January 20, 2011 - Time to Tighten Up Those Stops

Featured Trades: (SPX), (BAC), (CSCO),

(DIG), (SSO), (GLD), (TBT), (JJG)

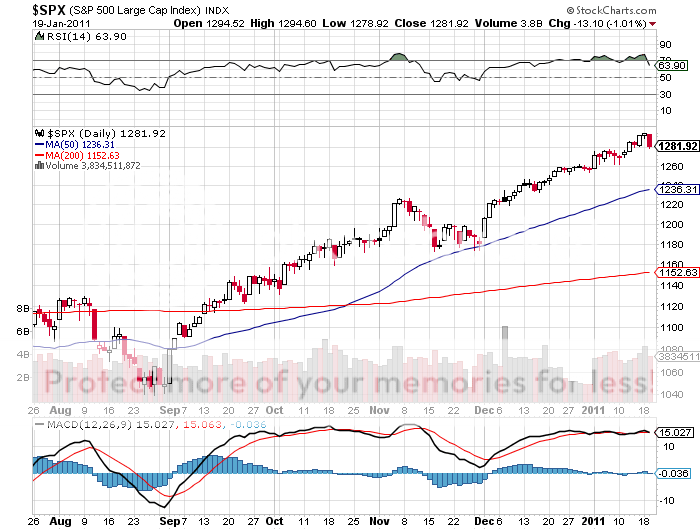

1) Time to Tighten Up Those Stops. Well, the party couldn't go on forever. Yesterday, the S&P 500 took its first 1% hit since November, and the NASDAQ took an even more severe spanking. Like in an Agatha Christie murder mystery, risk has made a sudden reappearance on the scene, after spending much of the show hiding behind the curtains. Since Ben Bernanke launched QE2 and Obama hatched his tax deal with the opposition in mid November, you could count the number of down days in the market on one hand, and the color red had become virtually an extinct species.

What is really interesting about the Wednesday weakness is that it hit virtually every asset class across the board at once. We are not seeing an equity correction, or a commodity correction, but a generalized asset correction of every description. Translate that into a big fat 'RISK OFF' trade. This is why I find hedging across asset classes a useless exercise in a binary world. It just becomes a method for losing money in more interesting and exotic ways.

You could blame Steve Jobs' illness for this state of affairs. In fact, the markets have been over extended for some time. The pros have been expecting this down move with some confidence. This is why I have been steadily scaling back risk in recent days, cutting my (TBT) position in half, bailing on Bank of America (BAC) and grain (JJG) positions, buying back short puts in (BAC) and (CSCO), and cautiously putting out shorts in gold (GLD) and the Euro (FXE).

Given that my 'Macro Millionaire' followers are spectacularly in the money with their seven week portfolios, I am going to exercise some prudence here and tighten up all of my stops considerably on what is left. This is to prevent them from becoming 'Macro Thousandaires'. I am only lowering my stop marginally in the (YCS) to keep someone from stealing my position at the bottom of the market. That way we will still be well ahead of the game if this sell off develops a considerable head of steam. Here are my new stop losses:

(SSO) $48.85

(YCS) $14.85

(CSCO) call spread - $19 in the stock

(TBT) $35

(DIG) $46

(GLD) put spread - $1,450 in gold

(FXE) put spread - $1.40 in the euro

To paraphrase Winston Churchill, this is not the end, nor the beginning of the end. But it is the end of the beginning. If you want to buy dips, you have to sell the rallies.

-

Winnie