March 25, 2011 - Airline Stocks Could Be Ready for Take Off

Featured Trades: (AIRLINE STOCKS COULD BE READY FOR A TAKEOFF)

3) Airline Stocks Could Be Ready for Take Off. When I was a young, clueless investment banker at Morgan Stanley 30 years ago, the head of equity sales took me aside to give me some fatherly advice. Never touch the airline industry. The profitability of this industry is totally dependent on fuel costs, interest rates, and the state of the economy, and managements haven't the slightest idea of what any of these are going to do.

At the time the industry had just been deregulated, and was still dominated by giants like Pan Am, TWA, Eastern Air, Western, Laker, and a new low cost upstart called People Express. None of these companies exist today. It was the best investment advice that I ever got.

If you total up the P&L's of all of the airlines that ever existed since Orville and Wilber Wright first flew in 1903 (their pictures are on my new anti-terrorism edition pilots license), it is a giant negative number, well in excess of $100 billion. This is despite the massive government subsidies that have prevailed for much of the industry's existence. The sector today is hugely leveraged, capital intensive, heavily regulated, highly unionized, offers customers terrible service, and is constantly flirting with, or is in bankruptcy. Its track record is horrendous. They are a prime terrorist target. A worse nightmare of an industry never existed.

I become all too aware of the travails of this business while operating my own charter airline as a sideline to my investment business. The amount of paperwork involved in a single international flight was excruciating. Every country piled on fees and taxes wherever possible. The French air traffic controllers were always on strike, the Swiss were arrogant, and the Italians unintelligible. The Greek military controllers once lost me over the Aegean Sea for two hours, while the Yugoslavs sent out two MIGs to intercept me.

While flying a Red Cross mission into Croatia, I got shot down by the Serbians, crash landed at a small Austrian Alpine River, and lost a disc in my back in the process. I had to make a $300 donation to the Zell Am Zee fire department Christmas fund so their crane could life my damaged aircraft out of the river. Talk about a tough business!

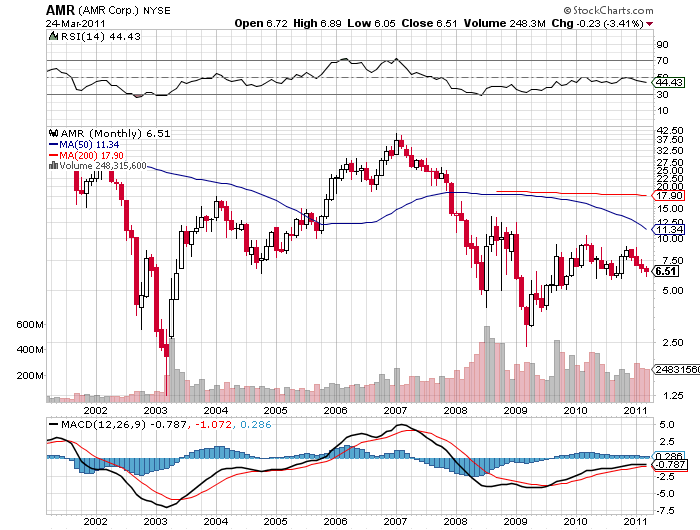

All of this leads me to conclude that there may be an opportunity here in airline stocks. The industry has once again been decimated by high oil prices, taking stock prices down to single digits. Many of these stocks have fallen so far, they have essentially become long dated call options on the companies with equivalent pricing. So for a little upfront cash you get a lot of bang for your buck.

A Darwinian concentration has taken place over the last 30 year that has concentrated the industry so much that it would attract the interest of antitrust lawyers, if it weren't losing so much money. Delta and United now control 50% of the US market, American 15%, and Southwest 10%, giving a 75% share to the top four carriers. The industry has fewer seats than in 1982; while inflation adjusted fares are down 40%.

They have taken yet another bloody nose from high oil prices, but this time they are covering a lot of this with higher fares, fees, and fuel surcharges. I can't remember the last time I saw an empty seat on a plane, and I travel a lot.

The real kicker here is that stock in an airline is in effect a free undated put on oil. If Khadafy suddenly chokes to death on a falafel, and the fear premium for crude disappears, these stocks would soar. You could easily have a five bagger on your hands.

I would vote for the airline that has been least adept at hedging its forward fuel needs through the futures market. That would be American Airlines (AMR). That means they will hurt the most now, but rake it in the most on any oil price pull back. And even if the decline in fuel prices turn out to be modest, a recovering US economy should boost profitability, given its recent maniacal pursuit of controlling costs. Just the missing pretzels alone should be worth a few cents a share in earnings. And no, I didn't get free frequent flier points for writing this piece.

-

Maybe I Should Consider a Different Career