January 5, 2011 - The Bank of America Settlement is Huge

Featured Trades: (THE BANK OF AMERICA MELT UP), (BAC)

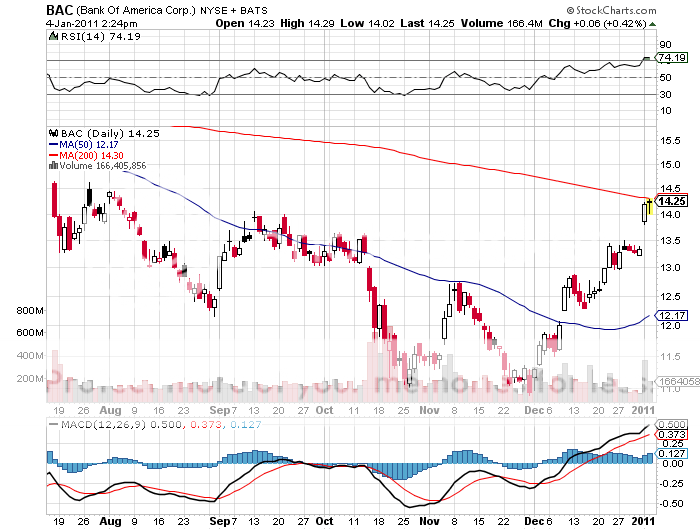

3) The Bank of America Settlement is Huge. For those Macro Millionaires who bought the (BAC) March, 2011 $12-$14 call spread that I recommended on December 7, this is your big payday. The North Carolina based 'too big to fail' bank announced a settlement with government agencies Fannie Mae and Freddie Mac over claims that (BAC) failed to adequately disclose the risks on 787,000 home mortgages they bought. Estimates of (BAC's) potential liability from the suit ranged up to $250 billion, and likely criminal prosecution of senior management. The settlement amount came in at only $3 billion.

Needless to say, this is a hugely positive development for the stock, which opened up 6% Monday morning, and is now up $2.54, or 22% from my initial trade alert. The March call spread has skyrocketed from 56 cents to $1.40, a gain of 150% in four weeks. Those who sold the March, 2011 $10 puts against the position made even more. I bet you didn't think your first trade in a new, untested, and unknown program would generate the best trade of your life. But I did.

I just ran the numbers on the Macro Millionaire portfolio, and in your first month you have earned a total return of nearly 17%. Of this, nearly half, or 7.50%, is accounted for by the (BAC) position. At this point, the spread is worth $1.40 out of a potential maximum value of $2 on expiration. So you have already wrested 70% of the potential profit from the trade.

I am convinced the call spread will expire at its $2 maximum value on March 18. But when you make this much money this fast, and one position accounts for such an outsized portion of your total performance, it becomes a risk control issue. So the more cautious among you might consider cutting half the position. I am going to hang on for the 'E ticket' ride for now, but when I bail, you'll be the first to know.

Well done, Macro millionaires!

-