December 3, 2010 - Trade Alert for the (TBT)

Featured Trades: (TBT TRADE ALERT)

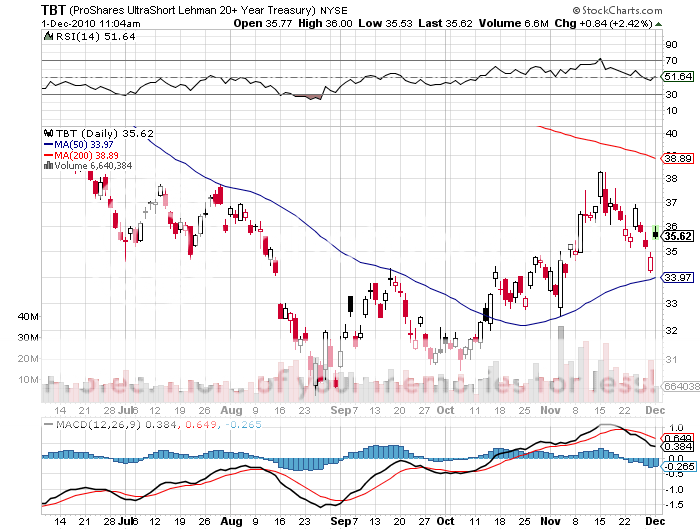

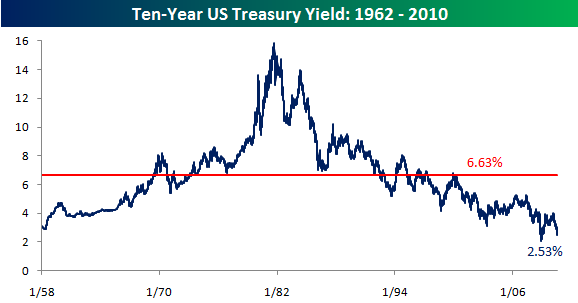

2) Trade Alert for the (TBT). It's time to get in on the greatest short play of the coming decade. I have been pounding the table that investors should pile into the (TBT), the 200% leveraged bet that Treasury bond prices would go down, since August. It rose 28% after that, rocketing from $30 to $38.40. Well, the market gods have deigned to give us a decent entry point. It neatly bounced off the 50 day moving average at $34 yesterday, and appears to have resumed its upward path.

Take a 50% position here at $35.60. If you are working with a portfolio of five positions, that is half of 20%, or 10% of your total funds. Buy the second half on a dip or an upside breakout. Put in a protective stop loss order to pull the ripcord at $32.90 in case congress fails to extend the Bush tax cuts, we go back into a double dip recession, or a giant comet destroys the earth.

The no brainer short term target here is last week's high of $38.40. The next stop is the 200 day moving average at $38.90, up 9% from here. Beyond that, you can contemplate this year's high of $52, up 45%. If you have read my research in any depth, then you already know that I believe the (TBT) will eventually trade to $200. I go into the fundamental arguments for this trade once more next week.

-

-