February 25, 2011 - My Victory Lap on Oil

(SPECIAL $100 OIL ISSUE)

Featured Trades: (MY VICTORY LAP ON OIL)

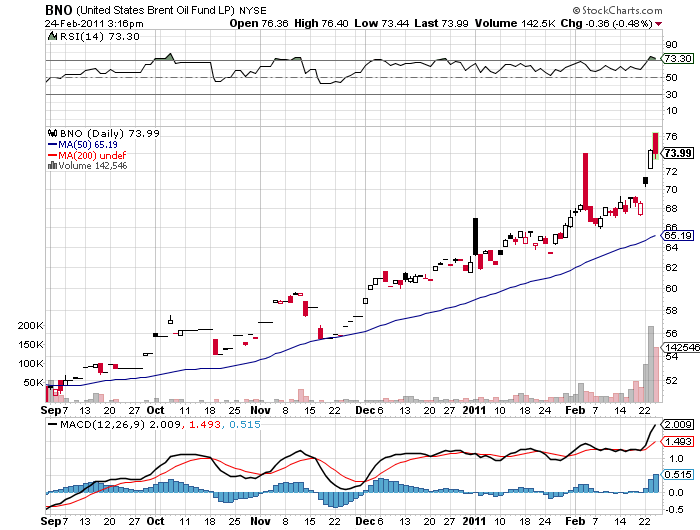

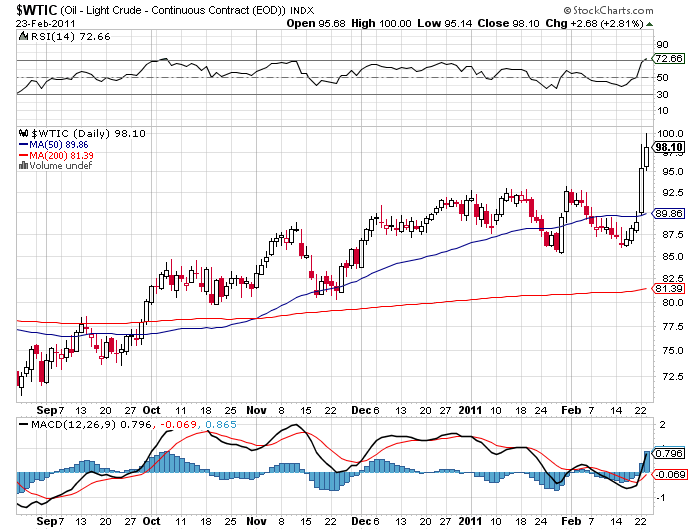

2) My Victory Lap on Oil. One of the boldest predictions that I made in my January 6 asset class forecast for 2011 was that oil would soon hit $100/barrel (click here for the link). My precise words were 'Probably $30 of the current $90 price reflects monetary demand, on top of $60 worth of actual demand from consumers. That will help it grind to $100 sometime in early 2010, and we could spike as high as $120.'

OK, I got the 'grind' part wrong. As it turns out, we have rocketed $18 in a week to a high of $103.40. Brent is up $28 this year. When I made this prediction,? I received tanker fulls of abuse, citing the glut of crude in storage at Cushing, Oklahoma, a slow US economic growth rate, a full strategic petroleum reserve, rapidly progressing conservation measures, and the threat posed by a newly discovered domestic 100 year supply of natural gas. In any case, alternative green energy sources will soon be replacing oil.

Well, there is only two days' worth of supply at Cushing, and they're full because the Canadian tar sands companies have been bringing new supplies on stream. The economy grew at a 4% rate, rather than the 2% many thought. Natural gas is nice, but it will take ten years of infrastructure building and deregulation before it starts to compete with oil. I can assure you that not a drop of SPR is coming on to the market. And alternatives are not going to be making a dent in our energy mix any time soon.

What is my just reward for this call? With gasoline well on its way to $5/gallon, my all-electric Nissan Leaf is looking pretty good, even if delivery has now been pushed back to May.

-

-