January 31, 2011 - Taking Some Cover on the (TBT)

Featured Trades: (TBT)

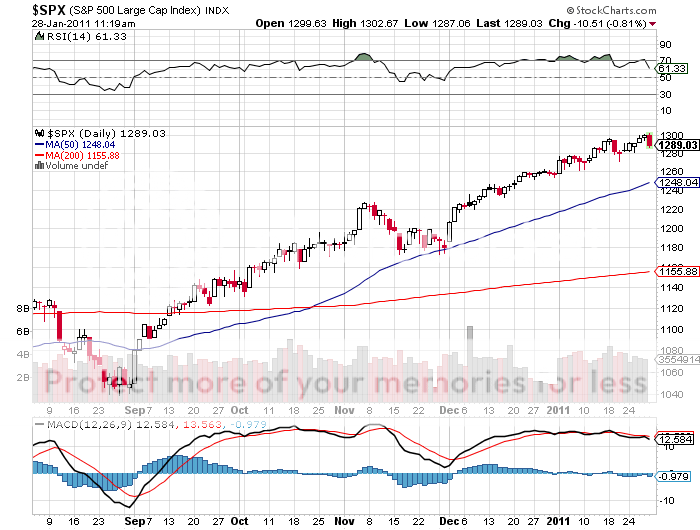

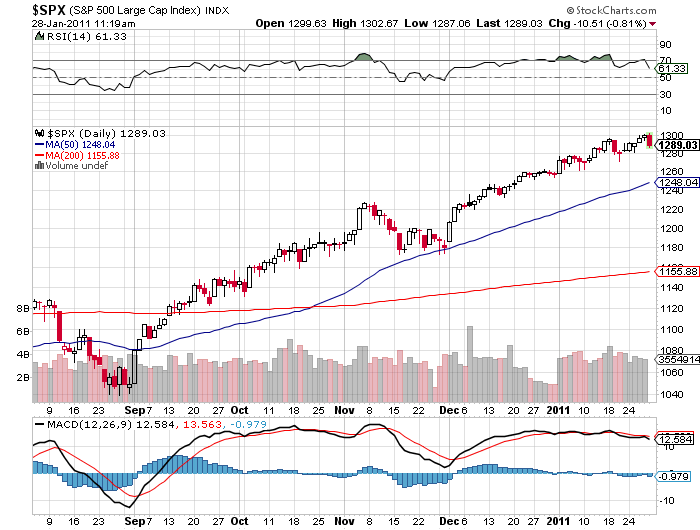

3) Taking Some Cover on the (TBT). The global equity markets are 'cruisin for a bruisin.' They are so overextended on the charts it is frightening, and the time to pay the piper is coming. I'm not looking for a collapse, just a missionary style 5%, 60 point correction, to at least the 50 moving average at 1,248 in the S&P 500, and then some.

If this happens, there will be the inevitable flight to safety into Treasury securities, not that it is justified in any way. This could give the ProShares Ultra Short Lehman 20+ Year Treasury ETF (TBT), the 200% leveraged bear play on long dated Treasury paper, a brief hickey. So I am going to step out of the way here and sell my modest 10% portfolio weighting in this ETF at today's opening at $39.06.

I still think that Treasury bonds are the world's most overvalued asset and that you should be selling every rally for the next ten years. But to sell the rallies you have to buy the dips, hence the logic behind my action. Use the news that came out yesterday to raise some cash; that the US budget deficit is rising back to $1.5 trillion during fiscal year 2011, which delivered a nice 1 ? point pop in the (TBT).? I'll look to buy the position back a few points lower down.

And by the way, if we do get a larger equity sell off, our short positions in the S&P 500 and the euro and our long position in the (VIX) are going to be looking pretty good.

-

-

It's Time to Pay Up, Matey