Featured Trades: (SOARING WITH THE EAGLES),

(SLV), (AGQ), (GLD), (TBF), (TBT), (XLF), (BAC), (YCS)

1) Soaring With the Eagles. I was sleeping like a rock last night, having one of those great flying dreams. I dove, rolled, and looped through the clouds, and soared with the eagles, my arms stretched out like wings. The phone rang. I looked at the clock. It was 2:00 am. What else was new? After 40 years in the business, I seemed to have developed a supercharged internal adrenaline pump that jolts me into full combat mode in seconds, firing on all 16 cylinders. Such is the life of a global macro long/short hedge fund manager.

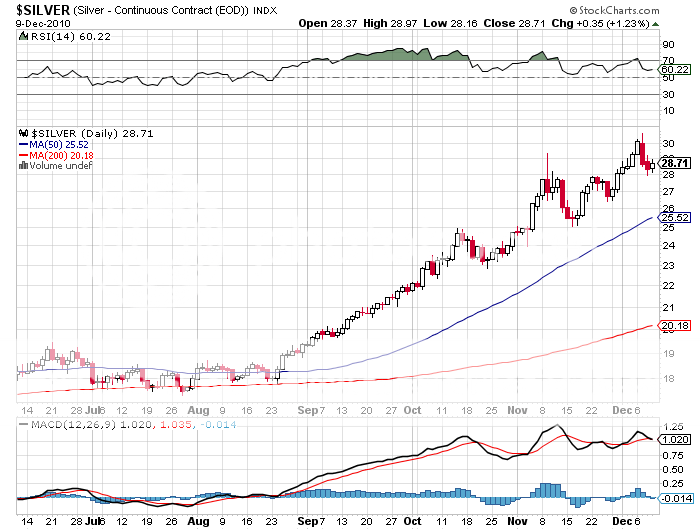

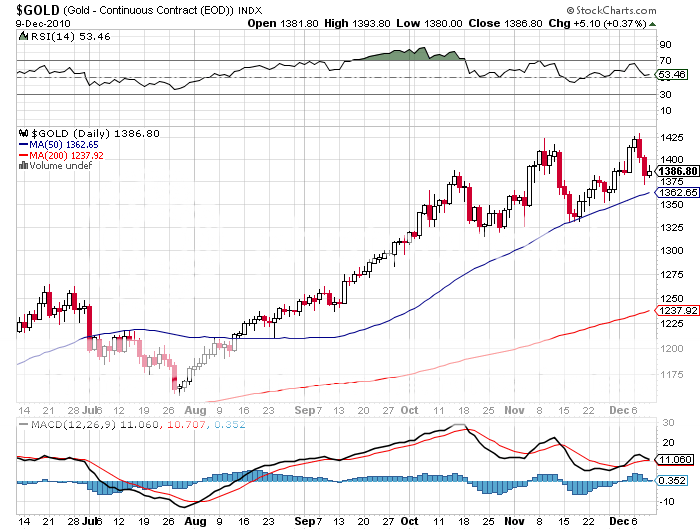

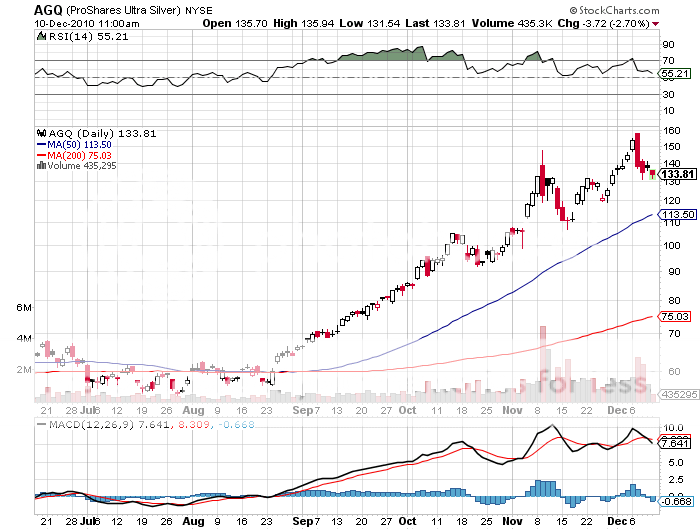

It was my friend, Ming, at the People's Bank of China in Beijing. They had just raised reserve bank requirements by 50 basis points, and another interest rate hike was in the works. Leaks of the impending move had prompted traders to dump holdings of commodities, energy, and precious metals, expecting the move to cool economic growth by the Chinese economic juggernaut. This is why silver (SLV), (AGQ) dove from $30.60 to $28 in recent days, and gold (GLD) backtracked from $1,430 to $1,374.

The wheels whirred away in my mind, calculating how this news would impact my trading book, which was long US stocks (SSO) and financials (BAC), (XLF), and short Treasury bonds (TBF), (TBT) and the yen (YCS). I concluded that I was perfectly positioned, and that my longs should go up and my shorts would go down. Back to soaring with the eagles.

I was just coming out of a white fluffy cloud when the phone rang again. It was 4:00 am. A friend at bond investment giant, PIMCO, in San Diego, CA was calling to tell me that they were upgrading their growth forecast for 2011 from an anemic 2.0%-2.5% range to a more virile 3.0%-3.5%. The rerating was off the back of the tax compromise between the President and the Republican leadership, and the massive, short term government stimulus that was working far better than imagined or publicized.

If there is one guy who's every word I hang on, it is PIMCO's eclectic managing director Bill Gross. This is not just because he was an ex-hippy, former Vietnam War swift boat veteran, who worked his way through college counting cards at blackjack in Las Vegas at the same time I did. We may well have sat at the same tables (play the videotape!). I think Bill and his cohorts, Mohamed El-Erian and Paul McCulley, are one of a tiny handful of people who have nailed it with their understanding of the global economy and the consequences for financial markets and asset classes. So we are usually reading from the same sheet of music.

I could see this easily leading to a round of competitive upgrades of forecasts by other financial institutions as we run into year end. Needless to say, this is a hugely positive backdrop for stocks. The wheels whirred again, popping out the same conclusion. If anything, my trading book looked even better. It was too late to soar with anymore damn eagles, so I staggered out of bed to do some flying of a different sort. I checked prices, and was reassured that the markets agreed with my analysis. It wasn't until noon that I realized that in the dark I had put on my boxer shorts backwards.

-

-

-

-

Come Fly With Me