priced cars in the US.

As we approached the hotel, I saw a dozen men lined up out front wearing cheap polyester suits, starched white shirts, and conservative ties. Each one took turns picking up a baseball bat and beating the daylights out of a severely shredded dummy on the ground before them, screaming a maniacal samurai scream. I asked my driver what the hell was going on. He deadpanned: 'They're beating the competition.'

This was back when Toyota made laughably tiny cars that looked like a giant ostrich eggs on wheels and had to get a running start to get up a freeway onramp. By 2006, the company had seized 18% of the US car market, and GM and Chrysler were wearing toe tags. I guess I taught them well enough.

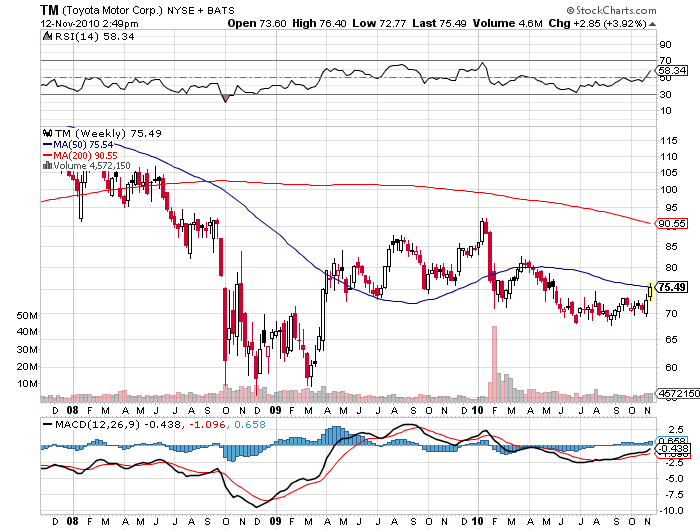

Today Toyota, the world's largest car maker, has been slammed by the perfect storm that has taken its share down a gut churning 25% from its 2010 peak. They took eight years to find a defect in an American made accelerator component that caused thousands of accidents, and dozens of deaths, forcing a worldwide recall of 10 million vehicles. Toyota is one of the worst performing stocks in the market this year.

To me, this all adds up to a great screaming? 'BUY.' You can start with the recall, the largest in history, covering eight models, which promises to be speedy, lavish and generous. It prompted a production shut down, an unprecedented measure in auto history. The company is going all out to reinforce customer loyalty. Toyota still makes great cars. And let's face it, many people would rather die than drive an American car, the Mad Hedge Fund Trader included.

It's usually a great idea to buy when there is blood in the streets, and in the auto industry it doesn't get any worse than this. Toyota has become the BP of the auto industry. I know the Toyoda family well, and they have assured me that they are pulling out all the stops to restore their brand, as well as their own name. When heads roll in Japan, they really do.

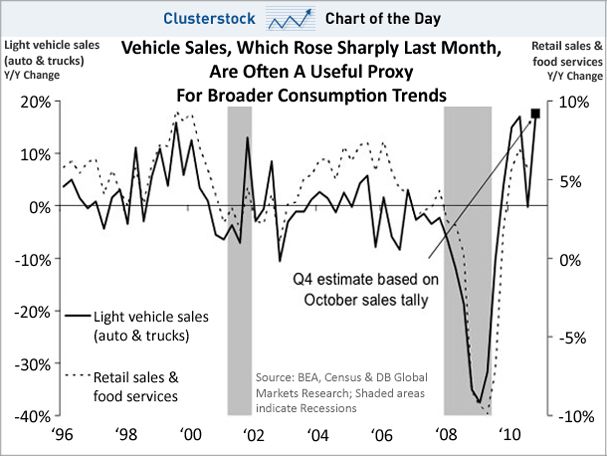

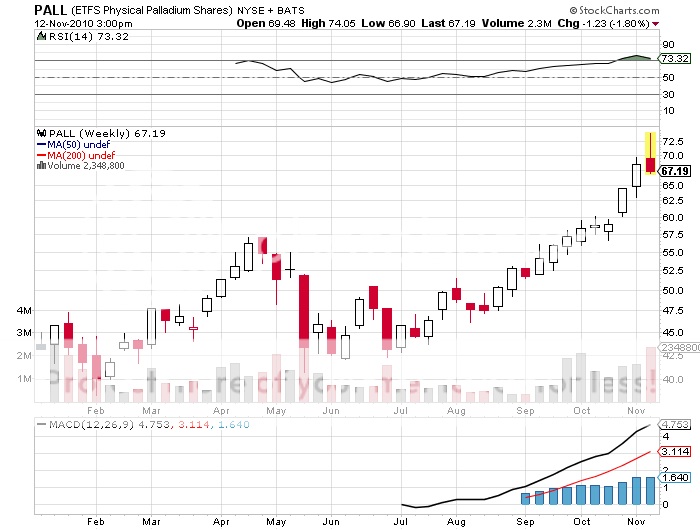

There are a few additional angles here. Since the company is Japan's largest exporter, it would benefit greatly from any weakness in the yen, which I consider as the world's most overpriced currency. Think of the stock as a long dated yen put. Look at the charts for Ford, US cars sales, and the palladium used for catalytic converters, and it is obvious that the world is seeing a surge in global car sales.

I know the philosophy, and the strengths of this company intimately, and they will come roaring back. Let the ruckus over the recall burn out, and add Toyota to your 'buy on dips' list. Keep in mind that this is not a day trade, but something to bury in your portfolio and then lose behind the radiator. It will also not be immune from the calamities that strike the stock market.

Meet My New Wheels