February 23, 2011 - A Buying Opportunity is Setting Up for the Ags

Featured Trades: (BUY THE DIP IN THE AGS), (DBA), (CORN), (MOS), (POT), (AGU), (ANDE), (CPO)

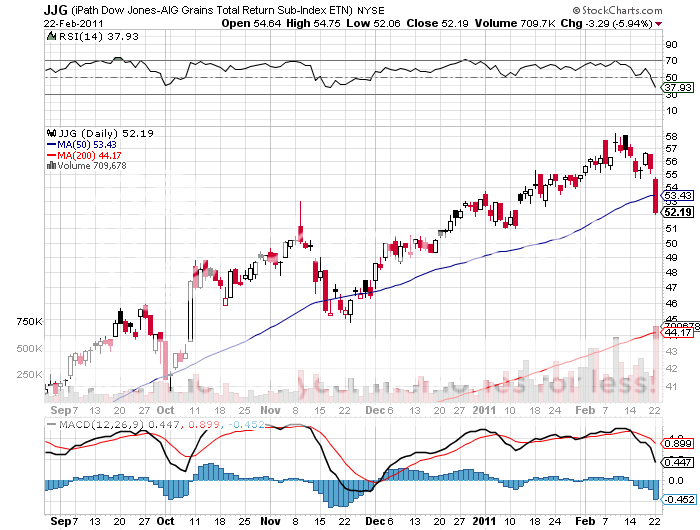

3) A Buying Opportunity is Setting Up for the Ags. In January, I wimped out of my hefty long position in the grain ETF (JJG), hoping to sidestep a potential sell off going into a dreaded US Department of Agriculture crop report, which last year triggered limit down moves. The report turned out to be benign, and I ended up sidestepping an 18% pop in the security.

It is now six weeks later, and we have our limit down moves across the entire ag space. But this time it is a global '?RISK OFF' trade triggered by the calamitous events in Libya. I just received word that a close friend working there for an oil major was safely airlifted to Malta, while another reader emails me that Khadafi is dynamiting pipelines to prevent them falling into the hands of rebels. A declaration of 'force majeure' does little to calm investors. Given that the ags have been among the best performers this year, it only makes sense that a flight to safety delivers to them the worst drubbing.

If you are still holding your position in this space, don't sweat too many bullets. This is but a kink in an upward trajectory that has possibly another two years to run. The world is still making people faster than the food to feed them. Almost every major supplier around the world is facing disruption. Supplies are at multi decade lows. A hungrier, more calorie addicted middle class is still burgeoning in emerging markets. Did I mention the threat to the food supply by global warming and melting glaciers? Food driven inflation isn't going away anytime soon.

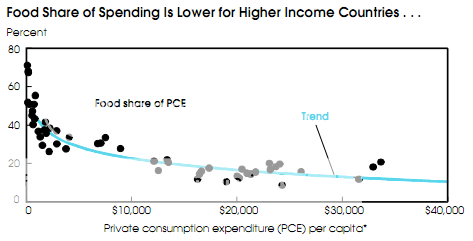

If you have any doubts, take a look at the chart below of the percentage of annual income spent on food by country. It starts with a low of 7% for Americans, and goes hyperbolic to 75% for several African countries. When you already spend 75% of your income on food, the only way to cope with a further 50% price increase is to eat less. Not easy when you are surviving on 1,000 calories a day. Expect higher prices, political instability, hoarding, and mass suffering to result.

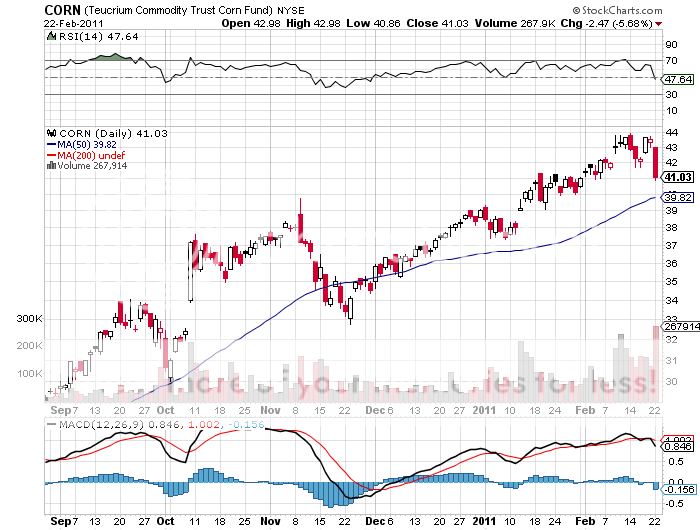

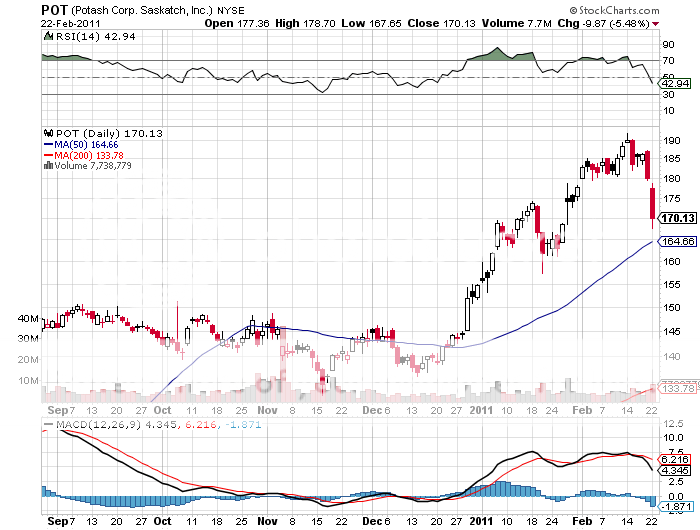

I have been a huge bull on the ag space since I put out my watershed piece last June, a call that turned out to be immensely profitable for everyone who participated (click here for 'Going Back Into the Ags'). Use the current distress to add to your ag positions, or pick them up if you have not already done so. Look at my favorites in the space the ag ETF (DBA), the corn ETF (CORN), and equities Mosaic (MOS), Potash (POT), and Agrium (AGU). When I see a short term bottom, I'll try to shoot out a trade alert, if I am clever enough to spot it.

You might also add a couple of new names, like Andersons, Inc.? (ANDE), which is involved in crop storage and fertilizer. Also visit and Corn Products International (CPO), which is benefiting from consumer flight from record high sugar prices towards cheaper high fructose corn syrup.

-

-

-

-

Here's Where I Want to Buy the Dip