March 14, 2011 - Emergency Japanese Earthquake Update

EMERGENCY JAPAN EARTHQUAKE UPDATE

Featured Trades: (EWJ), (FXY), (YCS), (TLT), (SPY), (VIX), (USO)

1) I just got off the phone with several frightened, somewhat dazed survivors of the Japanese earthquake who work in the financial markets, and I thought it important to immediately pass on what they said. Some were clearly terrified.

Japan's economic outlook now appears far more dire than I anticipated only a day ago. It looks like GDP growth rate is going to instantly flip from +2% to -3%, a swing of -5%, similar to what we saw after the Kobe earthquake in 1995.? We have just had a 'V' shaped economy dumped in our laps, and we have just embarked on a precipitous down leg. Two very weak quarters will be followed by two strong ones. The initial damage estimate is $60-$120 billion, and that will certainly rise.

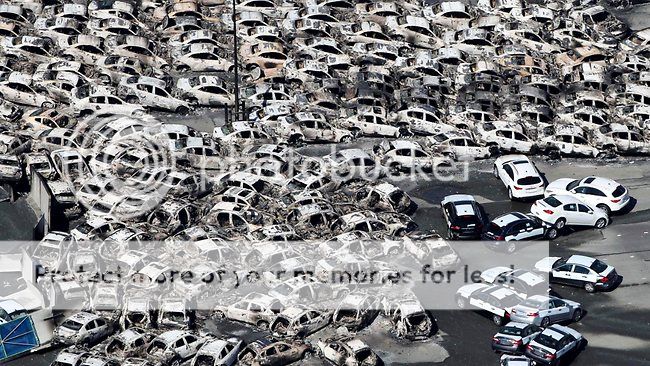

Kobe had a larger immediate impact because of its key location as a choke point for the country's rail and road transportation networks and ports. But the Sendai quake has affected a far larger area. Magnifying the impact is the partial melt down at the Fukushima Dai Ichi nuclear power plant, forcing the evacuation of everyone within a 12 mile radius.

Most major companies, including Toyota, Nissan, Honda, and Sony have shut down all domestic production. Management want to tally death tolls, damage to plant and equipment, and conduct emergency safety reviews. In any case, most employees are unable to get to work because of the complete shutdown of the rail system. Tokyo's subway system is closed, stranding 25 million residents there.

Electric power shortages are a huge problem. The country's eight Northern prefectures are now subject to three hour daily black outs and power rationing, including Tokyo. That has closed all manufacturing activity in the most economically vital part of the country.

Panic buying has emptied out every store in the major cities of all food and bottled water. Gas stations were cleaned out of all supplies and reserves, since much of Japan's refining capacity has been closed. There are 20,000 expatriates waiting at Tokyo's Narita airport as foreign companies evacuate staff to nearby financial centers in Hong Kong and Singapore. Airlines are diverting aircraft and laying on extra flights to accommodate the traffic.

The Tokyo Stock Exchange absolutely took it on the nose on Monday morning. Trading lasted exactly four minutes until, with the TOPIX Index down 7%, the circuit breakers kicked in. Most lead blue chips were down 10%, and 175 stocks never opened. Only construction stocks were up. Most of the selling was being done by foreign institutions and hedge funds, locals having vacated this market ages ago. This could be the beginning of a new bear market that will last for many months.

Prime Minister Naoko Kan has asked the Bank of Japan 'to save the country.' The central bank responded promptly with ?15 trillion, or $187 billion worth of credit market purchases. The yen spiked at the opening, as I expected, to ?81.4, as carry trades were unwound en masse. Then the BOJ showed its heavy hand, slapping it back down to ?82.2 where it has sat since. They appear to be taking on all comers at this price, and have the printing presses to fall back on. The situation remains fluid.

My global macro call proved spot on. Oil is down $2, plunging to a two week low below $100/barrel, blindsided by shrinking Japanese demand. Equities were sold worldwide. Uranium miners in Australia took a particular pounding, as the nuclear crisis casts a long shadow over this reviving energy source. Insurers were unloaded in London and Zurich. The S&P 500 opened down 10 points to 1,295 in the futures markets, close to Friday's low.

It looks like we are seeing the first multiple partial nuclear meltdowns in history. But a professor at nearby UC Berkeley tells me this is more of repeat of Three Mile Island, where half the fuel rods melted, than Chernobyl, where they all did. Small amounts of low radiation cesium and iodine have already been released, which should be measurable on American roof tops in about ten days. Neighboring countries are enforcing radiation testing of all food imports from Japan.

The death toll is certain to ratchet up considerably. Seaside villages that have been wiped off the face of the earth don't return phone calls. Japan's maritime self-defense forces are scouring the seas off of Sendai, rescuing a lucky few clinging to floating debris.

Finally, I wish to thank the many who sent me emails of concern, aware of my long family ties to Japan. Everyone is safe as they were fortunately out of the country when the disaster struck, or did not live in the worst affected areas.

Further updates to follow.