December 30, 2010 - The Big Hedge Fund Killing in For Profit Education

Featured Trades: (FOR PROFIT EDUCATION)

3) The Big Hedge Fund Killing in For Profit Education. Hedge funds have made huge profits this year by shorting the for-profit educational sector.

The industry was ripe for the taking. For two decades, for-profit schools have lured gullible students with inflated promises of impressive sounding degrees which they pay exorbitant tuition to obtain. In education's version of the subprime crisis, creative financial aid departments obtained cheap government loans to finance the entire program.

There are now over 2 million attending these institutions, accounting for 10% of all higher education in the US, and the profits that have poured in have been absolutely massive. Early investors rode the IPO train all the way to the bank. The problems arose when few students ever achieved these laudable goals.

According to Department of Education statistics, 55% of US college students obtain a degree within six years. At the University of Phoenix (click here for their website at http://www.phoenix.edu/ ), with 400,000 students, the largest for-profit university, only 36% meet this deadline, only 6% at some campuses, and a mere 4% of online students. Dropouts end up defaulting on loans that can amount to as much as $100,000 for a worthless, incomplete bachelor's degrees, and up to $200,000 for advanced degrees.

It now looks like the gravy train is about to end. Secretary of Education Arne Duncan has promised a crack down on the industry, bringing in more regulation and prosecutions of deceptive marketing practices, where degree programs are sold like time shares. The leading accreditation organizations are also having second thoughts about the for-profits, where 95% of the instructors are part time and tenure is unknown. Complaints are rife about shoddy teaching standards and missing doctorates.

The government has funded $750 billion in student loans, and while 10% of public university loans go unpaid, the default rate at for profit schools is thought to be as high as 50%. Starve these schools of subsidized government funding, and their shares are history. And just try and get a job with one of these Mickey Mouse degrees.

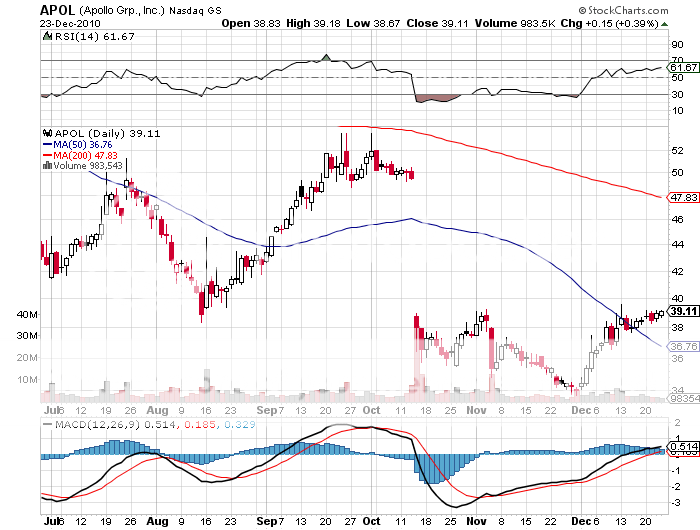

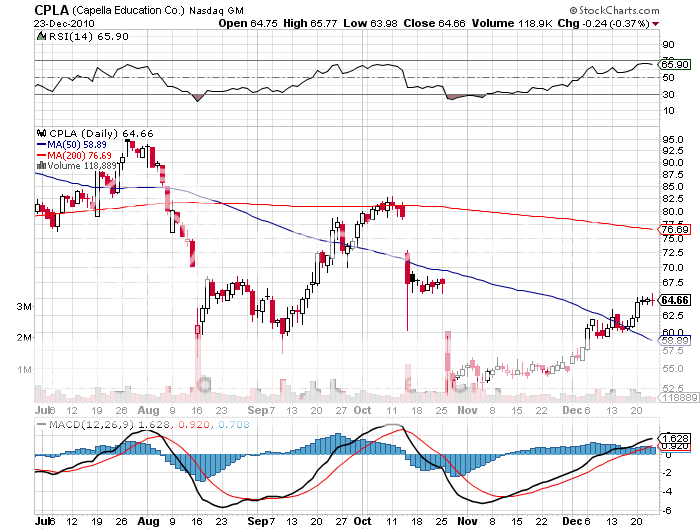

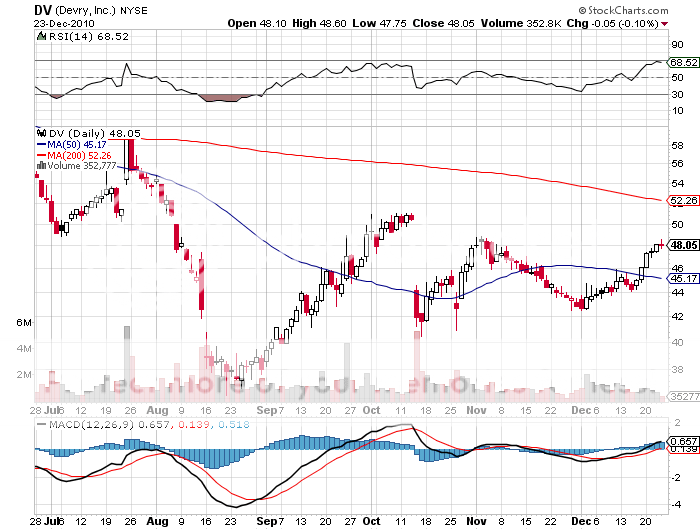

Some of the worst offenders have already seen cataclysmic declines in their share prices this year, like Apollo Group (APOL), -37%, Capella Education (CPLA), -45%, and DeVry (DV), -37%. And a Republican win of the House of Representatives in November has enabled these stocks to rally in the hope that this will cause some heat to disappear.

There is no trade in these stocks here, as they have already fallen too far to make them attractive shorts, and I don't want to touch the long side with a bargepole. However it is a great example of how the hedge fund industry performs a public service by ferreting out corrupt practices and crooked management and taking their capital away by crashing their stocks. Making a few hundred million dollars along the way is nice too. Call it creative destruction with a turbocharger.

-

-

-